Pakistan stock market hits record high of 145,000 on expectation of strong earnings

Investor confidence boosted by robust results, export growth, and improved liquidity

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

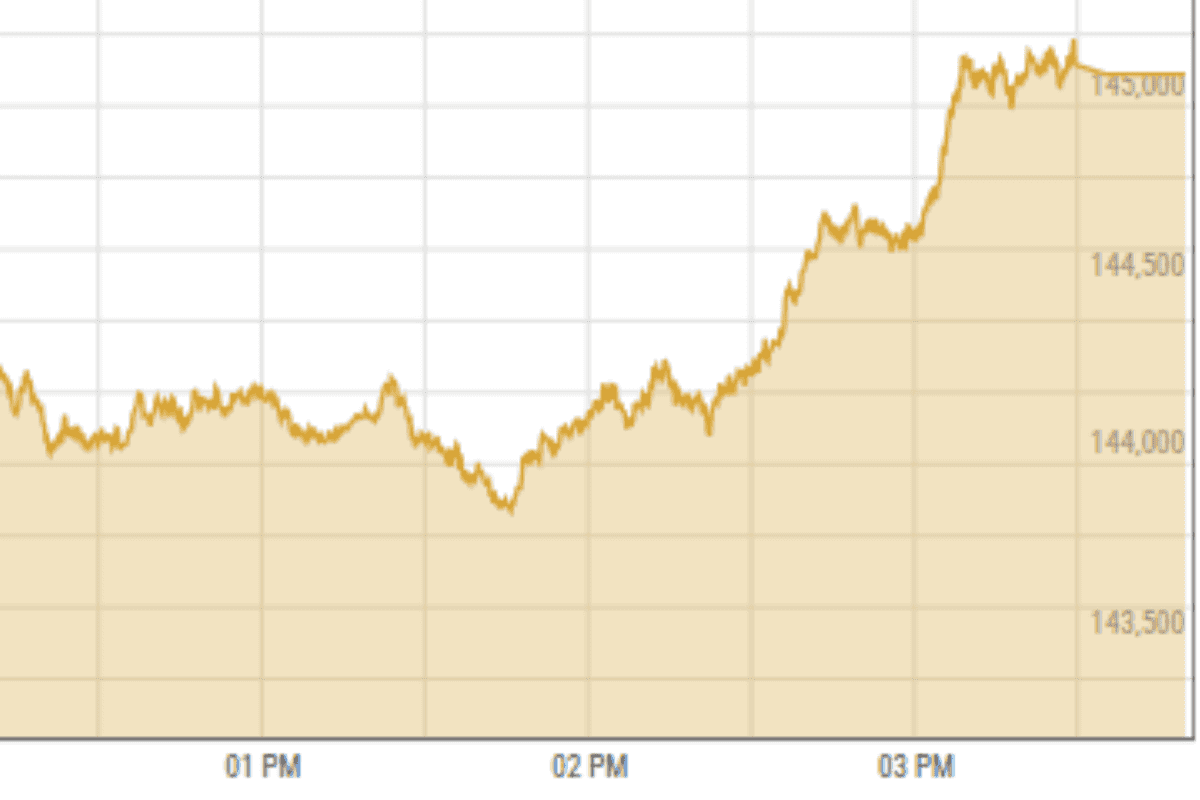

KSE100 graph

PSX Website

The Pakistan Stock Exchange (PSX) recorded significant gains on Wednesday, with the KSE-100 Index closing at an all-time high of 145,088 points, up 2,051 points or 1.4%. The market continued its winning streak, driven by strong corporate earnings, particularly from the banking and fertilizer sectors.

The week’s momentum began with rallies in the oil and gas sector, followed by fertilizers and now banking stocks. Cement shares also saw sharp gains after the sector reported better-than-expected financial results and encouraging sales figures for July.

Pakistan’s cement industry recorded a notable year-on-year increase in total dispatches during July. Local dispatches rose 18.4% to 2.988 million tons, up from 2.524 million tons in July 2024. Export volumes nearly doubled, surging 84% to 1.008 million tons from 0.547 million tons a year earlier.

Investor sentiment has remained strong since the federal budget announcement, which included measures that improved market liquidity—particularly the imposition of taxes on mutual funds. The move boosted inflows into equities, pushing share prices higher.

Further supporting market optimism was the recent reduction in U.S. tariffs, which were slashed by 10% to 19% for Pakistani goods. In contrast, key competitors such as India face a duty of 25%, giving Pakistan a potential export edge.

Textile exports also posted impressive growth in July, rising 33.7% to $1.69 billion, compared with $1.27 billion in the same period last year.

Banking stocks were the session’s top performers. HBL, NBP, MEBL, and UBL collectively added 1,017 points to the index. HBL and NBP hit their upper circuits during intraday trade, although mild profit-taking near the close trimmed some gains.

Investor participation remained strong, with trading volume reaching 784 million shares and turnover rising to Rs 52.7 billion—both showing significant improvement from previous sessions. Bank of Punjab led the volume chart with 67 million shares traded.

According to analyst at Pearl Securities, the KSE-100 Index witnessed a strong bullish surge, marking its highest-ever intraday close as investor confidence soared. The rally was supported by aggressive buying across key sectors, improving macroeconomic indicators, and a positive corporate earnings outlook.

Comments

See what people are discussing