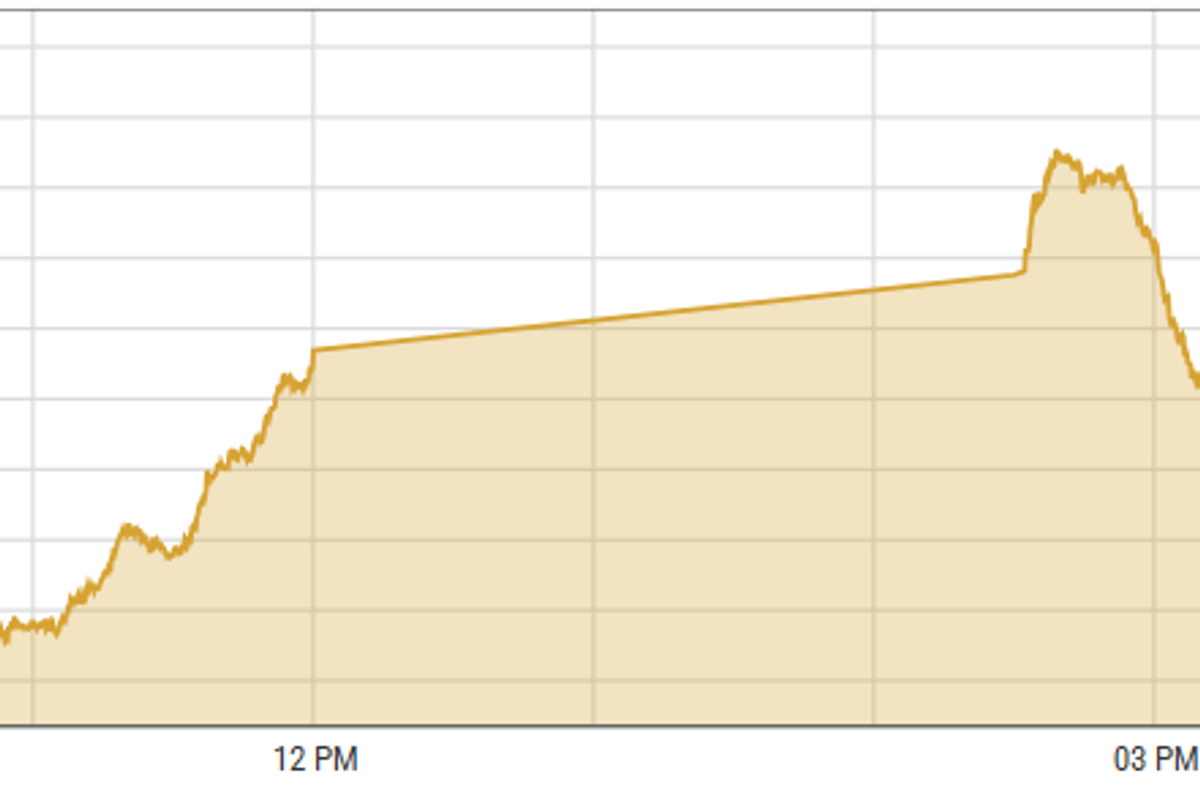

Pakistan stock rebounds on strong valuations

KSE-100 index gained 3.05% to close at 109,513 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 3.05%

PSX

Pakistan stocks rallied on Friday, recouping some losses from the past three sessions, as the market closed on a bullish note. The strong performance was driven by scrips across the board, buoyed by attractive valuations.

Investors seized the opportunity to take new positions, as the pressure from local mutual fund redemptions finally eased. Leading the charge were the Commercial Banks, Fertilizer, and Oil & Gas Exploration Companies sectors, which were the major contributors in Friday's session.

The market's rebound provided a much-needed boost to investor confidence, setting a positive tone as the week came to a close.

The KSE-100 index gained 3,238.17 points or 3.05% to close at 109,513.14 points.

Indian stocks dropped on Friday due to global selling. This happened after the U.S. Federal Reserve suggested that interest rate cuts will be slow. There was heavy selling in the real estate and PSU bank sectors.

Key events affecting the market sentiment include the upcoming U.S. Presidential change with Donald Trump taking office in January, and the Indian Union Budget announcement coming up in a few weeks.

BSE-100 index shed 448.20 points or 1.76% to close at 25,006.81 points.

DFM General index gained 10.75 points or 0.21% to close at 5,057.30 points.

Commodities

Oil prices have gone down after recently rising. The prices went up because of new U.S. sanctions on major oil producers Russia and Iran, and possible sanctions on "dark fleet" tankers and Chinese banks to limit Russia's oil revenue, mentioned by U.S. Treasury Secretary Janet Yellen.

China's plans to increase economic stimulus could increase oil demand. Market sentiment improved with interest rate cuts by central banks in Canada, Europe, and Switzerland.

Traders are now focusing on the Federal Reserve's expected 25-basis-point rate cut, which might help economic growth and boost oil demand.

Brent crude prices shed 1.13% to $72.06 per barrel.

Investors expect the Federal Reserve (Fed) to be more cautious with rate cuts next year because inflation progress has slowed. This expectation has caused U.S. Treasury bond yields to rise, making it harder for gold, which doesn’t earn interest, to perform well.

Traders are also hesitant to make big bets on gold before the key Federal Open Market Committee (FOMC) policy decision on Wednesday.

International gold prices increased 0.3% reaching $2,603.43 per ounce.

Currency

US dollar gained some strength against PKR in the inter-bank market, up 0.04%. Pakistani currency settled at 278.41 with a loss of 6 paisas. In the open market USD was trading at PKR 279.

Comments

See what people are discussing