Pakistan stocks rise on record current account surplus, low inflation

Investor confidence strengthens as economic indicators point to growth

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

Pakistan’s stock market closed higher as investors reacted positively to the country’s record current account surplus and easing inflation, amid corporate results announcements, analysts said.

Ahsan Mehanti of Arif Habib Corp attributed the bullish close to optimistic economic forecasts, citing Fitch Ratings’ projection that GDP growth will edge up to 3% in fiscal year 2025. The agency also expects a primary surplus of 2% of GDP and a current account deficit of 1% of GDP, providing a boost to investor sentiment.

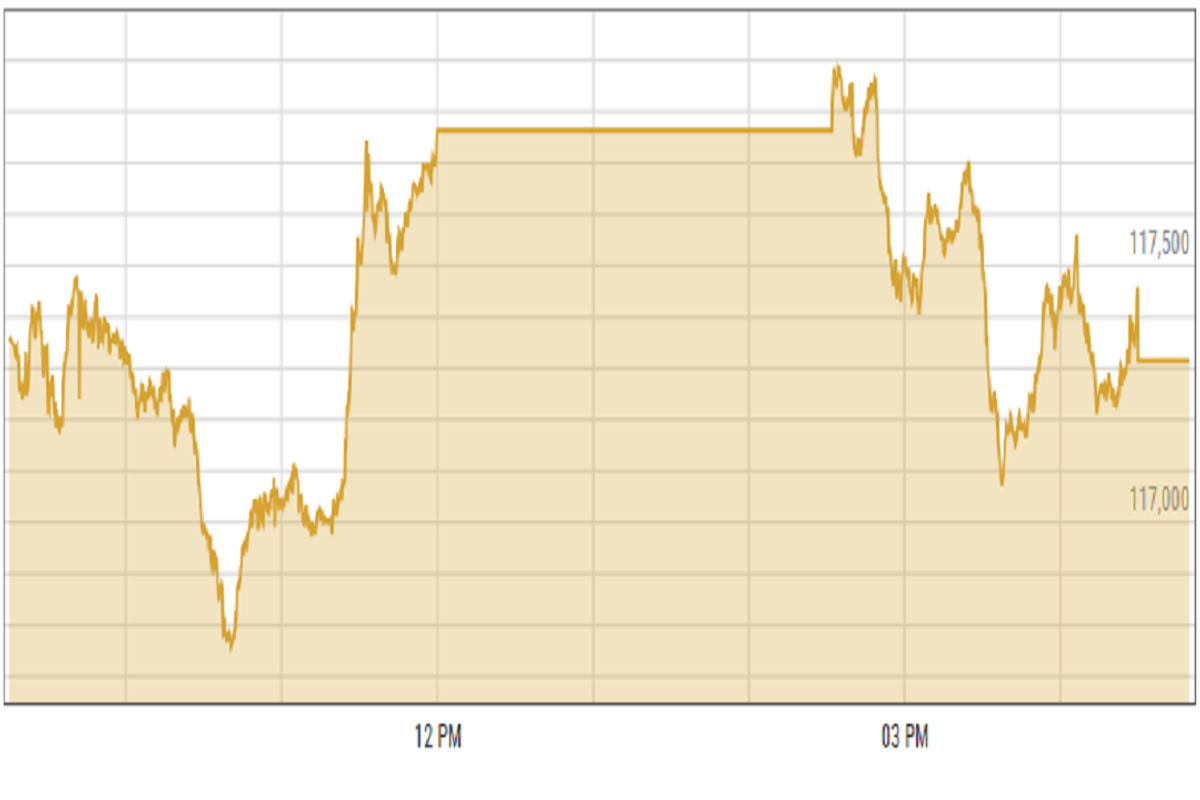

“The market remained largely in the green, benefiting from the positive economic indicators,” said an analyst at Topline Securities. The benchmark KSE-100 index traded mostly in the positive zone during the session.

Pakistan recorded its highest-ever monthly current account surplus of $1.195 billion in March, according to data released by the State Bank of Pakistan (SBP). The Real Effective Exchange Rate (REER) also declined to 101.62 in March, down from 102.25 in February, further reinforcing investor confidence.

KSE-100 index gained 0.35% or 414.45 points to close at 117,315.59 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency shed 10 paisas to close at 280.72. In the open market USD was trading at PKR 282.3.

DFM General Index gained 0.7% or 35.41 points to close at 5,096.93 points.

Crude Oil

Oil prices surged amid optimism surrounding a potential trade agreement between the United States and the European Union, while fresh U.S. sanctions aimed at restricting Iranian oil exports heightened concerns over global supply.

During a meeting in Washington, U.S. President Donald Trump and Italian Prime Minister Giorgia Meloni conveyed confidence in resolving trade disputes that have strained U.S.-European relations.

Brent crude prices increased by 3.2% to $67.96 per barrel.

Gold Prices

Gold prices remained steady on Friday after falling from a record high of $3,358. Investors sold some of their holdings to secure profits during the long Easter weekend.

Concerns about US President Donald Trump’s import tariffs and global political tensions could keep gold prices strong, as gold is considered a safe investment during uncertain times.

Meanwhile, Federal Reserve Chair Jerome Powell took a tough stance, making an interest rate cut in June less likely. If interest rates stay higher, the US dollar could gain strength, which might lower gold prices. Powell warned that slow economic growth and rising inflation could create economic troubles, known as stagflation.

International gold prices decreased 0.03% to close at $ 3,315.13 per ounce. In the local market, gold prices decreased by PKR 300 to 349,700 per tola.

Comments

See what people are discussing