Stocks close negative as investors opt for profit-taking

Market opens strong, closes lower amid fiscal concerns and IMF compliance reports

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.13%

PSX

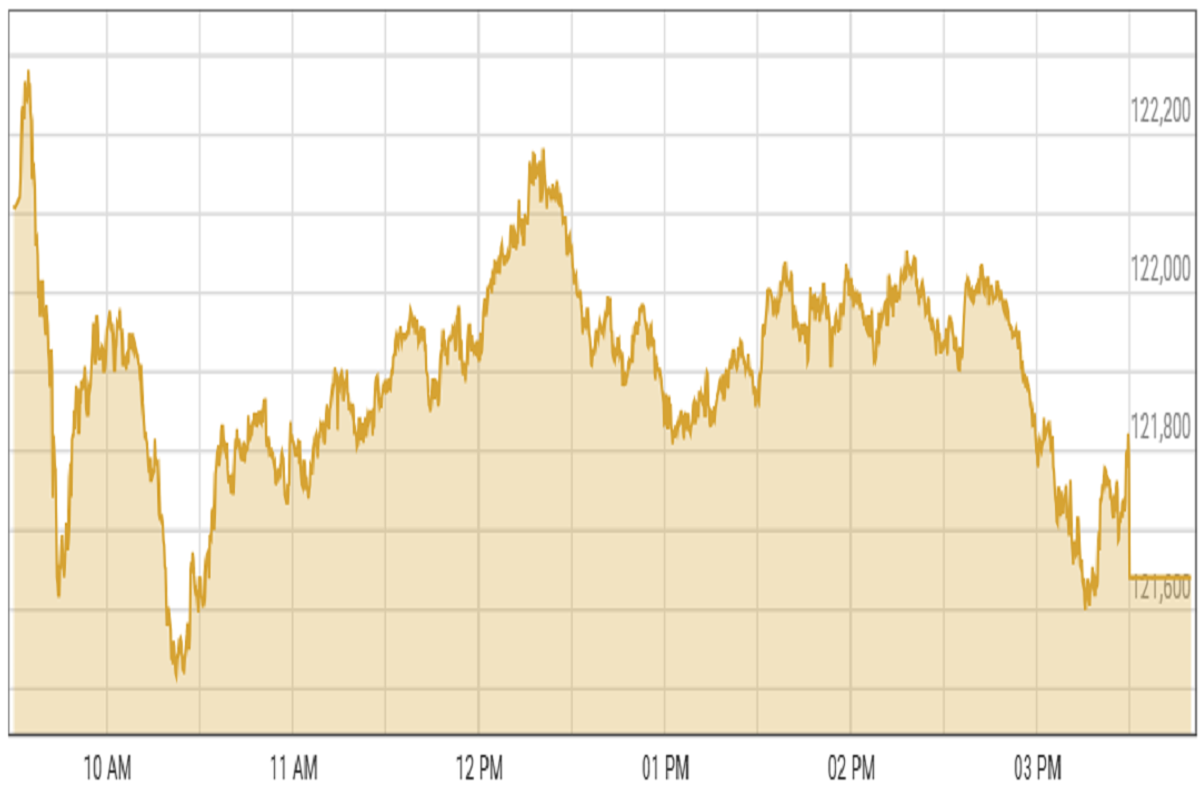

Pakistan's stock market opened on a bullish note Thursday, with the benchmark index surging to a new intraday high of 122,281, fueled by strong investor sentiment. However, profit-taking later in the session pulled the market downward.

An analyst at JS Global Capital attributed the early rally to sectoral momentum and improving investor confidence. “We expect the market to remain positive in the near term, supported by strong sectoral momentum and improving investor sentiment,” the analyst said.

Ahsan Mehanti, director at Arif Habib Corp, noted that the market closed lower following reports of the International Monetary Fund’s strict compliance measures on agricultural taxes and revenue collection, which opposed provincial energy subsidies.

Additionally, expectations of higher taxes on banking and savings income, along with petroleum levies in the upcoming Federal Budget FY26, contributed to the bearish close.

Market analysts suggest that fiscal policy changes and IMF directives will remain key factors shaping investor sentiment in the coming days.

KSE-100 index shed 0.13% or 157.87 points to close at 121,641 points.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 5 paisas to close at 282.17. In the open market USD was trading at PKR 284.45.

Indian Stocks

Indian stock markets moved up on Thursday, despite mixed signals from global markets. Early trading saw investors buying shares in the pharmaceutical, automobile, and IT sectors.

Experts say that global political and economic developments could impact the market in the near future. One key factor is the recent drop in the US ISM PMI data, which suggests that the US economy is slowing down significantly. As a result, the yield on US 10-year government bonds has fallen to 4.36%, and it may continue to decline as the economy weakens.

BSE-100 index gained 0.53% or 137.59 points to close at 25,972.38 points.

Crude Oil

Oil prices went up on Thursday morning. Despite worries about too much supply and slow economic growth, investors remained optimistic.

Saudi Arabia, the top oil exporter, is trying to boost production and has lowered prices for buyers in Asia, suggesting demand is slowing.

This price cut for July follows OPEC+'s (a group of oil-producing nations) recent decision to increase oil output next month.

Brent crude prices increased by 0.4% to $65.12 per barrel.

Gold Prices

Gold prices rose as weak US jobs data fueled expectations of a Fed rate cut. May’s ADP report showed only 37,000 new jobs, and the services sector contracted, signaling economic weakness.

Falling Treasury yields and growing geopolitical risks further boosted demand for gold.

International gold prices increased 0.59% to close at $ 3,394.67 per ounce. In the local market, gold prices increased by PKR 4,300 at 358,400 per tola.

Comments

See what people are discussing