Microsoft surges on $60bn buyback; Apple down on lower projected demand for iPhone 16

Japan’s yen strengthens past ¥140 to the dollar first time since July 2023

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

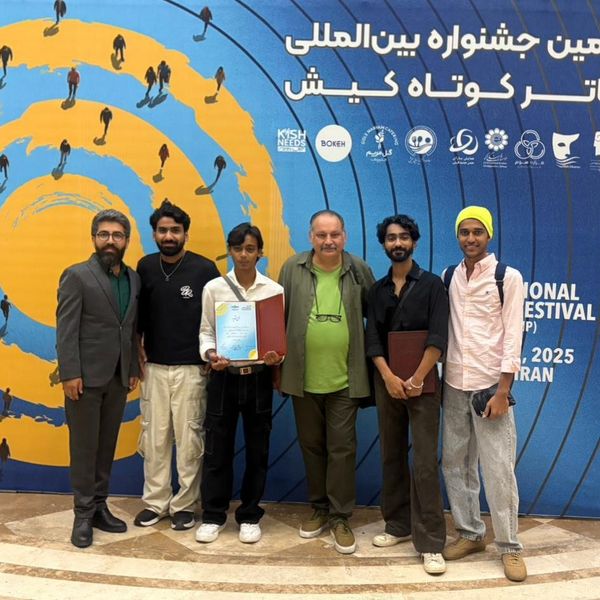

Microsoft Sign outside store in London

Shutterstock

Microsoft has unveiled a new $60 billion share buyback program, replacing its previous $60 billion initiative launched in 2021. This new program has no set expiration date. Alongside this, the tech giant has increased its quarterly dividend by 10%.

Despite significant investments in artificial intelligence and a recent slowdown in the growth of its Azure cloud computing division, Microsoft continues to prioritize shareholder returns.

The announcement places Microsoft among the top companies in terms of buyback programs, trailing only Apple’s $100 billion and Alphabet Inc.’s $70 billion buybacks. Nvidia and Meta have also announced $50 billion buybacks this year.

Currently valued at $3.2 trillion, Microsoft remains the world’s second-largest company, just behind Apple, which is valued at slightly under $3.3 trillion. Following the announcement, Microsoft’s shares rose 0.7% to $431.34 in after-hours trading, adding to a 0.2% gain during regular trading. The stock has increased by over 16% this year.

In contrast, Apple’s shares fell 2.8% to $216.32 after a prominent analyst reported lower-than-expected demand for the new iPhone 16, down 15% compared to the iPhone 15 launch.

This decline comes at a critical time for Apple, which heavily relies on its flagship product for revenue. The recent market turbulence has raised concerns among analysts, especially as competitors in the smartphone market continue to advance.

Japanese Yen

Japan’s yen has strengthened past ¥140 to the dollar for the first time since July 2023. This surge is driven by expectations of diverging monetary policies from the US and Japanese central banks. The yen reached ¥139.56 against the dollar on Monday, marking it as one of the best-performing currencies among major economies and Asia-Pacific nations in the past two months. The Japanese currency has appreciated by 13.5% against the dollar since mid-July, as investors anticipate the Federal Reserve to start cutting interest rates from a 23-year high, while the Bank of Japan begins raising its benchmark lending rate and reducing government bond purchases after years of ultra-loose policy.

Comments

See what people are discussing