Pakistan stock market surges toward 180,000 points on rate-cut optimism

Benchmark index jumps over 2,600 points as investors eye monetary easing and stronger growth

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

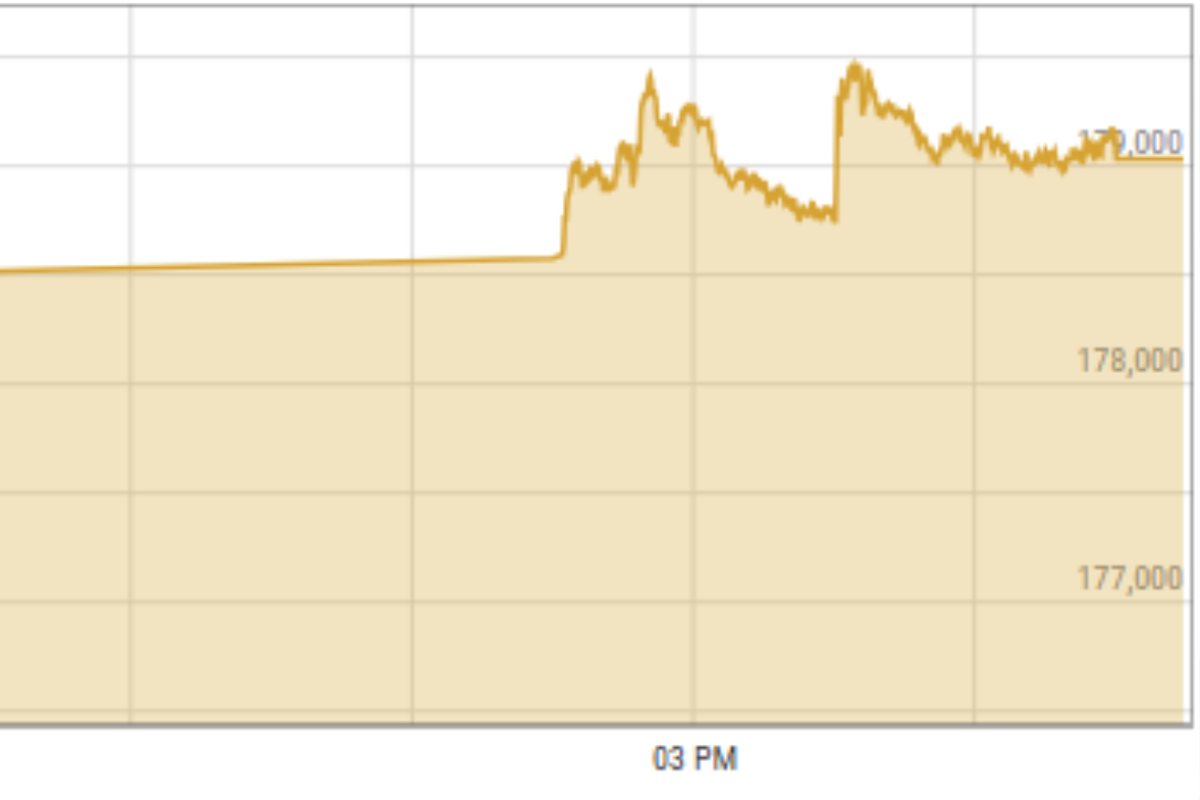

A snapshot of trading activity at the Pakistan Stock Exchange on Friday

PSX Website

Pakistan’s stock market marked another milestone in the final trading session of the week, with the benchmark KSE-100 index racing toward the 180,000 mark on optimism that inflation remains low, creating room for another interest rate cut.

In the second session of the new year, the KSE-100 posted a strong recovery, surging by more than 2,600 points — a move analysts described as a major achievement. The index closed at 179,034.93 points, up 1.52%.

During 2025, the index gained more than 51%, extending its winning streak for a third consecutive year as it continued to post solid annual gains.

According to analysts, two key factors have driven the recent momentum: inflation staying below the 6% mark — clocking in at 5.6% in December — and renewed hopes that the State Bank of Pakistan (SBP) may opt for another rate cut. While such a move is not seen as imminent, past monetary policy decisions have sometimes surprised markets.

The SBP is scheduled to announce its next monetary policy on January 26. The benchmark interest rate currently stands at 10.5%, its lowest level in more than four years.

Market sentiment was further boosted by the latest GDP figures released by the Pakistan Bureau of Statistics, which showed economic growth of 3.1% in the first quarter of the current fiscal year.

Shahryar Butt, Head of Portfolio Management at Darson Securities, stated that the entry of fresh liquidity significantly improved market sentiment, as investors had remained on the sidelines earlier due to year-end considerations.

He added that two key factors supporting the overall investment climate were the recent reduction in petroleum product prices and the decline in December inflation to 5.6%.

According to Butt, broad-based sectoral performance has remained encouraging, with the benchmark index closing at a historic high, and he expressed optimism that the market is likely to maintain its upward trajectory going forward.

Jibran Sarfraz, an equity market expert, said a combination of factors helped trigger the bullish rally.

He cited discoveries of oil and gas reserves supporting recovery in the energy sector, lower inflation and expectations of strong corporate earnings.

According to data compiled by a leading research house, cash dividends paid by listed companies totaled PKR 920 billion in 2025, up from around PKR 766 billion in 2024. Dividends are expected to comfortably cross the PKR 1 trillion mark in 2026.

Comments

See what people are discussing