'The index that doesn't rest': PSX surges to new all-time high

The market has now posted a staggering 90% return over the past year

Hammad Qureshi

Senior Producer / Correspondent

A business journalist with 18 years of experience, holding an MS in Finance from KU and a Google-certified Data Analyst. Expert in producing insightful business news content, combining financial knowledge with data-driven analysis.

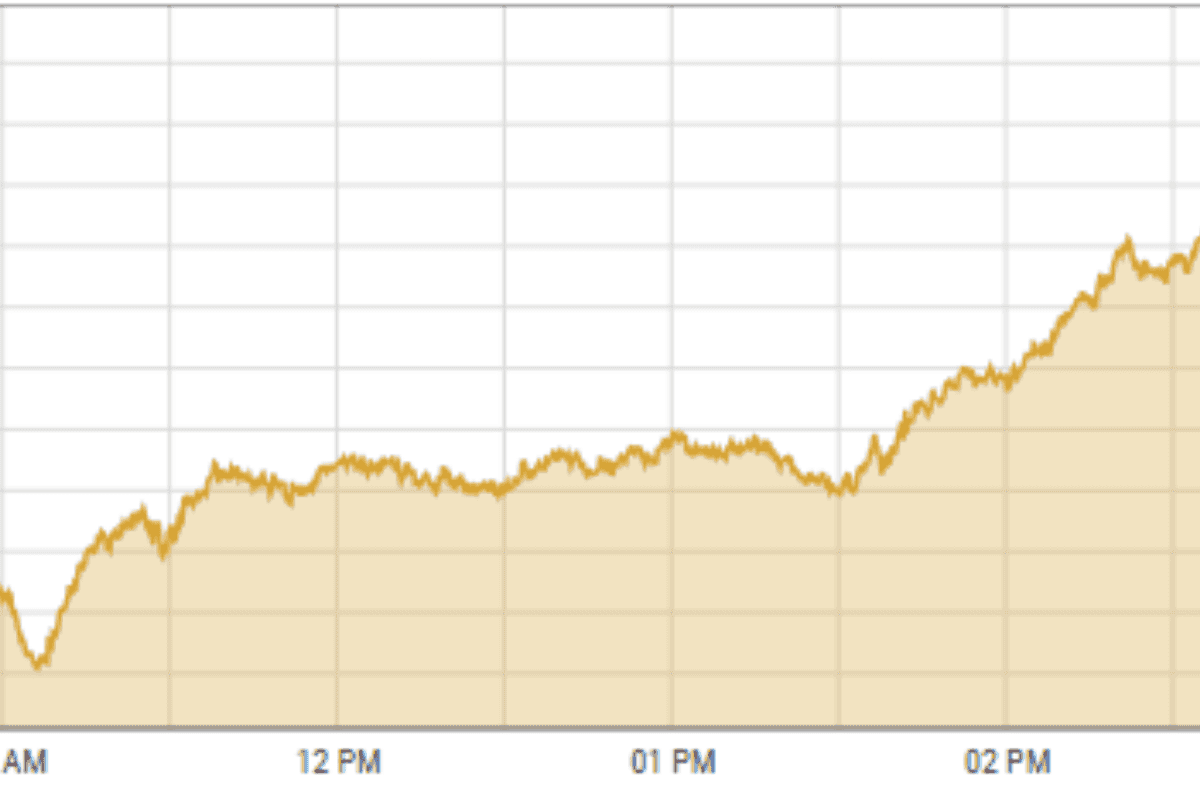

A snapshot of trading activity at the Pakistan Stock Exchange on Monday

PSX website

The Pakistan Stock Exchange (PSX) surged to another all-time high on Monday, with the benchmark index gaining 1,704 points to close at 148,196, driven by strong fund buying and robust investor sentiment.

The value of traded shares stood at around PKR 28 billion.

The market has now posted a staggering 90% return over the past year, making it one of the best-performing exchanges globally.

Several blue-chip stocks have delivered standout gains since the beginning of 2025, including National Bank of Pakistan (NBP) at 121% , National Foods (NATF) at 94%, United Bank Limited (UBL) at 93%, Askari Bank (AKBL) at 81%, and Maple Leaf Cement Factory (MLCF) at 71%.

Despite the bullish momentum, foreign investors continued to offload holdings, selling shares worth $375.5 million during the year.

Local funds and institutions absorbed much of the selling pressure, fueling the record-setting streak.

Credit rating agency Fitch recently noted in a report that, “Fitch expects the combination of lower interest rates and an improving macroeconomic environment to stimulate private credit demand, supporting steadier loan and deposit growth, and banks’ financial performance.”

An analyst at Topline Securities said, “Market sentiment brightened on reports of the government’s circular debt reform drive, which entails reducing LNG cargoes, revising RLNG pricing, and mobilizing funds through LNG diversion savings, SOE dividends, and power sector receivables. Detailed proposals are expected to be announced next week.”

Ahsan Mehanti from Arif Habib Corporation said that stocks closed at a new all-time high as investor sentiment turned more positive following the Fitch report and Moody's recent credit rating upgrade.

Strong earnings outlook, rupee stability and speculations over Pakistan-U.S. trade investment deals, including reports that the government is seeking further U.S. export tariff incentives, played a catalyst role in the PSX's record close, he added.

Comments

See what people are discussing