SBP to integrate Raast with Arab Monetary Fund’s Buna for easier remittances

With 38 million unique Raast IDs, the system now handles an average of 2.5 million transactions daily

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

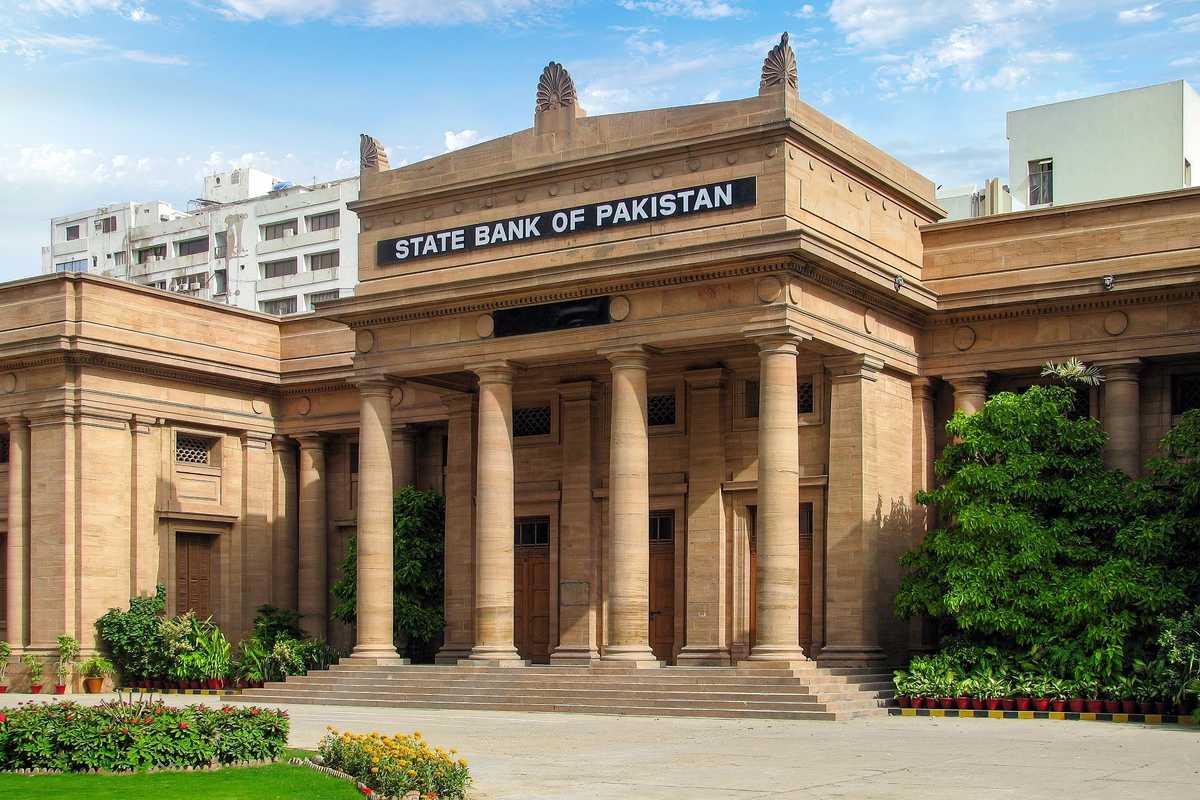

State Bank of Pakistan

Shutterstock

The State Bank of Pakistan (SBP) is set to integrate its instant payment system, Raast, with the Arab Monetary Fund’s Buna platform. This move aims to simplify remittances for millions of Pakistanis residing in Arab countries, announced SBP Governor Jameel Ahmed at the 13th Bank of The Future Forum.

Governor Ahmed highlighted SBP's efforts to modernize Pakistan's retail payments industry by adopting the ISO-20022 payment standard.

Launched in 2021, Raast has quickly become a cornerstone of this transformation, processing approximately 850 million transactions worth over PKR 19 trillion in under three years.

With 38 million unique Raast IDs, the system now handles an average of 2.5 million transactions daily.

The governor also noted significant growth in digital banking in Pakistan. The country now boasts 59 million branchless banking wallets, 19 million mobile banking apps, 3.7 million e-money wallets, and 12 million internet banking users.

Since 2020, digital retail transactions have surged by 30%, with digital payments' share in total retail payments rising from 76% in FY23 to 84% in FY24. Mobile and internet banking transactions are growing annually at rates of 70% and 30%, respectively, driven by a tech-savvy young population.

Comments

See what people are discussing