SBP cuts cash reserve requirement to boost industrial credit and exports

Topline Securities says the CRR rollback reflects SBP’s comfort with inflation and intent to support bank liquidity

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

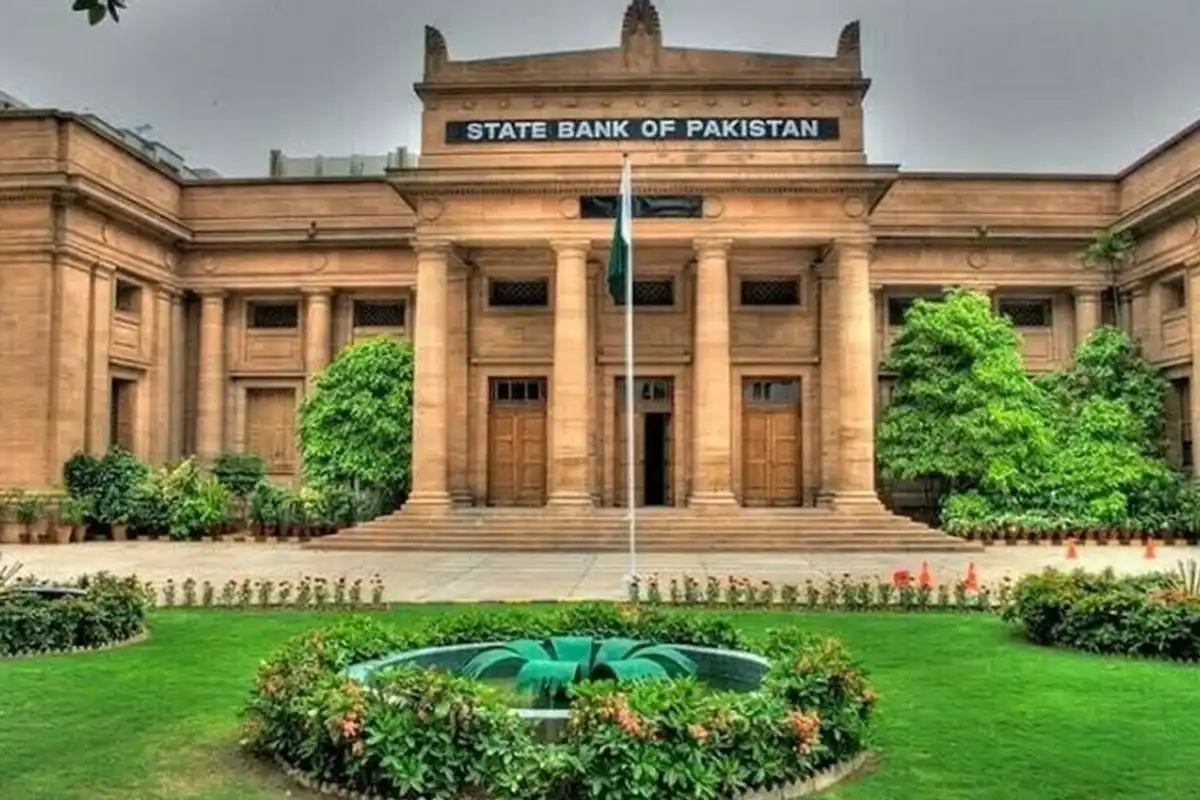

Pakistan’s central bank has reduced the cash reserve requirement for commercial banks in a move aimed at boosting industrial lending and reviving the country’s faltering exports, officials and analysts said.

The State Bank of Pakistan (SBP) announced during a press briefing by Governor Jameel Ahmad that it has lowered the Cash Reserve Requirement (CRR) by 100 basis points to 5% on a weekly average basis and 3% on a daily basis. The revised ratios took effect immediately.

The CRR was previously raised in November 2021 as the central bank sought to absorb excess liquidity amid rising inflationary pressures. The rollback to earlier levels signals easing concerns over the inflation outlook and a renewed focus on supporting economic activity.

“The decision to revert to the old CRR ratios reflects the central bank’s comfort with the inflation trajectory and its intent to support liquidity conditions for banks,” Topline Securities said in a note to clients.

The CRR represents the portion of banks’ time and demand liabilities that must be held as cash with the SBP. Funds parked with the central bank do not earn any return, effectively acting as a cost for lenders.

Topline Securities estimated that the reduction will release between PKR 300 billion and PKR 315 billion into the banking system. “Based on our calculations, the banking sector could see additional liquidity of around PKR 300–315 billion,” the brokerage said. “If deployed at an assumed yield of 10%, the annualized bottom-line impact on banks could be close to 2%.”

Analysts said the additional liquidity could support credit expansion, particularly in export-oriented and industrial sectors, while also improving profitability for banks operating in a tight monetary environment.

A research analyst noted that the SBP’s decision to reduce the CRR from 6% to 5% is broadly positive for banks, as it eases liquidity constraints and provides greater operational flexibility. When the CRR is lowered, banks are required to hold less of their deposits as reserves with the central bank, freeing up funds for lending.

Comments

See what people are discussing