Inflation seen easing to near 4% in August in Pakistan

Falling energy costs offset food price spikes; analysts say trend opens room for further interest rate cuts

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

A shopkeeper uses a calculator while selling spices and grocery items along a shop in Karachi, Pakistan

Reuters

Pakistan’s headline inflation is expected to decelerate sharply in August, with Consumer Price Index (CPI) figures projected to rise between 3.75% and 4.25% year-over-year, down from 9.63% in August 2024 and slightly below July’s 4.07%, according to estimates from Topline Securities.

Month-on-month inflation is expected to tick up by 0.3%, driven primarily by a jump in transport costs, said Myesha Sohail, research analyst at Topline Securities.

“The month-on-month increase is mainly due to a 2.34% rise in the transport segment, led by a 4.7% increase in diesel prices,” she said in a research note.

Despite the uptick in transport, the overall inflation trend remains subdued, with the food segment expected to stay largely flat, declining by a marginal 0.05% month-on-month.

“While we are seeing notable price hikes in tomatoes (26.2%), onions (15.2%), and eggs (9.5%), these are likely to be offset by declines in fresh fruits (9.9%), sugar (4.7%), and chicken (4.4%),” she added.

The housing, water, electricity, and gas category is also forecast to decline by 0.37% in August, thanks in part to a 9.8% drop in liquefied petroleum gas (LPG) prices. Electricity charges are also expected to fall by 1.36% due to a new quarterly tariff adjustment of –PKR 1.8881/kWh and a lower fuel cost adjustment of PKR 0.7772/kWh for August, compared to PKR 0.4952/kWh in July.

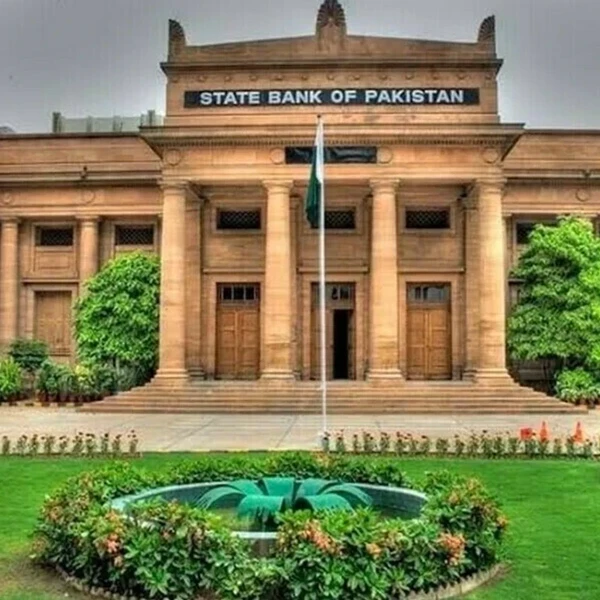

Looking ahead, Topline expects average inflation for fiscal year 2025-26 (FY26) to settle between 6% and 7%, in line with the State Bank of Pakistan’s target range of 5% to 7%.

With inflation easing, real interest rates—the difference between the policy rate and inflation—are expected to rise sharply.

“At current inflation expectations of 3.75–4.25%, real rates will surge to 675-725 basis points, significantly above Pakistan’s historical average of 200-300bps,” Sohail noted. “However, based on the full-year inflation target of 6-7%, real rates would still remain elevated at 400-500bps.”

This dynamic, analysts say, strengthens the case for monetary easing.

“We maintain our view that the central bank has further room to cut rates by 50 to 100 basis points,” Sohail said. “We expect interest rates to bottom out at 10% by December.”

Still, she cautioned that global factors could derail the disinflationary trend. “A significant shift in global commodity prices remains a major risk to this outlook,” Myesha said.

The official CPI data for August is expected to be released early next month.

Comments

See what people are discussing