Pakistan stocks down amid IMF concerns over revenue shortfall, potential new taxes

Commercial banks, fertilizer, and oil & gas sectors drag index down

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.43%

PSX

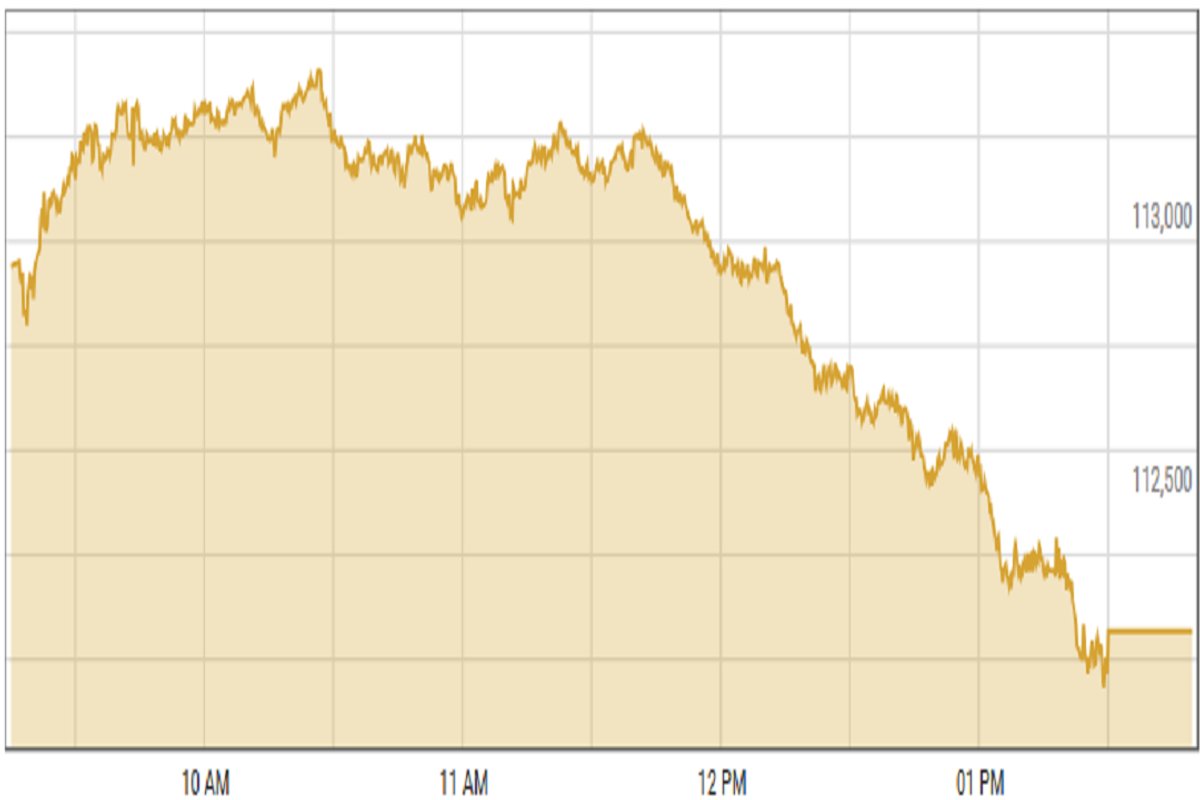

Pakistan stocks closed lower on worries that the IMF might raise concerns about falling revenue collection, forcing the government to come up with solutions to impose new taxation measures.

"The benchmark index closed on a negative note, gradually losing points throughout the session as selling pressure persisted, keeping market sentiment subdued," said an analyst at Ismail Iqbal Securities.

An analyst at Topline Securities said the local stock market experienced a range-bound session, with the KSE-100 index fluctuating between a high of 583 points and a low of 598 points. “Investor sentiment remained mixed due to the ongoing Ramadan period.”

In Wednesday's trading session, the commercial banks, fertilizer, and oil & gas exploration sectors were the major laggards, collectively shedding 364 points from the benchmark index.

KSE-100 index shed 0.43% or 490.04 points to close at 112,253.76 points.

US dollar steadied against PKR in the inter-bank market. Pakistani currency lost 11 paisas to close at 279.87. In the open market USD was trading at PKR 281.3.

Indian stocks saw a significant rebound shrugging off Donald Trump's threats of reciprocal tariffs on Indian imports. All major sectoral indices closed in the green, and the broader market rebounded strongly, providing relief to investors after a prolonged period of pressure.

A positive economic outlook from China sparked a strong rally in metal stocks. Meanwhile, IT stocks attracted buying interest from Dalal Street investors following a prolonged sell-off that had pushed them to an eight-month low.

BSE-100 index gained 1.39% or 319.03 points to close at 23,326.67 points.

DFM General Index shed 0.78% or 41.73 points to close at 5,312.92 points.

Commodities

Oil prices went down for the third day in a row on Wednesday. Investors were concerned because OPEC+ planned to increase oil production in April. Additionally, U.S. President Donald Trump's tariffs on Canada, China, and Mexico were making trade tensions worse.

The day before, oil prices were already near their lowest levels in several months. This was because people expected that the U.S. tariffs and the other countries' responses would slow down economic growth and lower the demand for fuel.

Brent crude prices decreased by 0.87% to $70.42 per barrel.

Gold prices went up on Wednesday. This was because the U.S. dollar was weaker and there was political uncertainty after U.S. President Donald Trump announced new import tariffs.

International gold prices increased by 0.25% reaching $2,917.22 per ounce.

Comments

See what people are discussing