Pakistan stocks fall as investors cash in on recent gains

Cement sector sees strong activity; geopolitical concerns weigh on sentiment

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

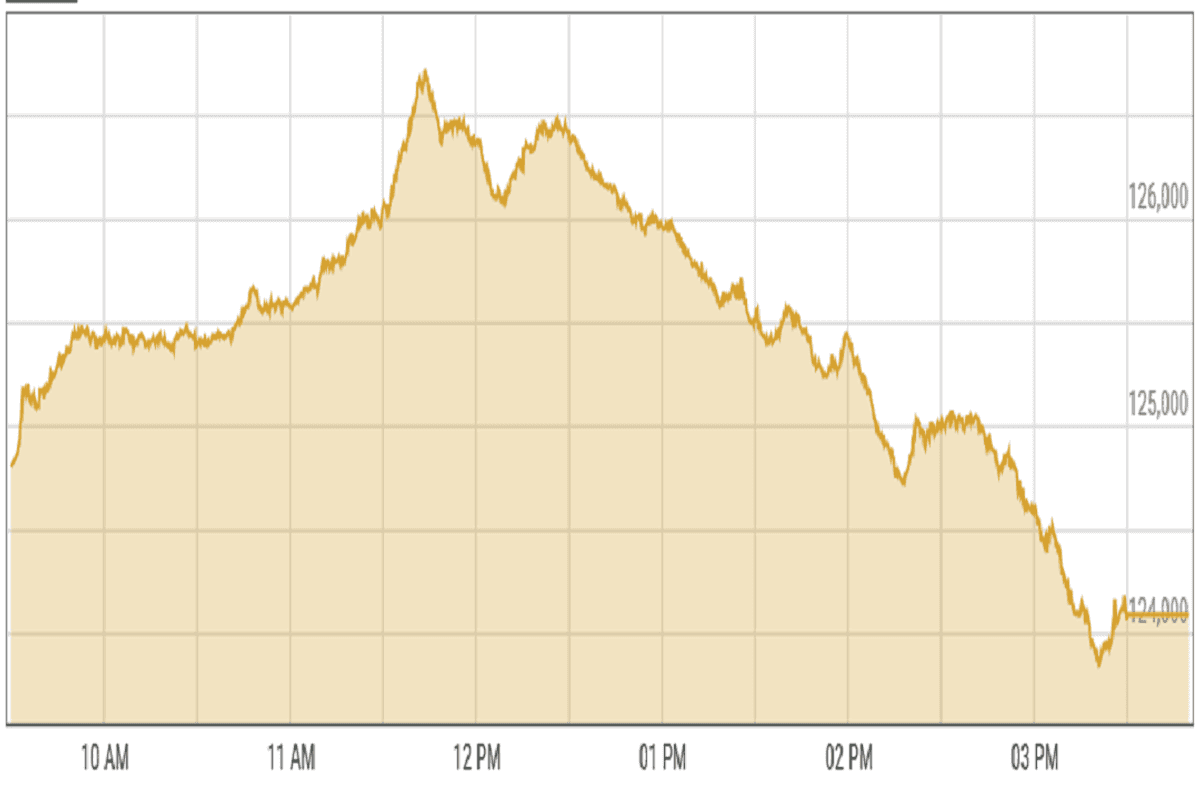

KSE-100 index shed 0.21%

PSX

Pakistan's stock market closed lower Thursday as investors engaged in profit-taking following a multi-session rally, analysts said.

Healthy trading volumes were recorded, particularly in the cement sector. The benchmark KSE-100 index ended in negative territory after hitting a new intraday high earlier in the session.

“This dip appears to be short-term profit-taking after a strong rally,” said an analyst at JS Global Capital.

An analyst at Topline Securities noted that cautious investor sentiment and profit-taking activity dragged the market lower. Meanwhile, Ismail Iqbal Securities said initial optimism over the upcoming fiscal year’s budget fueled early gains, but selling pressure and concerns over global geopolitical risks led to a decline.

The oil and gas exploration, fertilizer, and automobile assembler sectors were the worst performers, collectively shedding 253 points from the index.

KSE-100 index shed 0.21% or 259.56 points to close at 124,093.12 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency lost 21 paisa to close at 282.67. In the open market USD was trading at PKR 285.

Indian Stocks

Indian stocks dropped sharply on Thursday, following a global trend as worries grew about rising political tensions, trade issues, and a slowing world economy.

Investors are also getting concerned about high stock prices in India. What started as a pullback in a few areas is now spreading to bigger, well-known companies too. Rising oil prices—linked to unrest in the Middle East—are adding to the nervous mood. As a result, sectors like IT, metals, and automobiles haven’t performed well.

BSE-100 index shed 1.14% or 301.37 points to close at 26,109.49 points.

DFM General Index shed 2.29% or 128.4 points to close at 5,467.1 points.

Crude Oil

Crude oil prices edged lower Thursday, following a 4% surge the previous day that sent futures to a two-month high amid geopolitical concerns.

Wednesday’s rally was triggered by news that the United States was withdrawing diplomatic staff from its embassy in Baghdad, prompting fears of escalating conflict in the region. Traders attributed Thursday’s pullback to profit-taking, though market sentiment remained broadly bullish.

Investors also weighed the potential for Israeli strikes on Iran, with earlier reports suggesting Tel Aviv was considering such action more seriously. Those reports had previously fueled a sharp uptick in oil prices.

Brent crude prices increased by 1.89% to $68.53 per barrel.

Gold Prices

Gold prices rose for a second consecutive session Thursday as escalating tensions in the Middle East boosted the metal’s appeal as a safe-haven asset.

The rally was further supported by a softer U.S. dollar, which made bullion more attractive to holders of other currencies. Investor attention also turned to remarks from President Trump, who said he would notify trade partners of upcoming tariff rates within two weeks.

International gold prices increased 1.72% to close at $ 3,381.86 per ounce. In the local market, gold prices increased by PKR 4,000 to 356,900 per tola.

Comments

See what people are discussing