Can Pakistan and Iran really push bilateral trade to $10B?

From barter trade to border markets, the two neighbors are betting big on formalizing economic ties

Nida Gulzar

Research Analyst

A distinguished economist with an M. Phil. in Applied Economics, Nida Gulzar has a strong research record. Nida has worked with the Pakistan Business Council (PBC), Pakistan Banks' Association (PBA), and KTrade, providing useful insights across economic sectors. Nida continues to impact economic debate and policy at the Economist Intelligence Unit (EIU) and Nukta. As a Women in Economics (WiE) Initiative mentor, she promotes inclusivity. Nida's eight 'Market Access Series papers help discover favourable market scenarios and export destinations.

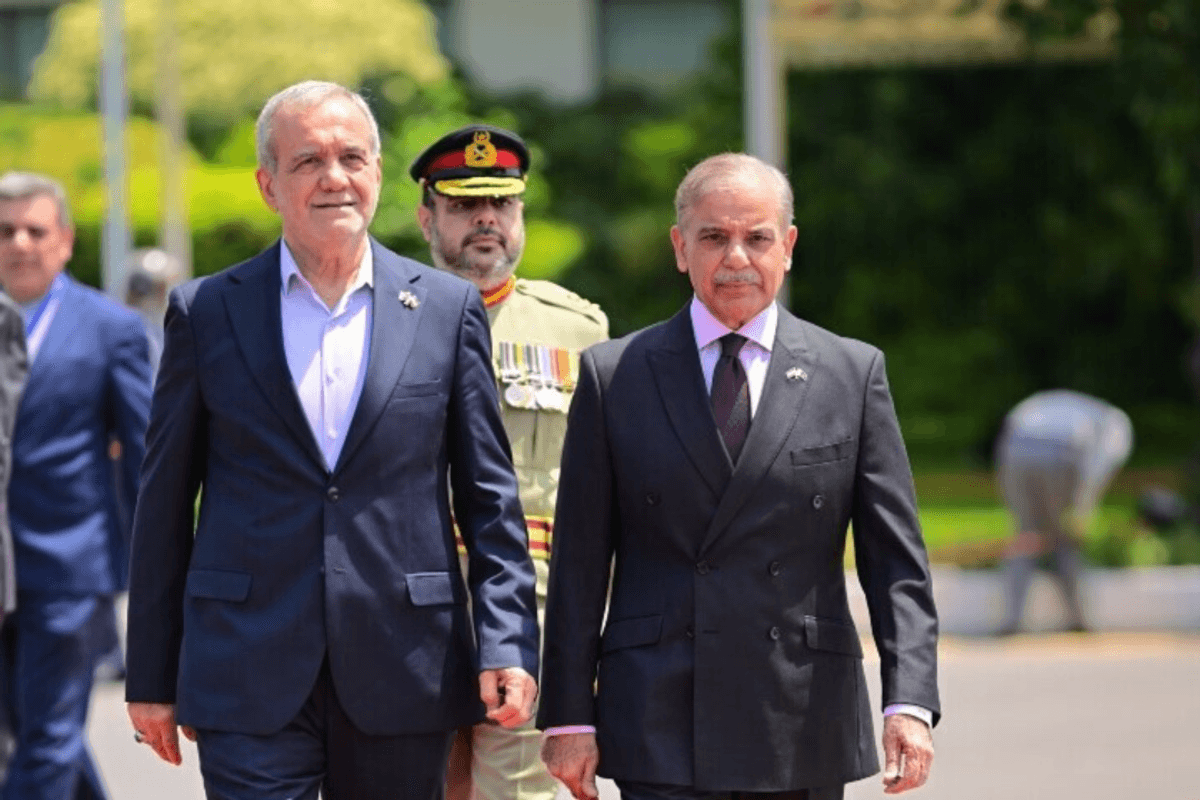

Iranian President Masoud Pezeshkian is received by Pakistan Prime Minister Shehbaz Sharif in Islamabad on August 3

X

Trade is dominating the news. From U.S. import tariffs to China’s export surge, economic chatter rules the airwaves. And for Pakistan, the stakes are high. The country is aiming to unlock export potential in pursuit of the State Bank’s GDP growth expectation of 3.25-4.25%.

Pakistan and Iran recently agreed to boost bilateral trade to $10 billion annually. But is that realistically achievable? Nukta dives into the numbers to gauge where things stand and what’s really driving the momentum.

So, what’s the deal?

During Iranian President Masoud Pezeshkian’s official visit to Islamabad this month, both countries claimed to boost bilateral trade from $2 billion to $10 billion. However, ITC Trade Map data shows current total trade at just $1.2 billion.

The absence of official banking channels prevents formal trade flows, a fact underscored by State Bank of Pakistan (SBP) data, which records zero transactions.

The recent visit resulted in the signing of 12 MoUs and agreements spanning energy, trade, technology, agriculture, and logistics. However, in the past, several memorandums of understanding have been signed, yet the absence of a proper banking channel raises the question of how informal trade can be institutionalized.

One of the major highlights was the joint commitment to finalize a long-pending free trade agreement (FTA). This deal is expected to lower tariffs, ease trade procedures, and create a framework for long-term cooperation.

How realistic is $10 billion?

While the current formal trade sits closer to $1.2 billion, a large chunk of commerce continues informally, often through barter trade along the shared border. The ambitious $10 billion target assumes better formalization, improved logistics, and resolution of cross-border constraints like banking, transport, and customs.

The current indicative export potential for products at the HS-02 level stands at $8.3 billion, as per Nukta’s findings.

The top products with the greatest export potential from Pakistan to Iran are semi-milled or wholly milled rice, maize, and sesame seeds. These fall under the category of Cereals (HS-10), with a total potential of $1.9 billion, accounting for 23% of the unrealized export potential.

Tehran is brimming with confidence. Iranian officials boldly declared about the $10 billion target, “We can easily, in a short time, increase the volume of our trade relations from the current $3 billion to the projected goal of $10 billion.” They insisted it could be met with ease if backed by swift infrastructure upgrades and unwavering political commitment.

Where could growth come from?

- Agriculture: Pakistan’s rice and fruits; Iran’s dates and processed foods.

- Energy: The long-stalled Iran-Pakistan gas pipeline is once again in focus, with Pakistan authorizing construction despite U.S. sanctions pressure.

- ICT and innovation: A new MoU covers cooperation in digital infrastructure and science.

- Tourism and services: Pakistan and Iran plan to boost cultural, health, and religious tourism.

The potential for an FTA

Fast-tracking the free trade agreement (FTA) is central to unlocking higher trade flows. The negotiations began in 2016. However, they have yet to be notified to the world trade organization (WTO).

Once in place, it could resolve tariff bottlenecks, harmonize standards, and ease payments. The FTA could also facilitate triangular trade, where Pakistan exports to Central Asia through Iran’s transport corridors.

Bilateral market access analysis

As per the data compiled by Nukta from the ITC trade map, Pakistan applies tariffs ranging from 3% to 59% at the HS‑02 level on goods imported from Iran. Only two chapters face the highest tariff range of 57% to 59%, primarily covering vehicles other than railway or tramway rolling stock.

On the other hand, Iran applies tariffs on goods imported from Pakistan across varying ranges. 28 sectors face tariffs between 5% and 10%, while 20 sectors fall within the 11% to 19% range. A further 29 sectors are subject to tariffs of 20% to 40%, and 19 sectors face the highest tariff band of 41% to 55%.

Outlook

The $10 billion target is ambitious but grounded in strategic aims to reshape regional trade flows. However, the absence of designated transit stations, coupled with hurdles in trucking, customs clearance, gate operations, and driver visas, has stalled progress. Trade from Central Asia and Iran via Pakistan remains on hold due to these and other legal barriers.

But for the plan to succeed, both sides need to move beyond MoUs and into measurable reforms: digital customs, modern banking channels, trade fairs, private-sector engagement, and border management.

The clock is ticking ... and so is the potential.

Comments

See what people are discussing