How Pakistan posted a fiscal surplus after 25 years

Nukta breaks down what fiscal and primary surplus mean, why Pakistan managed to achieve these surpluses, and why they’re important

Urooj Imran

Senior Producer

Urooj has over five years of experience reporting and editing for some of Pakistan's leading publications. She is passionate about simplifying business news; her favorite pieces to work on are explainers.

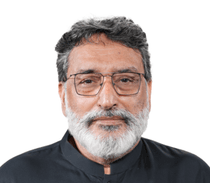

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

Pakistan has done something it has not managed in nearly a quarter century: post a fiscal surplus.

Data shared by the Ministry of Finance shows that Pakistan posted a fiscal surplus of PKR 542 billion for the July-December period (the first half of fiscal year 2025-26). That marks a sharp turnaround from the PKR 1.5 trillion deficit posted in the same period last year.

The primary surplus was even greater at PKR 4.1 trillion or 3.2% of the GDP, far above the International Monetary Fund’s (IMF) target of 2.6% of the GDP in the entire fiscal year.

Nukta breaks down what fiscal and primary surplus mean, why Pakistan managed to achieve these surpluses, and why they’re important.

Surplus for the layman

A fiscal surplus is the broadest measure of a government’s finances. It simply means total revenues exceed total expenditures, including interest payments on debt.

If a government earns more than it spends after paying salaries, subsidies, development spending, defense, pensions, and interest on past borrowing, it posts a fiscal surplus.

A primary surplus, however, excludes interest payments. It measures whether the government’s current revenues are enough to cover its current spending, ignoring the cost of servicing past debt.

In simple terms, fiscal surplus answers: Did the government end up with money left over overall? Meanwhile, primary surplus answers: Are today’s policies generating enough to pay for today’s spending?

Pakistan’s PKR 4.1 trillion primary surplus shows that current fiscal operations are strongly positive. The smaller fiscal surplus — PKR 542 billion — reflects the heavy burden of past debt servicing.

This distinction is critical. A country can run a fiscal deficit and still have a primary surplus if the only reason it is in deficit is interest payments. Conversely, a weak primary balance signals ongoing structural stress.

Why did Pakistan post a surplus?

“Pakistan reported a rare fiscal surplus in the first half (1HFY26) after many years of persistent deficits, reflecting a combination of improved revenue performance, expenditure discipline, and delayed development spending,” said Ali Nawaz, CEO of Chase Securities.

“The most important driver was an increase in tax collection by the Federal Board of Revenue (FBR), supported by higher petroleum levy collections, documentation measures, and administrative tightening under the ongoing program with the International Monetary Fund. At the same time, non-tax revenues, particularly profits transferred by the State Bank of Pakistan, provided additional fiscal space.”

Interest payments fell sharply

The single largest driver was a dramatic decline in interest payments.

As inflation began to ease from record highs, Pakistan’s central bank also began its monetary policy easing in June 2024. The interest rate, which had reached a record 22%, was gradually brought down to 11% in July 2025.

Consequently, markup expenses fell 31% year-on-year in FY26’s first half, led by a 33% decline in local debt servicing costs

In the second quarter alone, interest expenses declined 43% YoY as policy rates came down from last year’s historic highs.

With lower borrowing costs, the government’s largest recurring expense eased considerably, providing fiscal space.

“Another contributing factor was the containment of interest payments growth relative to expectations. Although debt servicing remains structurally high, relatively stable domestic interest rates compared to last year and cash management helped prevent a further surge in markup payments during the first half,” Nawaz added.

Total expenditures declined

Total expenditures fell 10% during FY26’s first half, even as subsidies and grants rose 42% YoY to PKR 838 billion, largely due to flood and rescue efforts

That combination — targeted increases in relief spending alongside broader restraint — helped stabilize overall outlays.

Waqas Ghani, Head of Research at JS Global, said the expenditure side played a decisive role.

“The improvement was largely driven by a sharp contraction in expenditures, led by a significant decline in debt servicing on the back of lower interest rates. Development spending also remained restrained in the first half of the year.”

Provincial surpluses supported consolidation

Provincial fiscal discipline played an important role.

The four provinces transferred a combined surplus exceeding PKR 1 trillion to the federal government in the first half, easing pressure on the center’s finances. During the same period last year, the provinces’ combined surplus had stood at PKR 775 billion.

Revenue growth and record levy collections

Total revenues rose 9% in FY26’s first half, supported by both tax and non-tax inflows.

Notably, petroleum levy (PDL) and related collections surged, contributing significantly to non-tax revenues. PDL and carbon levy collections showed strong growth, reinforcing the revenue side of the equation.

State Bank profit transfer

The State Bank of Pakistan transferred PKR 2.428 trillion in profits to the federal government during the period.

This one-time windfall, largely driven by previously elevated interest rates, materially boosted non-tax revenue. Analysts caution that such transfers are not recurring at this scale, but even adjusting for this factor, the underlying fiscal improvement remains substantial.

Debt retirement and IMF

Amid the surplus, the government retired PKR 575 billion in domestic debt during FY26’s first half while borrowing only PKR 34 billion externally.

This matters because debt sustainability depends heavily on the primary balance. If a country runs a primary surplus large enough to offset the gap between interest rates and economic growth, its debt-to-GDP ratio can stabilize or decline.

Pakistan’s 3.2% of GDP primary surplus not only exceeded the IMF’s 2.6% target but also signals a serious attempt at fiscal consolidation under the Extended Fund Facility program.

Pakistan has run fiscal deficits almost continuously since FY01. Posting a half-year fiscal surplus breaks a 24-year pattern of persistent shortfalls.

For investors, lenders, and rating agencies, the primary balance is the clearer indicator of policy credibility. It shows whether a country is living within its means today.

This does not mean the problem is solved. Spending typically rises in the second half of the fiscal year. Some revenue drivers were one-off. Sustainability will be tested.

But for the first time in decades, Pakistan has demonstrated that fiscal consolidation is possible. The real test now is whether this discipline is temporary or structural.

“Going forward, durable fiscal stability will depend on broadening the tax base and reducing dependence on one-off revenue measures,” Ghani said.

Comments

See what people are discussing