Pakistan extends deadline to file tax returns for 2nd time

1.636 million of the returns filed so far were nil-income returns

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

The FBR has received a record 4.436 million income tax returns so far for tax year 2024

Photo by Leeloo The First at Pexels

Pakistan has extended the deadline to file tax returns to October 31. The announcement, made by the country's tax collection authority — the Federal Board of Revenue (FBR) — on Monday night came as the first extension till Oct 14 was set to expire.

Despite repeated statements from officials that the deadline to submit tax returns would not be extended this year, this is the second time the deadline has been extended from the original date of September 30.

The FBR has received a record 4.436 million income tax returns so far for tax year 2024, an increase of over 100% from the 2.17 million returns filed during the same period for tax year 2023.

However, 1.636 million of these returns were nil-income returns, meaning no tax was deposited with these filings — a notable rise from the 778,137 nil-income returns filed last year.

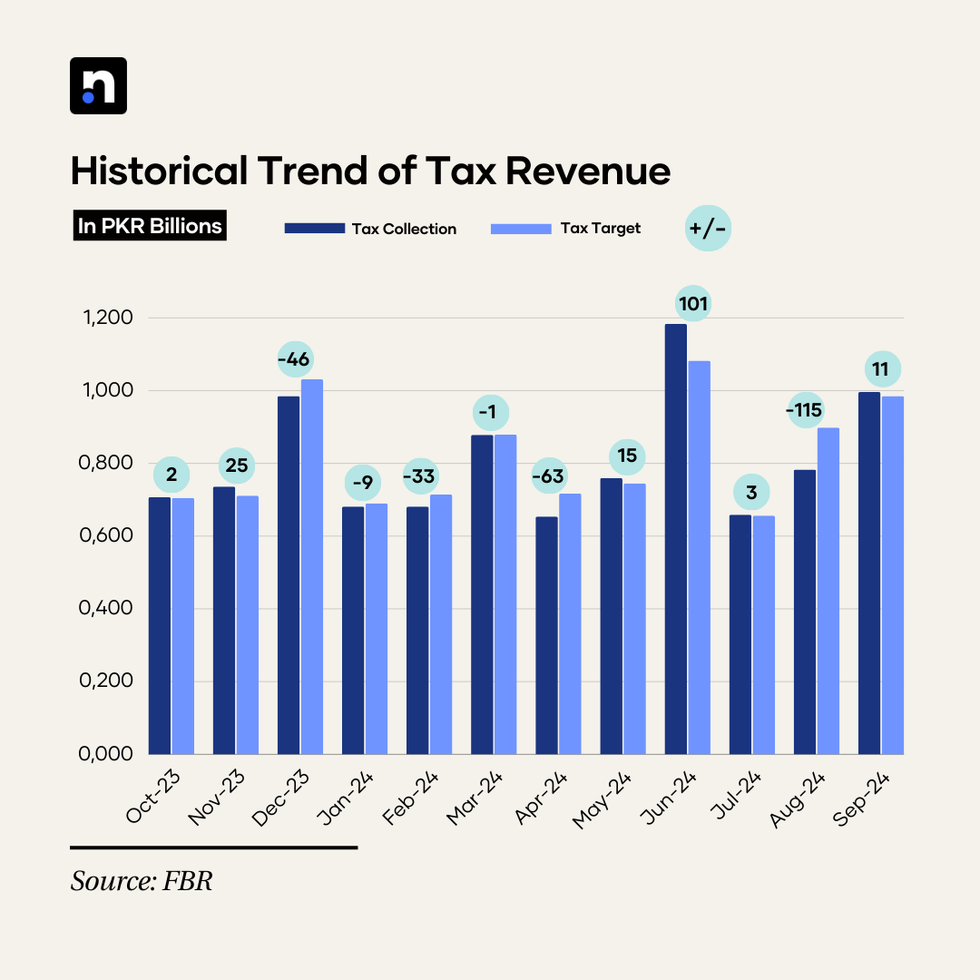

The extension comes as Pakistan's revenue collection for the first quarter of fiscal year 2024-25 (FY25) fell short of the target by a massive PKR 101 billion.

The FBR collected PKR 2,438 billion against the target of PKR 2,539 billion set for July-September, according to a senior official.

Enforcement measures

Sources had previously informed Nukta that as part of Pakistan's $7 billion loan program with the International Monetary Fund (IMF), if the FBR failed to meet the tax collection target by over PKR 100 billion in the first quarter of this fiscal year, the government would announce a "mini-budget" imposing additional taxes amounting to PKR 200 billion.

The FBR has also announced a slew of measures directed at non-filers and late-filers. It emailed notices to individuals on their registered emails, warning that a failure to file tax returns in the stipulated time period would result in sims getting blocked.

In the second phase, their electricity supply would be discontinued. In the last phase, their accounts would be frozen and they would face a travel ban.

- YouTubeyoutu.be

Last year too, the FBR blocked around 458,000 sims of people who had not filed their tax returns. Following this, around 80,000 people filed their returns within a week.

Comments

See what people are discussing