Pakistan stocks close negative amid profit-taking and early IMF review

KSE-100 index lost 0.31% to close at 92,021 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index lost 0.31% to close at 92,021 points

PSX

Pakistan stocks closed negative on Wednesday as investors opted for profit-taking in an over-bought market. Caution prevailed as the IMF staff led by Nathan Porter is scheduled to visit Pakistan next week to review performance and compliance with around 40 conditions mutually agreed upon at the time of the loan approval.

This review could result in additional taxes, especially since the government missed its first quarter revenue collection target.

Global equity and commodity markets reacted to Donald Trump’s victory against Kamala Haris, which also kept the market in cautious mood.

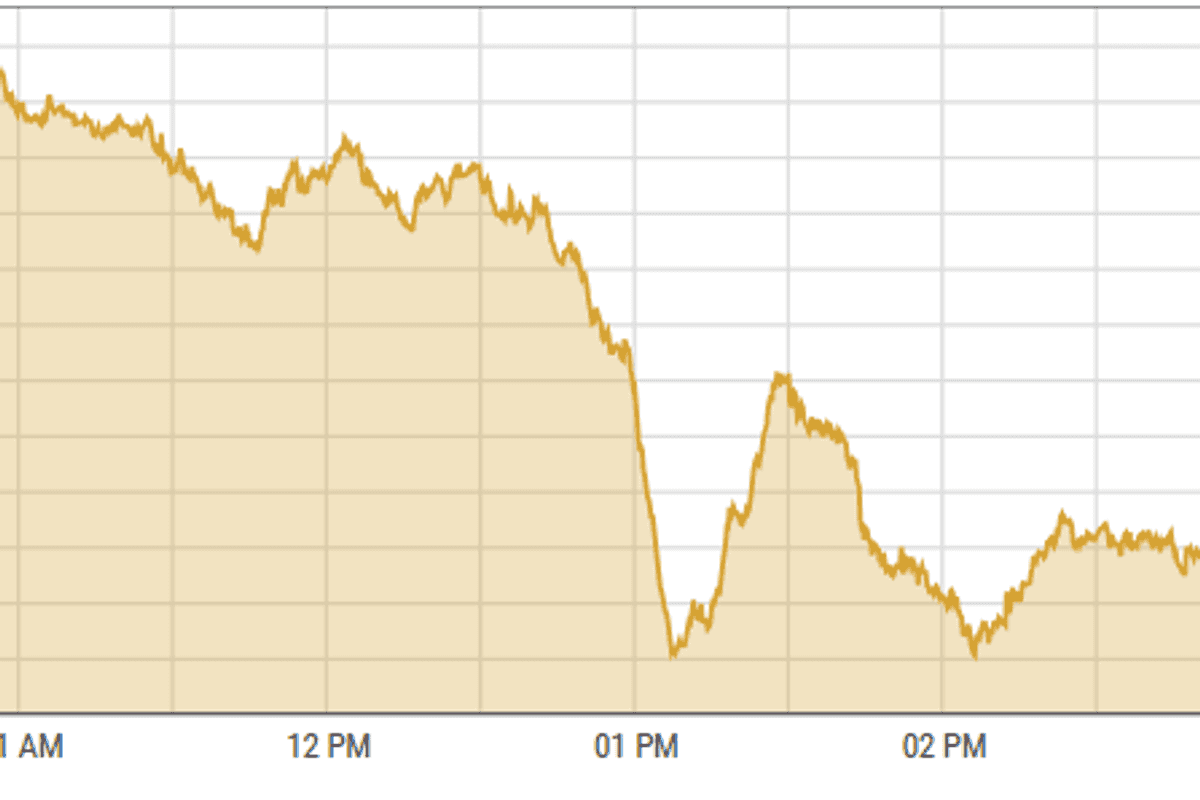

The market experienced significant volatility, with the index peaking at 92,967 and dipping to a low of 91,891 as investors took profits in large-cap stocks. The technology & communication, oil & gas exploration, and commercial banks sectors were the biggest losers in today's session.

KSE-100 index shed 282.88 points or 0.31% to close at 92,021.44 points.

The Indian stock market quickly reacted to the news of Donald Trump winning the US presidential race, showing both caution and opportunity.

Investors are preparing for changes in US foreign policy, trade, and economic strategy, which could affect India's trade, technology, and currency sectors.

On Wednesday, Indian stocks experienced sharp swings as market participants considered the potential policy changes under Trump's renewed "America First" approach.

India’s BSE 100 Index gained 1.35% or 343.52 points to close at 25,868.11 points.

The Dubai Financial Market (DFM) General Index gained 0.57% or 26.19 points to close at 4,620.72 points.

Commodities

Crude oil prices dropped on November 6, ending a five-day rise. This was due to a stronger US dollar, influenced by reports of Donald Trump nearing a second term in the White House.

A stronger dollar makes oil more expensive for buyers using other currencies. Other factors affecting the market include OPEC+ delaying production plans, rising Middle East tensions, and the upcoming US Federal Reserve meeting. Economic improvements in China, the largest crude importer, could also impact future demand.

Brent crude prices declined 1.26% to $74.58 per barrel.

Gold prices stayed mostly negative on Wednesday as investors waited for the results of the Fed’s two-day policy meeting, which ends on Thursday amid reports of Donald Trump winning the election.

They are also looking forward to Chair Jerome Powell’s comments on interest rates.

Markets expect the Fed to cut rates by 0.25% this week, following a larger 0.50% cut in September.

Gold is seen as a safe investment during uncertain times and does well when interest rates are low.

International gold prices declined 0.66% reaching $2,722.26 per ounce. In Pakistan, gold prices dropped by PKR 500 to PKR 283,200/tola on Wednesday.

Currency

US dollar strengthened against PKR, up 0.02% in the inter-bank market. Pakistani currency settled at 277.89, a loss of 6 paisas against the US dollar. In the open market USD was trading at PKR 280.0.

Comments

See what people are discussing