Pakistan stocks hit the historic 100,000 points milestone

Market capitalization has surged 38% to $45 billion since year start

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

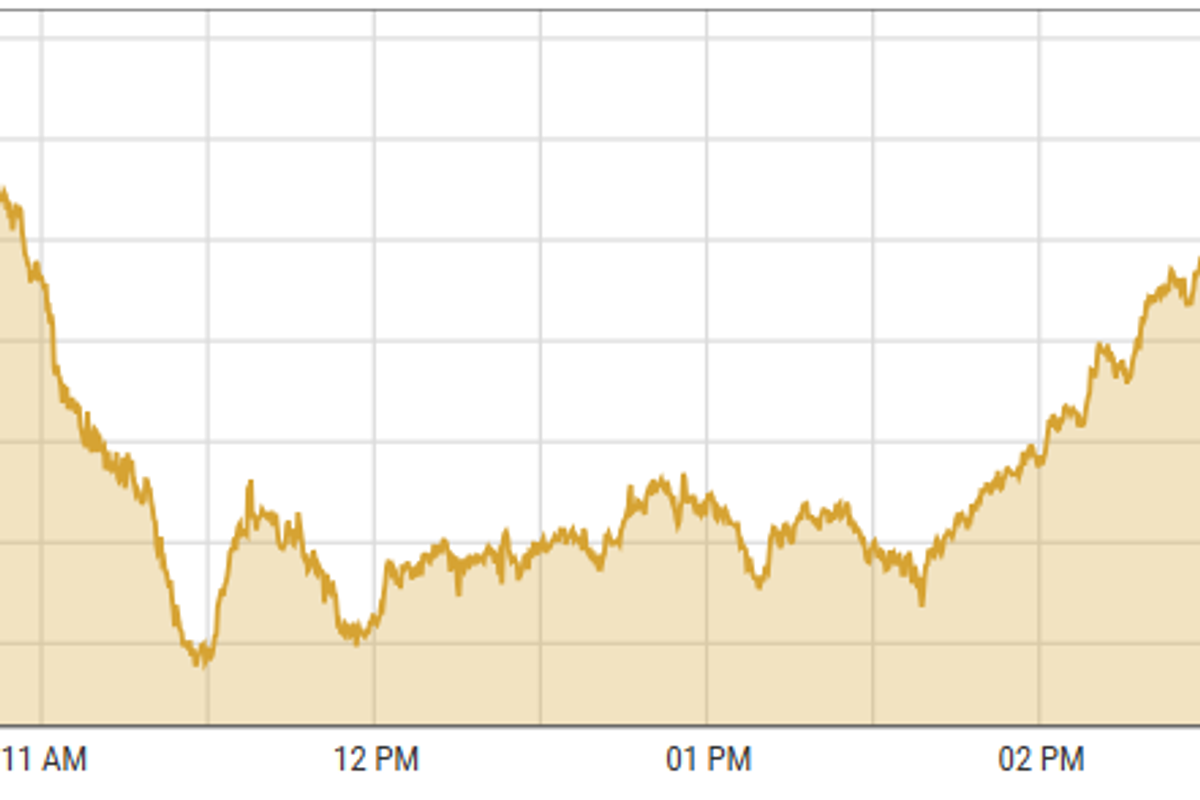

The KSE-100 index surged 0.82% or 813.52 points to close at 100,082.77 points.

PSX

Pakistan stocks rallied on Thursday closing above the historic milestone of 100,000 points on anticipation of further cut in interest rates next month.

Decline treasury bill yields a day earlier has cemented expectation of continued monetary easing, while inflation is already receding.

The record comes two days after the PSX saw brief uncertainty due to political tensions, recovering tremendously the next day as it witnessed the highest single-day gain on Wednesday.

The Ministry of Finance has projected inflation in November to be between 5.8% and 6.8%, and for December, it is expected to decrease to between 5.6% and 6.5%.

The KSE-100 index surged 0.82% or 813.52 points to close at 100,082.77 points.

Pakistan Stock Exchange (PSX) surged past the 100,000 mark, reflecting a 150% return in just 16 months from 40,000 points to 100,000 points, Shahid Ali Habib, CEO of Arif Habib Limited said in an email.

“The milestone reflects robust economic recovery and consistent performance across major sectors, driving investor confidence.”

Habib said the price to earnings ratio (P/E) increased from 2.6x to 5.5x, but still below the historical average of 7.25x, indicating potential for further growth.

“Continued growth is anticipated due to increased market participation, ongoing reforms, resilience in challenging conditions.”

It may be mentioned here the market has been recognized as the best performing globally for the calendar year 2024, boasting a 60% return year-to-date.

The market capitalization has surged 40% to PKR 12,700 billion ($45 billion) compared from PKR 9,006 billion as on December 31, 2023.

Indian stock markets fell sharply on Thursday, with benchmark indices dropping over 1% due to a selloff in the IT sector.

The drop was caused by uncertainties about U.S. President-elect Donald Trump's policies and upcoming U.S. interest rate decisions.

Meanwhile, Adani Group shares jumped by up to 9.3% after it was clarified that key executives were not charged under the U.S. Foreign Corrupt Practices Act in recent indictments.

BSE-100 index lost 306.76 points or 1.2% to close at 25,348.74 points.

The Dubai Financial Market (DFM) General Index gained 0.38% or 18.31 points to close at 4,823.38 points.

Commodities

Crude oil prices stayed steady today after a ceasefire between Israel and Hezbollah began, hinting that the violence in the oil region might be ending. Additionally, the anticipation that OPEC+ will extend its production cuts on Sunday helped maintain stable benchmarks.

Brent crude prices surged 0.85% to $73.45 per barrel.

Gold prices traded near the day's high on Thursday, but without strong upward momentum.

Investors are worried that US President-elect Donald Trump's tariff plans could hurt the global economy. Additionally, the ongoing Russia-Ukraine conflict supports the demand for gold as a safe investment.

International gold prices surged 0.28% reaching $2,648.03 per ounce. In Pakistan, gold prices decreased by PKR 700 to PKR 275,200/tola.

Currency

US dollar strengthened against PKR in the inter-bank market, up 0.04%. Pakistani currency settled at 278.04 with a loss of 8 paisas. In the open market USD was trading at PKR 280.

Comments

See what people are discussing