Pakistan links national airline’s sale with fleet expansion and 3-year retention

Bidding process for majority stake in Pakistan International Airlines to be completed by October

Javed Mirza

Correspondent

Javed Iqbal Mirza is an experienced journalist with over a decade of expertise in business reporting, news analysis, and investigative journalism. His work spans breaking news, editorial pieces, and in-depth interviews.

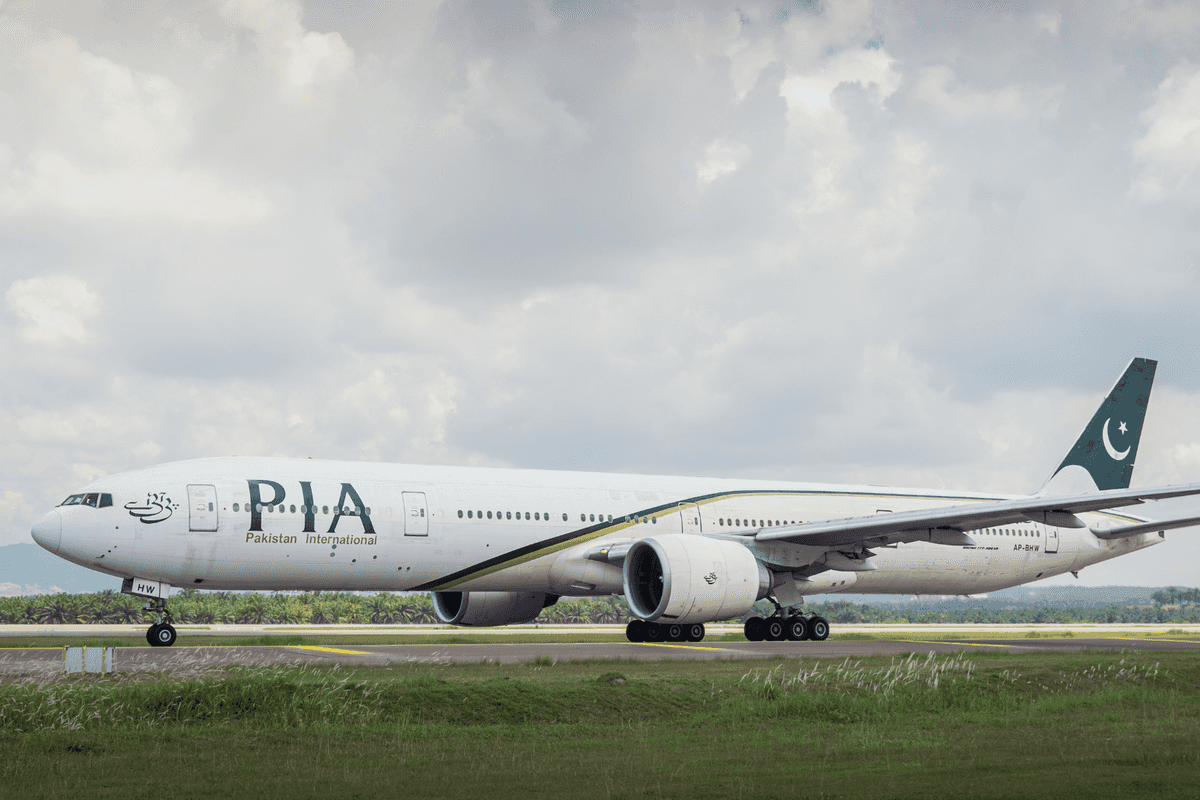

A Pakistan International Airlines flight on a runway in Malaysia

Shutterstock

The Pakistan government has linked the sale of a majority stake in the national airline to an expansion of its fleet by at least 20 aircraft and the condition that it will not be resold for the next three years.

The government expects the bidding process to be completed and the Pakistan International Airlines (PIA) to be privatized by October.

Arif Habib, chairman of the Arif Habib Group which is one of the pre-qualified bidders for the airline, pointed out that PIA's major issue has been debt and interest payments. Of PIA's PKR 800 billion ($2.86bn) debt, PKR 600 billion would belong to the holding company, while PKR 200 billion would be the buyer's liability.

The majority of PIA's debts are owed to the Federal Board of Revenue and Civil Aviation Authority.

“It is crucial that the buyer is given a reasonable time frame to repay these debts. Immediate repayment demands could adversely affect the price,” he said.

“PIA is an operationally viable entity and if the issues related to debts and employees are resolved after the takeover, it could quickly turn around and become profitable,” Habib added.

PIA initially became unprofitable in 2011. By the end of 2018, the national flag carrier was saddled with $3.3 billion in debt and needed government bailouts to continue operations.

According to the latest financial results, PIA posted a net loss of PKR 75.7 billion for the nine-month period ended September 30. Revenue for the period under review stood at PKR 186.5 billion. As of June 30, 2023, PIA’s total assets stood at PKR 389.8 billion.

Comments

See what people are discussing