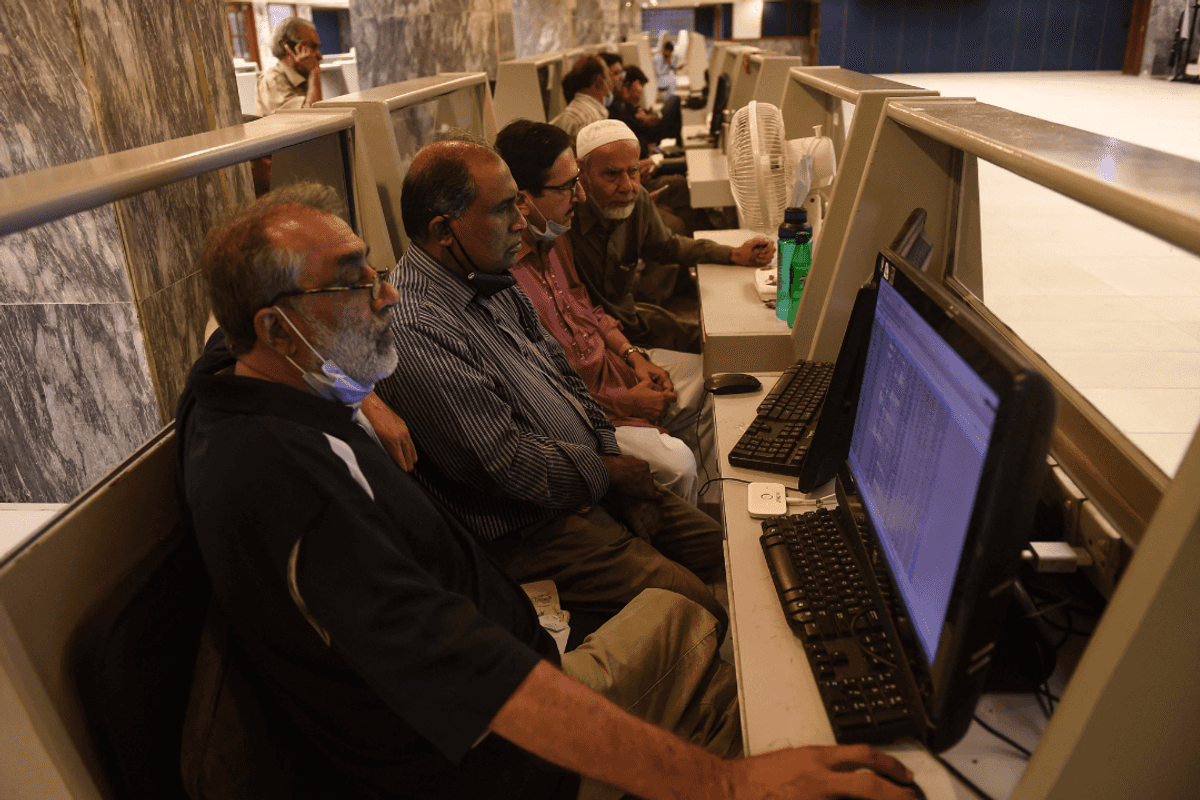

Pakistan capital market moves to T+1 settlement cycle

Pakistan adopts T+1 cycle, joining countries like the U.S., Canada, China, and Mexico

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Pakistan’s capital market has officially transitioned to the T+1 settlement cycle, a major reform aimed at enhancing market efficiency, reducing risk, and aligning the country with global best practices. Effective February 9, 2026, all eligible trades on the Pakistan Stock Exchange (PSX) are now settled on a Trade plus one (T+1) basis, replacing the previous T+2 cycle.

The move was implemented under the guidance of the Securities and Exchange Commission of Pakistan (SECP), in close coordination with the PSX, National Clearing Company of Pakistan Limited (NCCPL), Central Depository Company (CDC), Pakistan Stock Brokers Association (PSBA), State Bank of Pakistan (SBP), Pakistan Banks Association (PBA), Mutual Fund Association of Pakistan (MUFAP), securities brokers, custodian clearing members, asset management companies, settling banks, E-Clear, and other non-broker clearing members.

By adopting the T+1 cycle, Pakistan joins markets such as the United States, Canada, Mexico, Argentina, Jamaica, and China, which have already shortened their settlement periods. Europe, the United Kingdom, and Switzerland are expected to follow suit by 2027. Pakistan’s early adoption positions it ahead of several advanced markets and demonstrates its commitment to modernization and investor protection.

The transition brings several key benefits. Faster settlement enables quicker access to funds and securities, improving liquidity and reducing counterparty and settlement risk. Shorter trade finalization periods enhance market efficiency, support stronger investor confidence, and make the market more attractive to institutional and foreign investors.

Dr. Kabir Ahmed Sidhu, Chairman of SECP, praised the PSX, CDC, and NCCPL for successfully implementing the T+1 system. “This reform modernizes Pakistan’s capital market, accelerates trade settlement, reduces market and counterparty risks, and strengthens liquidity. The adoption of T+1 also reinforces investor confidence and aligns Pakistan with evolving international standards,” he said.

The milestone reflects SECP’s broader commitment to capital market modernization, systemic risk reduction, and enhanced investor protection. PSX, NCCPL, and CDC extended congratulations to all stakeholders for their collaborative efforts in achieving this landmark transition.

Comments

See what people are discussing