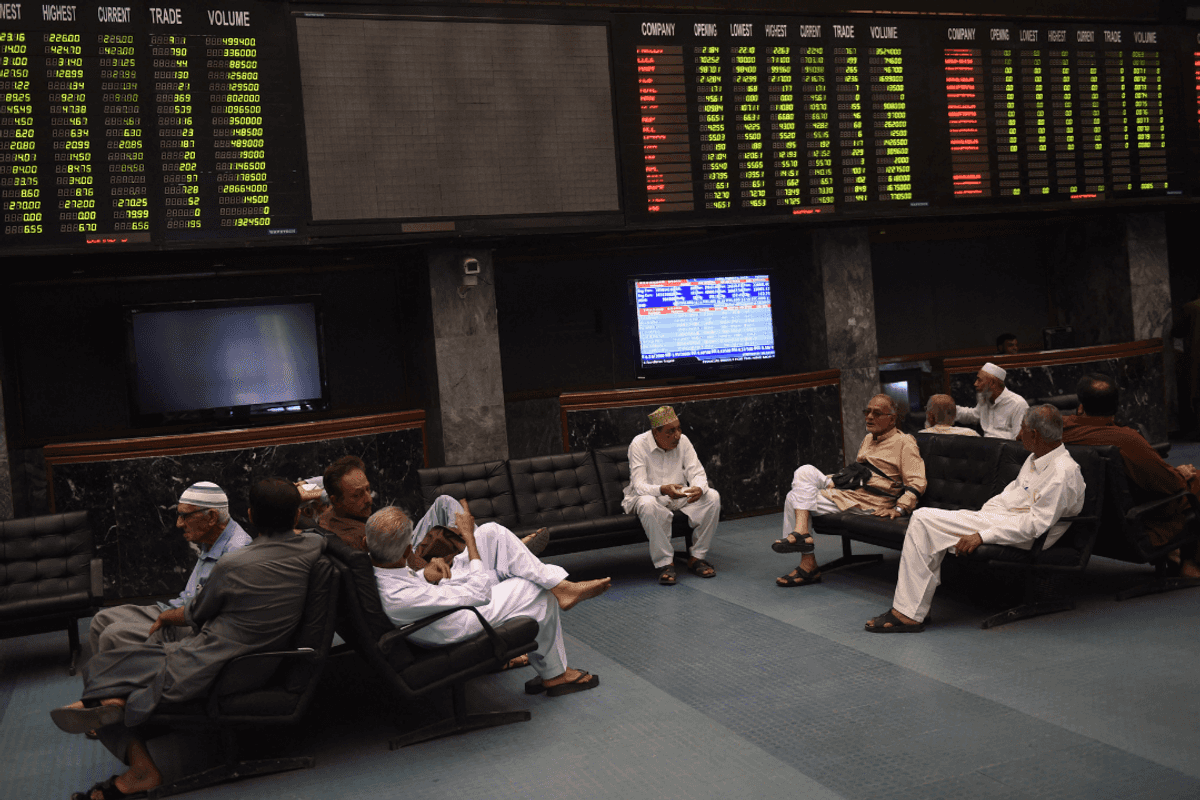

PSX's market capitalization rises to 6.5-year high

The last time it was at this level was on Feb 19, 2019

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

The Pakistan Stock Exchange's (PSX) market capitalization rose to a 6.5-year high in dollar terms on Thursday, mainly because key economic indicators improved, inflation eased, the rupee recovered, and a new trade deal was finalized between the United States and Pakistan.

The PSX's market capitalization at the close of July 31 stood at $59 billion. The last time it was at this level was on Feb 19, 2019.

Since the start of the new fiscal year, the market capitalization (value) has risen by 10% from $53.7 billion.

Meanwhile, from July 1, 2024 to date, it has climbed by more than 57%.

The benchmark KSE-100 index extended its upward trajectory in July, reaching an all-time high of 139,419 points, posting a month-on-month gain of 13,763 points.

The rally was fueled by improved macro indicators, strong external sector performance, and renewed optimism around international cooperation.

Market sentiment received a boost after U.S. President Donald Trump announced that the United States and Pakistan had reached an agreement to explore Pakistan's untapped oil reserves, while also indicating that both countries were working towards finalizing a trade deal, according to a report of brokerage firm Arif Habib Limited.

The central bank, however, held its policy rate steady at 11% this week, citing concerns about the inflation outlook and the widening trade deficit.

Another factor which helped rebuild confidence of the local investors was S&P Global's upgradation of Pakistan’s credit rating to 'B-' with a stable outlook, citing macroeconomic stabilization and reform progress.

Macroeconomic improvements helped and promoted fresh buying in key sectors, such as the first current account surplus in 14 years.

Another factor which helped build up the rally was inflation continuing to ease, with June's CPI clocking in at 3.2%.

Average daily volumes in July settled at 766 million shares, while traded value increased by 19.3% to $124.9 million.

Comments

See what people are discussing