Pakistan stocks rebound amid global recovery

Banks, cement attract investors on cheap values

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

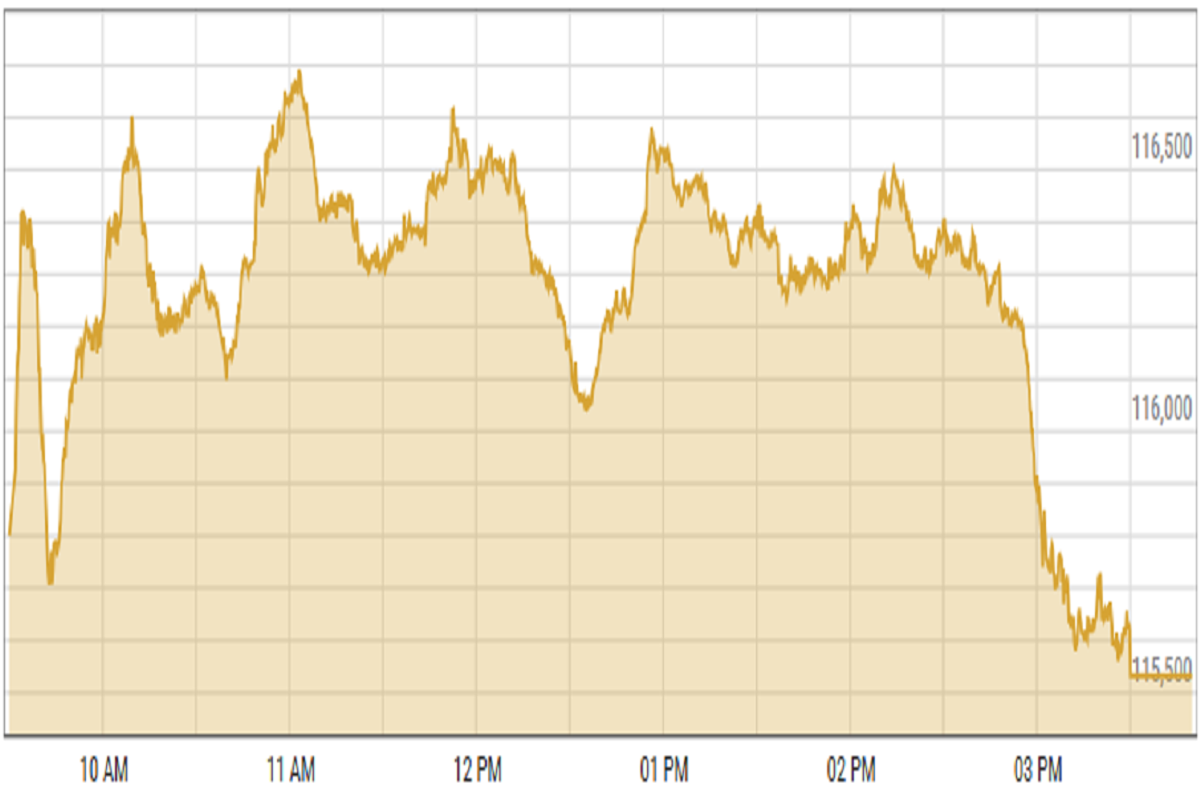

KSE-100 index gained 0.54%

PSX

Pakistan’s stock market staged a recovery Monday, buoyed by a global rebound in equities and crude oil prices, as investors eyed potential negotiations on U.S. tariff levies.

Institutional support, fueled by expectations of an imminent International Monetary Fund (IMF) tranche release next month and government efforts to address circular debt, played a key role in the bullish close at the Pakistan Stock Exchange (PSX), analysts said.

“The recovery was led by scrips across the board,” said Ahsan Mehanti of Arif Habib Corp. “Optimism surrounding global market trends and economic policy measures contributed to the positive momentum.”

An analyst at Topline Securities noted that the rally aligned with the broader global trend, as investor sentiment improved.

Among the top performers were Lucky Cement, Mari Energies, Meezan Bank, Bank Al Habib, and Bank Al-Falah, which together added 688 points to the benchmark index.

Lucky gained 6.6% after announcing gold and copper find in Chaghi. Mari surged 5.05% after announcing another discovery in North Waziristan.

KSE-100 index gained 0.54% or 622.95 points to close at 115,532.43 points.

Currency

US dollar steadied against PKR in the inter-bank market. Pakistani currency lost 16 paisas to close at 280.73. In the open market USD was trading at PKR 282.

Indian Stocks

Indian equity markets staged a strong comeback on Tuesday following Monday’s steep decline, as concerns over a global trade war began to subside.

US President Donald Trump’s assurance that multiple nations are open to negotiations on the new reciprocal tariffs helped ease fears of an escalating trade dispute.

Additionally, short covering by traders played a key role in bolstering the recovery of domestic benchmarks.

BSE-100 index gained 1.72% or 399.45 points to close at 23,581.83 points.

DFM General Index shed 3.08% or 152.46 points to close at 4,799.01 points.

Crude Oil

Oil prices went up by more than 1% on Tuesday after dropping to their lowest level in nearly four years the day before. The previous drop happened because people worried that U.S. tariffs could reduce demand and cause a global economic slowdown. However, experts warn that risks are still present.

On Tuesday, oil prices recovered some of the losses, helped by more stable stock markets. Recently, the market has fallen a lot as traders expect a major drop in demand, but it’s still unclear how big that impact will be.

Brent crude prices increased by 0.37% to $64.45 per barrel.

Gold Prices

Gold prices rose on Tuesday, rebounding from a four-week low, as investors sought safe-haven assets amid escalating global trade tensions. The trade war intensified after U.S. President Donald Trump threatened higher tariffs on China, while the EU proposed countermeasures.

Trump ruled out pausing tariffs for negotiations but said he would discuss duties with China, Japan, and other countries.

International gold prices increased 1.52% to close at $ 3,012.3 per ounce. In the local market, gold prices declined by PKR 2,000 to 318,000 per tola.

Comments

See what people are discussing