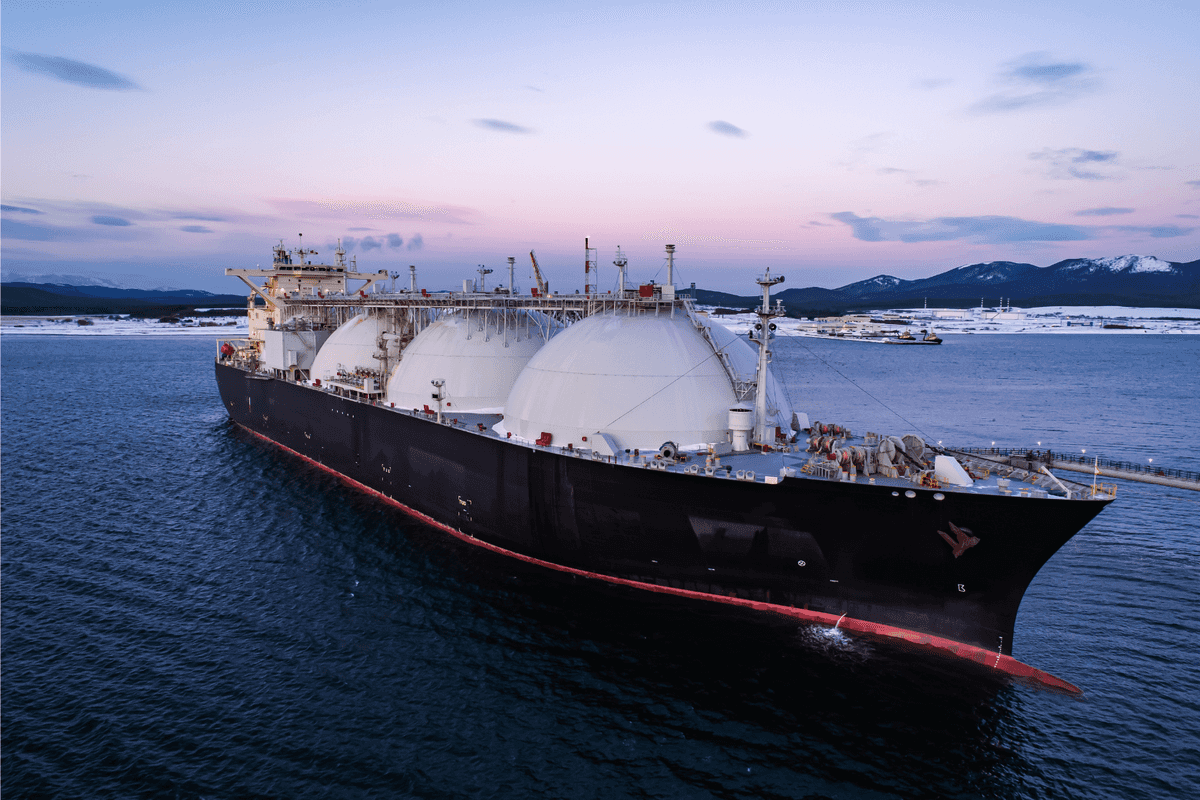

Pakistan raises RLNG prices for August on higher terminal charges

Asian spot LNG prices declined this week amid soft demand

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

Pakistan’s Oil & Gas Regulatory Authority has increased the prices of re-gasified liquefied natural gas (RLNG) by up to 1.46% for August, impacting consumers of both Sui Northern Gas Pipelines Ltd. (SNGPL) and Sui Southern Gas Company Ltd. (SSGCL).

The adjustment, driven by a marginal uptick in terminal charges, reflects a rise of up to $0.1548 per million British thermal units (MMBtu) across transmission and distribution costs, in line with federal policy directives.

For SNGPL consumers, the transmission price rose 1.32% to $10.977/MMBtu, up $0.1432 from July, while the distribution rate increased 1.33% to $11.733/MMBtu, a $0.1543 hike.

SSGCL’s revised transmission price climbed 1.46% to $9.6097/MMBtu, compared to $9.4713/MMBtu last month. Its distribution rate also rose 1.46%, reaching $10.7285/MMBtu from July’s $10.5737/MMBtu.

The new RLNG prices incorporate charges for LNG terminals, transmission losses, port fees, and margins for state-run importer Pakistan State Oil (PSO).

Ogra said the weighted average sale prices were calculated based on 10 cargoes imported by PSO under two long-term contracts with Qatar, priced at 13.37% and 10.20% of Brent crude, respectively. Five cargoes were procured at each slope, Ogra added.

Meanwhile, Asian spot LNG prices declined this week amid soft demand and robust storage levels. The average price for September delivery into northeast Asia fell to $11.65/MMBtu from $11.90/MMBtu last week, according to industry estimates.

October delivery contracts were pegged at $11.45/MMBtu.

Analysts expect further price softening next week, citing high Chinese inventories, stable Pacific supply, and seasonal temperatures contributing to a bearish market outlook.

Comments

See what people are discussing