Trump’s 'tariff medicine' sparks global market turmoil

Move has ignited fears of a prolonged trade war triggering one of the worst single-day market routs since the 2008 financial crisis

Dubai Desk

The Dubai Desk reports on major developments across the UAE, covering news, culture, business, and social trends shaping the region.

All 225 constituents of the Nikkei were in negative territory

In India, the Nifty 50 and BSE Sensex each fell more than 4%

Gulf markets were also dragged lower though the region’s relatively limited direct trade reliance on the US provided some insulation

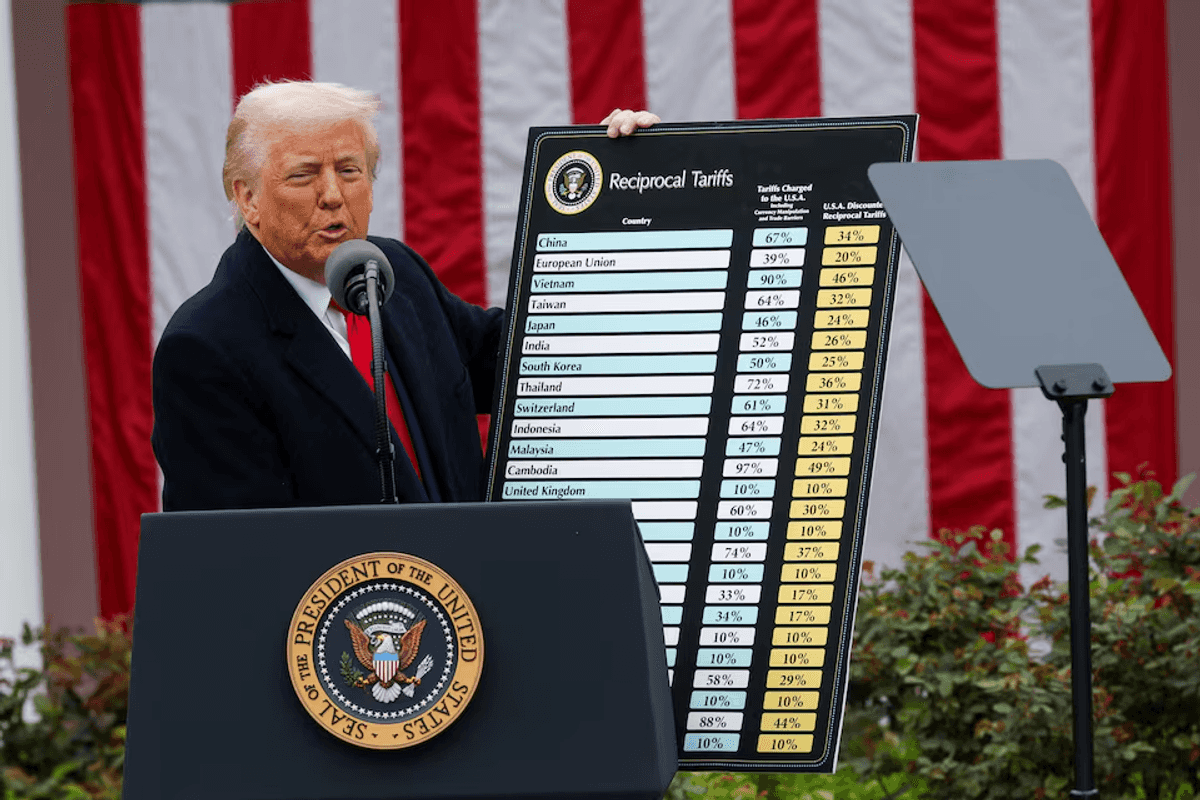

U.S. President Donald Trump's sweeping tariff plans hammered global financial markets on Monday after he warned foreign governments they would have to pay "a lot of money" to lift the levies, which he referred to as “medicine”.

Asian equity markets plunged, European shares crashed to a 16-month low, and oil prices dropped sharply as investors feared the new tariffs—some as high as 50%—would lead to higher consumer prices, collapsing demand, and a global recession.

Taiwan’s stock market fell nearly 10%, marking the biggest single-day loss in its history. In Japan, the Nikkei 225 sank 8.8%, falling to a 1.5-year low, led by a 23% decline in the banking sector over just three sessions. Chinese stocks in Shanghai and Hong Kong also suffered heavy losses, prompting China’s sovereign fund to step in to try to stabilize the market.

“Investors are clearly on edge,” said one India-based equity strategist to Reuters, pointing to the severity of the moves and the speed with which markets have repriced risk.

India feels the pressure

India’s equity markets weren’t spared. The Nifty 50 fell 4.4% and the BSE Sensex dropped 4.3%, both recording their worst single-day performances in 10 months, according to Reuters. The sell-off was broad-based, with over 45 of the Nifty’s 50 stocks ending in the red.

The Indian rupee also took a beating, logging its worst day in nearly three months, falling to 85.80 per dollar before settling slightly above 85.60. Foreign outflows from Indian equities surged, with traders citing fears that sustained tariffs could erode export earnings and trigger tighter financial conditions.

Indian officials, however, are holding firm. As Reuters previously reported, the government is maintaining its 2025–26 GDP growth projection of 6.3% to 6.8%, assuming oil prices remain under $70. Goldman Sachs has trimmed India’s growth forecast to 6.1%, citing weakening external demand and uncertainty over global trade flows.

Global fallout

On Wall Street, S&P 500 futures plunged more than 5%, according to Bloomberg. U.S. tech and industrial stocks entered bear territory as investors feared margin pressures, supply shocks, and further retaliatory measures.

In Europe, defense sector shares fell over 6%, the worst daily drop since April 2020. The broader Stoxx 600 index fell to levels last seen in December 2023, according to Reuters.

Governments across Europe scrambled to form a united front. EU ministers met to coordinate their stance, with Dutch Trade Minister Reinette Klever saying, “We need to get ourselves at the table with the Americans and see how we can lower these tariffs.”

Germany’s incoming chancellor Friedrich Merz also weighed in: “This is a wake-up call. We need lower taxes and energy prices to regain our competitiveness.”

Trump doubles down, allies react

Speaking aboard Air Force One, Trump brushed off concerns about trillions in market losses.

“Sometimes you have to take medicine to fix something... They want to talk, but there’s no talk unless they pay us a lot of money on a yearly basis.”

His remarks came after calls with leaders from Europe and Asia, including those from Taiwan, India, and Vietnam, who are seeking to strike bilateral arrangements to soften or avoid the duties.

China, however, responded with retaliatory tariffs and accused the U.S. of “economic bullying.”

In Japan, Prime Minister Shigeru Ishiba told parliament that a deal may take time but remains a priority. The Topix bank index dropped more than 17%, and Japan’s financial sector has now lost almost a quarter of its market value in just three days, Reuters reported.

Recession fears and rate cut bets

Goldman Sachs now places the chance of a U.S. recession at 45%, while JPMorgan expects the U.S. economy to contract 0.3%, down from earlier 1.3% growth estimates.

Investors are increasingly pricing in a U.S. Fed rate cut as early as June, although Fed Chair Jerome Powell has so far struck a cautious tone.

Billionaire hedge fund manager Bill Ackman, a Trump supporter, warned the tariffs could lead to an “economic nuclear winter” and said the president is “losing the confidence of business leaders around the globe.”

Gold prices dipped as investors rushed to liquidate assets and cover losses. Oil fell over 4% on fears of declining demand, while copper and silver also saw volatile trading.

Comments

See what people are discussing