Pakistan stocks closed positive amid buoyant sector performance and rate cut speculation

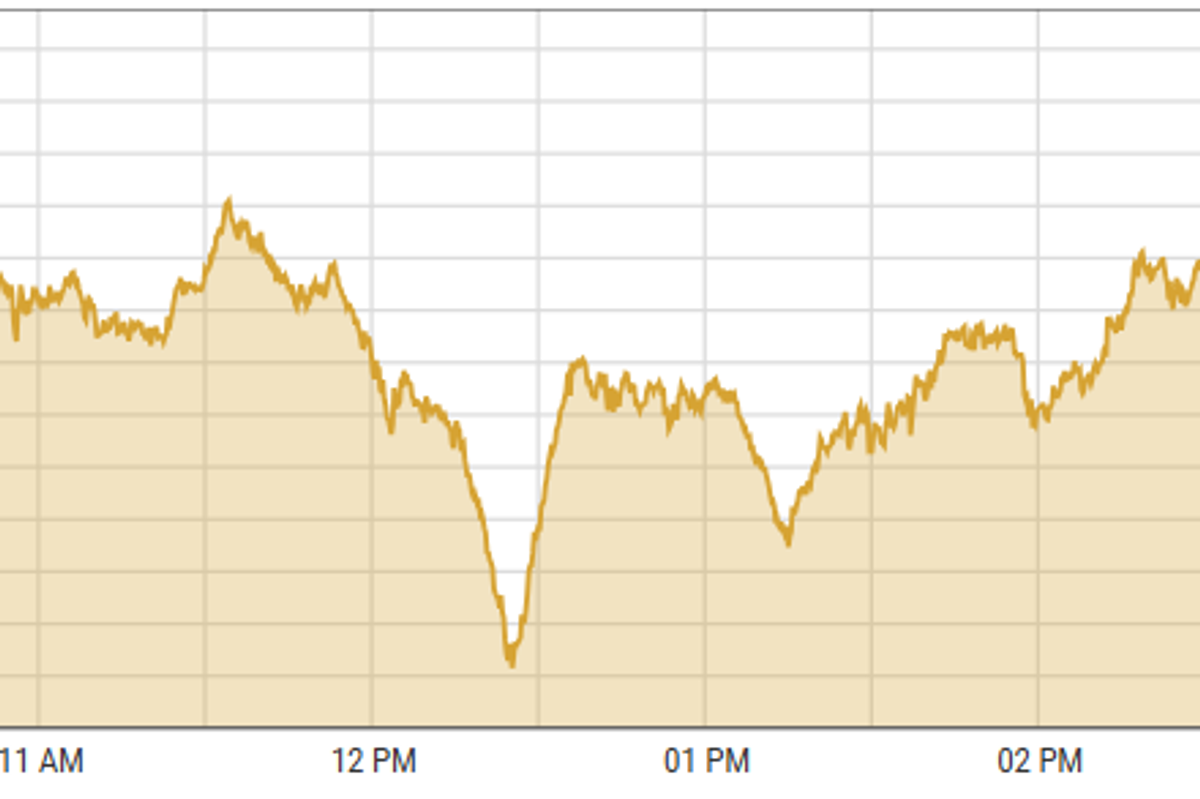

KSE-100 index gained 0.52% to close at 105,104.33 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

Pakistan stocks closed on a high note on Wednesday, primarily driven by the robust performance of the oil and energy sector.

This positive momentum followed the release of encouraging data, showing a year-over-year increase of 15% in petroleum sales and a 5.6% year-over-year rise in cement sales for November.

Market optimism was further bolstered by speculation surrounding a potential reduction in interest rates, with key market players anticipating a significant rate cut in this month’s Monetary Policy Committee (MPC) meeting.

Notably, the session saw substantial contributions from the oil & gas exploration companies, power generation & distribution, and technology & communication sectors.

Their strong performance played a pivotal role in the index's upward movement, reflecting investor confidence and a buoyant market outlook.

KSE-100 index gained 545.26 points or 0.52% to close at 105,104.33 points.

Separately, Indian stock markets went up slightly on Wednesday, but gains in banking and IT sectors slowed down. Meanwhile, in economic news, India's services sector grew a bit less in November.

The HSBC India Services Business Activity Index dropped a little to 58.4 from 58.5 in October.

BSE-100 index gained 54.22 points or 0.21% to close at 25,954.82 points.

DFM General index gained 9.03 points or 0.19% to close at 4,856.37 points.

Commodities

On Wednesday, oil prices went up a bit because traders think OPEC+ will keep reducing their oil supply. The market is also tense due to global political issues.

OPEC+ is expected to keep cutting 2.2 million barrels per day into early 2025, so prices probably won't change much unless something new happens.

Brent crude prices increased 0.75% to $74.17 per barrel.

On Wednesday, gold prices stayed the same because traders were thinking about the political unrest in South Korea and important economic information.

The president of South Korea declared martial law but then took it back, which might make people buy more gold as a safe investment.

Other metals' prices fell as investors waited to hear from Fed Chair Powell later in the day.

International gold prices declined 0.03% reaching $2,644.57 per ounce. In Pakistan, gold prices remain unchanged at PKR 275,200 per tola.

Currency

The PKR steadied against the dollar in the interbank market, down 0.03%. Pakistani currency settled at 277.92 with a loss of 6 paisas. In the open market, USD was trading at PKR 279.

Comments

See what people are discussing