What will be the impact of Pakistan's reduced electricity rates?

The rate cut is being facilitated by an increase in the petroleum development levy and a proposed levy on captive power plants

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

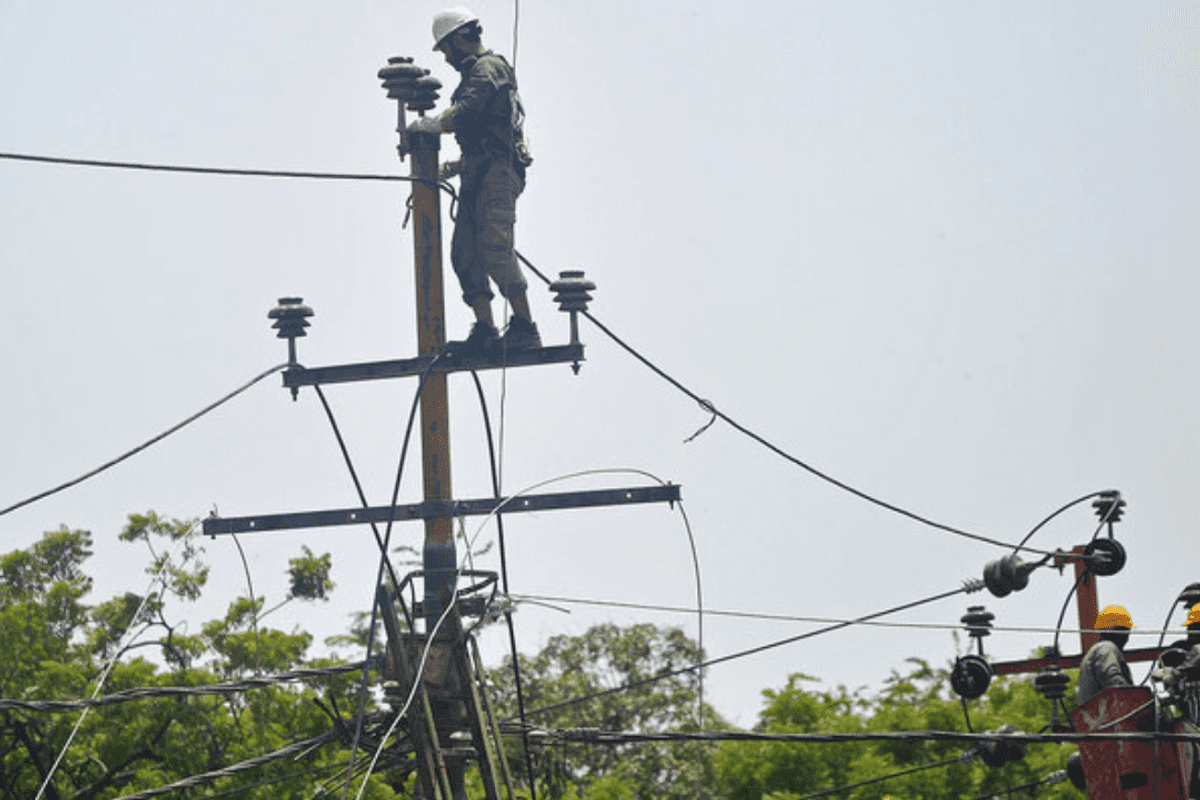

Pakistan has finally announced some relief for electricity consumers in the country, who have been struggling with skyrocketing bills in recent years. The government has reduced power tariffs by PKR7.41 per unit for consumers (18% reduction) and PKR7.59 per unit for industries (17% reduction).

The announcement has the IMF's assent and is likely to boost demand and impact overall inflation during the incoming months.

The rate cut is being facilitated by an increase in the petroleum development levy — which was recently raised by PKR 10 to PKR70 per liter — a proposed levy on captive gas power plants, and negotiations between the government and independent power producers, which created the necessary fiscal space.

This relief package will boost demand by stimulating industrial activity, while also potentially improving the recovery of electricity bills in a sector struggling with electricity theft, according to a report by brokerage InterMarket Securities.

Moreover, given electricity forms 4-5% of the CPI basket, the announcement should have a beneficial impact on the inflation outlook. This may potentially lead the central bank to resume rate cuts after it held the policy rate at 12% in the last Monetary Policy Committee meeting, the report said.

Sector-wise effect

Cement

The cement sector has made significant investments to reduce grid dependence amid rising electricity prices. However, Fauji Cement Company Ltd (FCCL) and Kohat Cement Company Limited (KOHC) still rely on the grid, with 52% and 35% dependence, respectively.

KOHC's furnace oil, costing PKR 36 per unit and making up 28% of its power mix, will shift to the grid, bringing costs down to about PKR 32 per unit after the price cut. This relief is timely, as both companies may face higher raw material royalty rates in Khyber Pakhtunkhwa.

Meanwhile, Pioneer Cement Ltd, Cherat Cement Company Ltd, Maple Leaf Cement Factory Ltd, and D.G. Khan Cement Company Ltd, with minimal grid reliance, should see a limited financial impact.

Steel

The key beneficiaries will be Mughal Steel and Amreli Steels Ltd (ASTL) after the electricity prices cut. The former currently has a 66% reliance on the grid, which will drop to 40% once its coal-fired power plant becomes operational.

Meanwhile, ASTL relies entirely on the grid and will experience a greater impact on EPS moving forward. However, lower electricity rates may reduce barriers to entry for smaller mill owners in the informal sector, many of whom had shut down due to the economic slowdown. With improving demand amid economic recovery and this relief package, these mills may restart operations, increasing competition in the sector.

Textile

The InterMarket Securities report on textile producers, exposed to the newly announced 29% reciprocal US tariffs, have some positive news with the electricity relief package.

Elevated electricity prices (14 cents per unit) have eroded Pakistan’s competitiveness against key rivals such as India (10 cents), Bangladesh (8.6 cents), and Vietnam (7.2 cents). While this rate cut should improve competitiveness, Pakistan will still remain relatively expensive at around 11 cents per unit post-cut.

"Lastly, it is important to note that the government is expected to impose a levy on captive gas power plants to partially fund this package, which may offset some of the benefits for the textile sector."

Separately, a report from Topline Securities said some components of this tariff will be reviewed again in July i.e. PDL/TDS amount allocation and Quarterly Tariff Adjustment is also subject to capacity payments and currency movement.

"We believe lower power tariff will be beneficial for steel, textile, select cement companies amongst others which rely on grid. However, continuity of this relief shall be subject to measures taken in Budget FY26, i.e. allocation of TDS/PDL and next Quarterly Tariff Adjustment," it stated.

The report further noted that the government aims to privatize the power distribution companies in line with IMF guidelines to make the sector viable and also plans to eliminate circular debt within five years.

Comments

See what people are discussing