EDB reports 222% surge in 2024 financing, boosting UAE industry and economy

The bank’s total financing since launching its transformation strategy in 2021 reached AED 15.7 billion, increasing its impact on the UAE’s industrial GDP to AED 7.4 billion by the end of 2024.

Dubai Desk

The Dubai Desk reports on major developments across the UAE, covering news, culture, business, and social trends shaping the region.

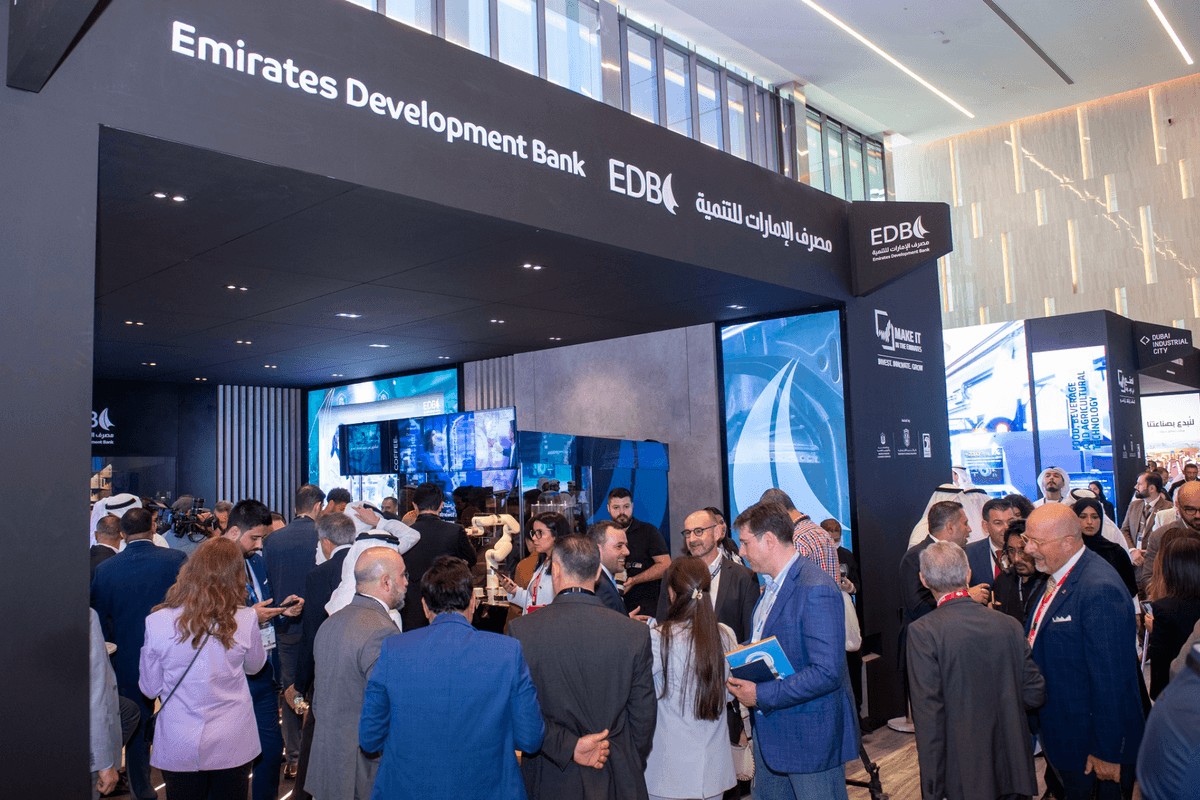

EDB announced its full-year results for 2024, highlighting significant contributions to the UAE’s industrial growth and economic diversification.

EDB

The UAE’s push for economic diversification is reshaping its industrial and financial landscape, with billions flowing into key sectors like manufacturing, renewable energy, and technology. In 2024, financing for industrial projects surged, fueling job creation and positioning the UAE as a competitive hub for advanced industries.

EDB announced its full-year results for 2024, highlighting significant contributions to the UAE’s industrial growth and economic diversification. The bank’s total financing since launching its transformation strategy in 2021 reached AED 15.7 billion, increasing its impact on the UAE’s industrial GDP to AED 7.4 billion by the end of 2024, according to a press release from the bank.

Expansion in industrial financing and foreign investment

EDB’s financial activities have supported AED 50.2 billion in capital expenditure (CAPEX) financing and facilitated AED 7 billion in Foreign Direct Investment (FDI) since 2021. The bank also contributed to the development of AED 15 billion in greenfield projects and played a role in creating 28,000 industrial jobs in the UAE, the release noted.

Sultan Ahmed Al Jaber, Minister of Industry and Advanced Technology and Chairman of EDB, emphasized that the bank's financing has been crucial in strengthening key sectors such as manufacturing, advanced technology, and renewable energy. He noted that these efforts align with the UAE’s national economic development goals, aiming to drive industrial competitiveness and sustainability.

Ahmed Mohamed Al Naqbi, CEO of EDB, described 2024 as a year of significant growth, with financing increasing by 222% to AED 8.7 billion. This contributed AED 4.1 billion to the UAE’s industrial GDP and led to the creation of 14,000 jobs.

Sector-specific investments and digital expansion

EDB focused on enhancing its operations and expanding digital banking services in 2024. The bank launched "EDB Smart Connect," a digital cash management system that onboarded 50 clients, according to the press statement.

It also introduced six trade finance products, facilitating AED 1.2 billion in trade finance solutions.

In 2024, EDB allocated AED 4.23 billion in loans to the manufacturing sector, accounting for 49% of its total financing. The renewable energy sector received AED 1.2 billion in support of net-zero initiatives, while AED 3 billion was directed toward advancing industrial technology and innovation. To strengthen food security, EDB provided AED 1.22 billion in financing, and the healthcare sector received AED 1.14 billion to support medical infrastructure and services.

Focus on SME growth and international recognition

Support for micro, small, and medium enterprises (mSMEs) remained a priority, with total financing reaching AED 3 billion. This included AED 758 million through EDB’s Credit Guarantee Scheme in partnership with 11 commercial banks, and AED 2.1 billion in direct financing, EDB noted.

S&P Global upgraded EDB’s credit rating to AA, the highest among financial institutions in the UAE and MENA region, reflecting its strong financial performance and alignment with national priorities.

Outlook for 2025

According to them, EDB plans to expand financing to AED 23 billion in 2025 while integrating AI-driven solutions, including robotic process automation and machine learning, to enhance operational efficiency. The bank will continue co-lending partnerships, digital transformation initiatives, and investments in industrial sectors to support the UAE’s long-term economic growth strategy.

Comments

See what people are discussing