Pakistan stocks surge to record highs on declining T-Bill yields

KSE-100 index posts third largest single day gain of 3,370 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 3.04%

PSX

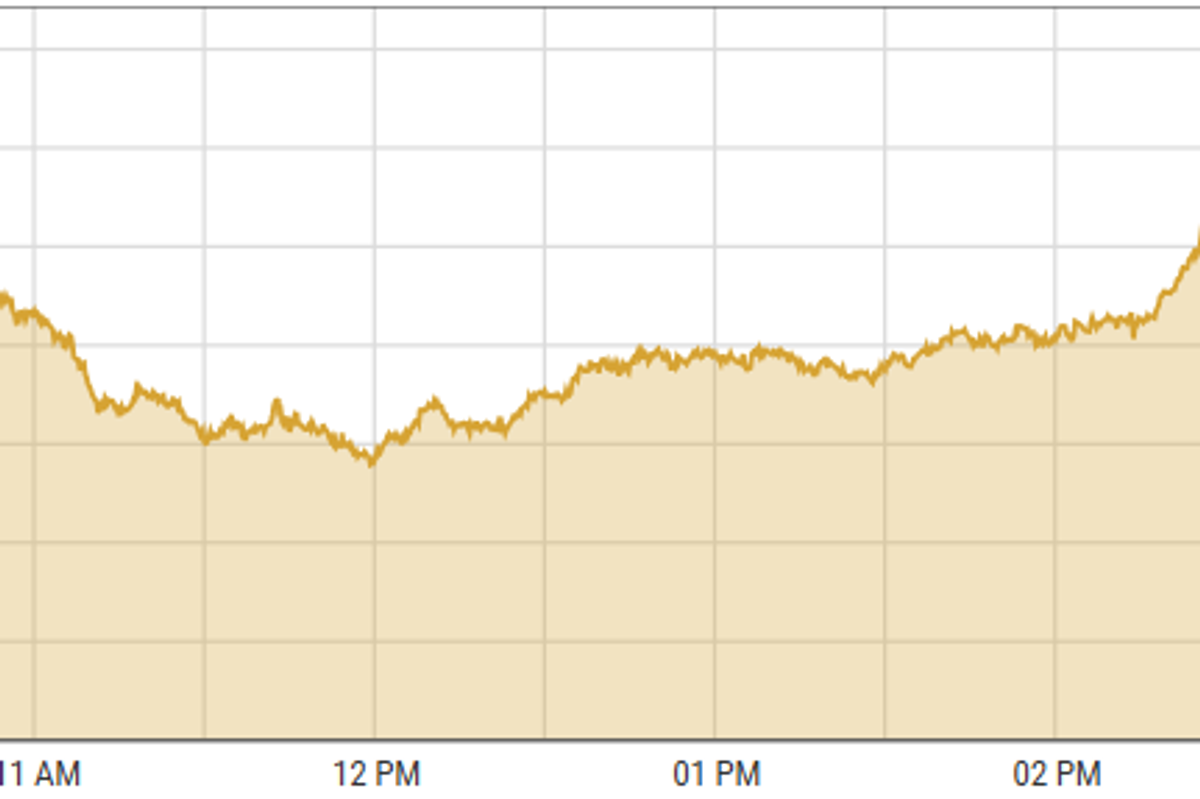

The stock market reached new highs today, fueled by investor excitement following a drop in Treasury bill auction yields. This positive development spurred aggressive buying across all sectors. The KSE-100 Index saw its third-largest gain ever, surging 3,370 points.

Notably, 9 of the top 10 largest gains have been recorded in 2024, highlighting a significant trend. The shift in liquidity from the asset class continues to be a driving force, influenced by the recent decline in secondary market yields. Major contributors to today's surge were the fertilizer, oil and gas exploration, and oil and gas marketing sectors.

The market outlook remains positive, with expectations of higher index levels in the near future.

The KSE-100 index gained 3,370.29 points or 3.04% to close at 114,180.51 points.

Indian stock markets ended the day lower as they continued to show little movement. Investors are waiting for domestic CPI data and watching the weakening rupee.

Although inflation is expected to decrease, everyone is keeping a close eye on vegetable prices, which will impact future interest rates. The focus is now on the upcoming inflation data.

BSE-100 index lost 88.82 points or 0.34% to close at 26,085.18 points.

DFM General index gained 16.29 points or 0.34% to close at 4,811.61 points.

Commodities

Oil prices remained largely unchanged in early trading on Thursday, influenced by conflicting signals from the global energy market.

Concerns about weak demand and rising oil inventories in the United States counterbalanced fears of supply disruptions due to new sanctions targeting Russian oil exports.

Brent crude prices shed 0.08% to $73.46 per barrel.

Gold prices edged lower on Thursday amid subdued spot demand.

Profit-taking in gold spiked after the US inflation figures for November aligned with the average consensus, significantly increasing the probability of the Federal Reserve reducing interest rates by 25 basis points (bps) at next week’s policy meeting to nearly 99%, according to CME FedWatch Tool estimates.

International gold prices declined 0.36% reaching $2,710.95 per ounce. In Pakistan, gold prices increased by PKR 2,300 to PKR 282,800/tola.

Currency

US dollar strengthened against PKR in the inter-bank market, up 0.05%. Pakistani currency settled at 278.23 with a gain of 9 paisas. In the open market USD was trading at PKR 279.

Comments

See what people are discussing