Pakistan stock market plummets as tensions with India escalate

Drone strikes, military clashes trigger largest single-day decline in KSE-100 index history

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

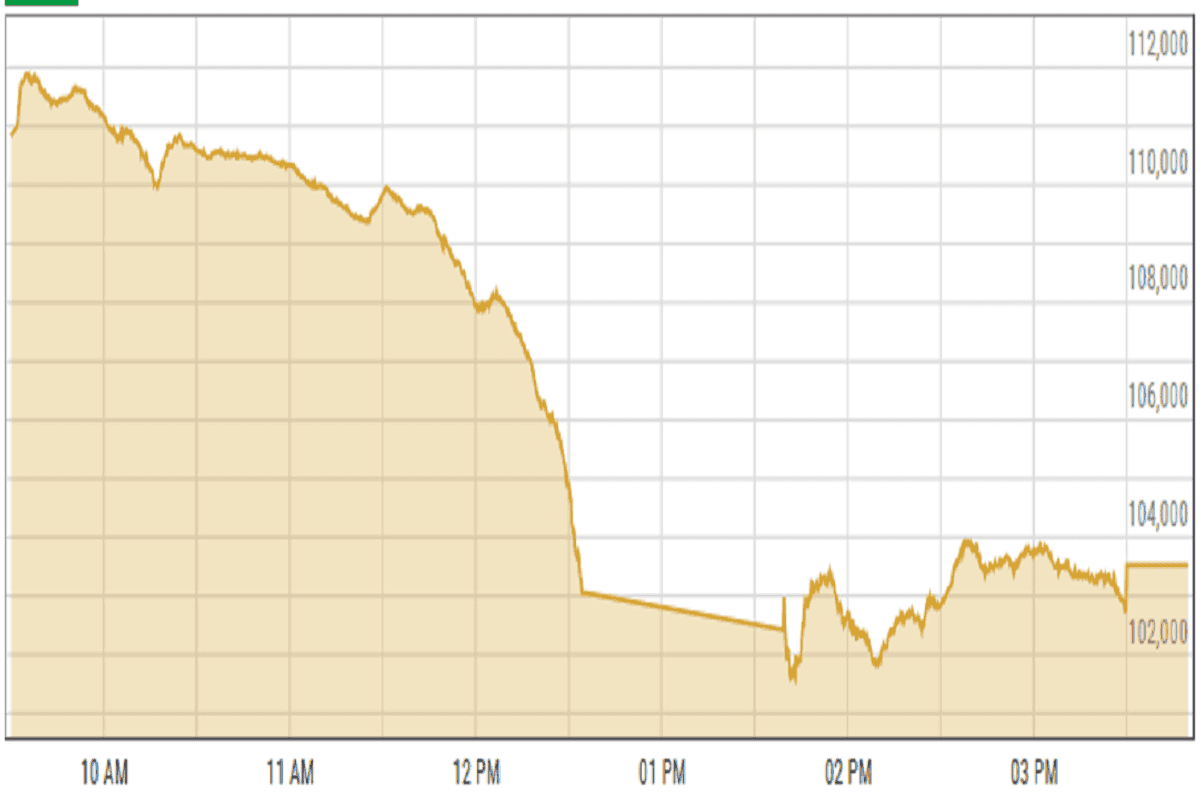

Pakistan’s stock market suffered a historic meltdown Thursday as escalating tensions with India triggered panic selling, leading to the sharpest single-day decline in the KSE-100 Index’s history.

The benchmark index plunged by 6,482 points to close at 103,527, with trading briefly halted for an hour after the KSE-30 Index dropped more than 5% in five consecutive minutes, activating the circuit breaker mechanism.

The market opened with cautious optimism but quickly reversed course following alarming geopolitical developments. Lt. Gen. Ahmed Sharif Chaudhry, spokesman for the Pakistani military, announced that Pakistani forces had intercepted and neutralized 25 Indian drones since the previous night. One drone partially struck a military installation, injuring four personnel, he said.

The announcement sent shockwaves through financial markets, prompting investors to exit positions amid fears of escalating cross-border hostilities.

“The market crash followed reports of multiple drone-strikes in major cities, triggering force-selling of leveraged positions and an investor exodus,” an analyst at Al Habib Capital said.

An analyst at Topline Securities described the plunge as “unprecedented” and said it reflected deep uncertainty among market participants.

“The session opened with hopes of de-escalation, but sentiment deteriorated as reports emerged of drones being shot down across various regions,” an analyst at Ismail Iqbal Securities said.

Markets remained highly volatile throughout the day, as concerns over geopolitical instability overshadowed economic fundamentals.

KSE-100 index shed 5.89% or 6,482.21 points to close at 110,009.03 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency lost 15 paisas to close at 281.52. In the open market USD was trading at PKR 283.15.

Indian Stocks

Indian equity markets ended Thursday on a sharp decline after a turbulent and range-bound trading session, as escalating geopolitical tensions and the weekly derivatives expiry fueled widespread selling pressure.

Investor sentiment weakened in the late hours as concerns grew over rising tensions between India and Pakistan. Reports suggested that Pakistan’s air defense systems in Sialkot and Lahore sustained damage, heightening fears of further escalation.

BSE-100 index shed 0.96% or 243.58 points to close at 25,217.75 points.

DFM General Index shed 0.36% or 19.23 points to close at 5,318.29 points.

Crude Oil

Oil prices went up on Thursday because people are hopeful about upcoming trade talks between the U.S. and China, the biggest users of oil.

The U.S. Treasury Secretary, Scott Bessent, will meet with China's top economic official on May 10 in Switzerland to discuss their trade war, which is affecting the global economy.

Since these two countries have the world's largest economies, their trade conflict could slow down the growth of oil demand. Meanwhile, a group of oil-producing countries called OPEC+ plans to increase oil production, which could put more pressure on prices.

Brent crude prices increased by 1.54% to $62.06 per barrel.

Gold Prices

Gold prices fell on Thursday as investors pulled back from safe-haven assets. This happened because U.S. President Donald Trump was expected to announce a trade deal with the U.K.

Another key factor was the Federal Reserve’s interest rate decision and comments from its chairman, Jerome Powell. Powell said the U.S. economy is holding up for now, but he warned that tariffs and uncertainty could hurt economic growth later this year.

International gold prices decreased 1.34% to close at $3,340.86 per ounce. In the local market, gold prices decreased PKR 4,200 to 352,700 per tola.

Comments

See what people are discussing