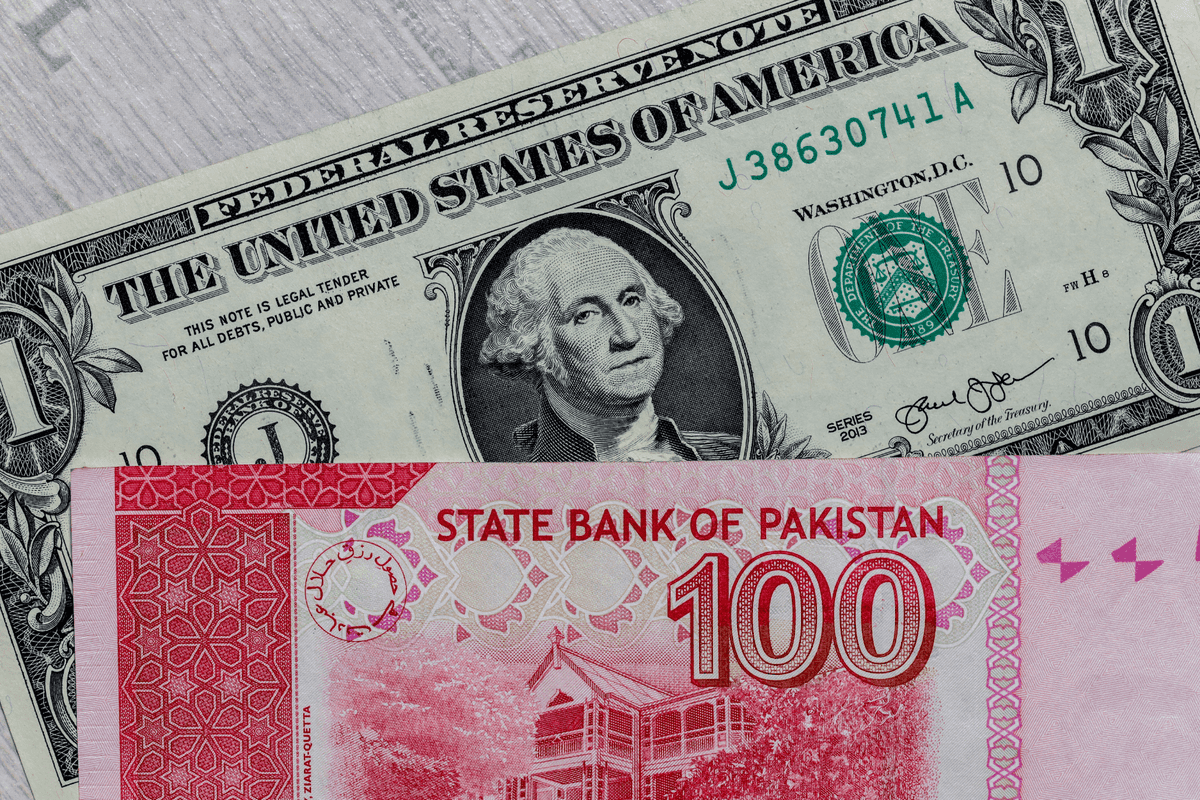

PKR to depreciate over next two years on higher import demand

Reports by Arif Habib Ltd. and Al Habib Capital forecast current account deficit to widen as economic activity picks up

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Pakistan’s currency remained broadly stable in 2025 but is expected to undergo a gradual and orderly adjustment over the next two fiscal years as economic activity picks up and import demand rises, according to reports by Arif Habib Ltd. and Al Habib Capital.

The Pakistani rupee depreciated by just 0.59% during calendar year 2025, reflecting stability supported by resilient remittances, disciplined monetary management and a steady buildup in foreign exchange reserves, Arif Habib Ltd. said.

The stability was further reinforced by improved external accounts and the resumption of an International Monetary Fund program, helping anchor expectations and limit market-driven volatility.

Looking ahead, the currency is expected to enter a more measured phase of adjustment.

As economic growth strengthens, higher import demand is likely to widen the current account deficit, placing mild pressure on the rupee. Arif Habib Ltd. projects the currency to average PKR 282.8 per U.S. dollar in FY26 and weaken further to PKR 292.3 in FY27, implying an annual depreciation of about 3.3%.

The brokerage described the expected move as a “healthy” adjustment that should support external competitiveness without triggering disorderly market conditions.

Al Habib Capital echoed the outlook, saying the rupee is likely to stabilize within a PKR 282–285 per dollar range by the end of 2026, underpinned by improved external account management, continued IMF support and steady rebuilding of the State Bank of Pakistan’s foreign exchange reserves.

On the reserves front, Arif Habib Ltd. said Pakistan’s external outlook for FY26 is supported by a broad mix of financing sources. IMF disbursements under the Extended Fund Facility and Resilience and Sustainability Facility are expected to provide around $2.6 billion, alongside $4 billion to $5 billion from multilateral partners.

Foreign direct investment is projected at $2 billion to $3 billion, depending on the pace of ongoing project pipelines. Market-based financing through a potential Eurobond or Sukuk issuance could contribute $1 billion to $1.2 billion, while bilateral and commercial inflows may add another $4 billion to $4.5 billion, subject to market conditions and bilateral commitments.

Additional support is expected from rollovers of deposits and loans from Saudi Arabia, the United Arab Emirates and China, covering sovereign deposits, commercial facilities and trade finance lines.

According to the State Bank of Pakistan, the country continues to meet all external debt obligations on time. Total external debt servicing for the year amounts to $25.8 billion, comprising $21.4 billion in principal and $4.0 billion in interest. Of this, $4.4 billion has already been repaid, while rollovers of about $5.3 billion have been secured. Of the remaining $15.3 billion, around $9.3 billion is expected to be rolled over.

SBP projections indicate foreign exchange reserves reaching $17 billion by June 2026, while Al Habib Capital estimates reserves could rise further to about $17.8 billion by December 2026.

Al Habib Capital Ltd. said Pakistan’s external position is further supported by record remittance inflows averaging $3.2 billion per month and SBP reserves of $15.89 billion, which provide a strong liquidity buffer. The firm said the remaining net external debt servicing requirement of $6.9 billion in FY26, excluding additional rollovers, is being managed without stress.

“This combination of reliable inflows, ample reserves and an established liability management strategy ensures that debt servicing will not disrupt the hard-earned stability of the external sector or pressure the exchange rate,” the report said.

However, both reports cautioned that risks remain.

Any shortfall in scheduled inflows from the IMF, multilateral lenders, bilateral partners or private creditors could undermine reserve targets and force a reassessment of the rupee’s valuation.

They also warned that political instability disrupting the reform agenda, or external shocks such as a sharp rise in global commodity prices, could widen the current account deficit and complicate Pakistan’s ability to meet its sizeable financing needs.

Comments

See what people are discussing