Pakistan stocks plunge on Indian airstrikes near border

Yields on Pakistan Euro/Sukuk bonds in international market have improved

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 3.13%

PSX

Pakistan’s stock market closed lower on Wednesday after a day of extreme volatility, as investors reacted to Indian airstrikes in Pakistan and Pakistan-administered Kashmir.

Since April 23 , Pakistan market has already lost 7.1% amidst uncertainty over possible attack from India.

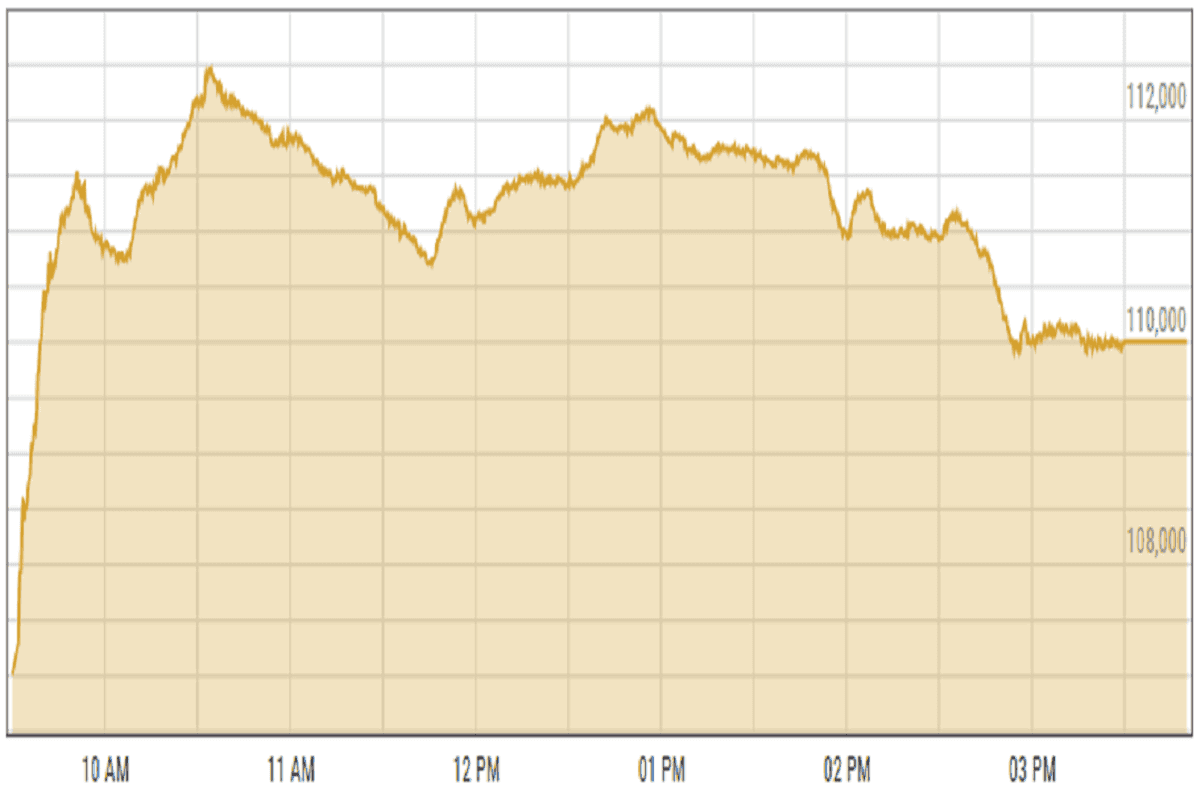

The benchmark KSE-100 index plunged more than 6,000 points at the open, marking one of its sharpest intraday declines in recent memory, as reports emerged of Indian military action near the border.

However, the market quickly regained over half its losses as flight operations resumed and investor sentiment stabilized.

Despite the temporary recovery, panic selling resumed late in the session after Prime Minister authorized military leaders to retaliate. A press conference by Pakistan’s military spokesperson reaffirming counterstrikes exacerbated uncertainty in the markets.

“Surprisingly, yields on Pakistan Euro/Sukuk bonds in international market have improved (prices increased) by 18-61 basis points after falling on average 160 basis points across various tenors in last 8-9 days,” Shankar Talreja at Topline Securities said.

“The sharp escalation raised fears of a broader conflict, unsettling investor sentiment and triggering risk-off moves across the market,” said an analyst at Ismail Iqbal Securities.

While Pakistan Stock Exchange (PSX) saw extreme swings, the Pakistani Rupee displayed more measured movement. An analyst at Tresmark Securities noted that while pressure on the currency is expected, it will likely remain range-bound, with gradual depreciation.

Meanwhile, market analysts remained divided on the outlook for Pakistan’s economy. “Many believe that after this, there will be no major escalation, and the dust will eventually settle,” an analyst at Topline Securities said, citing optimism over an upcoming International Monetary Fund (IMF) board meeting that could decide on a loan tranche for Pakistan.

“The market’s trajectory will depend on Pakistan’s response to this aggression. The government’s statement suggests armed forces have been given authority to respond. Additionally, the approval of the IMF program on May 9 will be a key trigger for market performance.”

KSE-100 index shed 3.13% or 3,559.48 points to close at 110,009.03 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency lost 10 paisas to close at 281.47. In the open market USD was trading at PKR 283.15.

Indian Stocks

Despite experiencing significant volatility on Wednesday, Indian benchmark indices closed in positive territory. This resilience was driven by easing global trade tensions, the signing of a free trade agreement with the UK, and robust overseas inflows, which helped counterbalance the ongoing tensions between India and Pakistan.

Although the market opened on a weaker note, it swiftly recovered its losses. By mid-session, it had gained momentum, turning positive as the auto, realty, and metal sectors provided much-needed support to the rebound.

BSE-100 index gained 0.3% or 75.16 points to close at 25,461.33 points.

DFM General Index shed -0.17% or 8.95 points to close at 5,344.02 points.

Crude Oil

Oil prices climbed on Wednesday morning, driven by investor optimism ahead of upcoming trade negotiations between the United States and China, scheduled to commence this week.

The discussions, set to take place in Switzerland over the weekend, were officially announced on Tuesday. Leading the U.S. delegation will be Treasury Secretary Scott Bessent and Chief Trade Negotiator Jamieson Greer, while China will be represented by Vice Premier He Lifeng.

In an interview with Fox News on Tuesday, Bessent emphasized that the talks would prioritize de-escalation rather than a sweeping trade agreement.

Brent crude prices increased by 0.27% to $62.32 per barrel.

Gold Prices

Gold prices declined by over 1% on Wednesday, pressured by optimism surrounding trade negotiations between the United States and China.

The safe-haven asset faced headwinds ahead of the Federal Reserve's anticipated rate decision later in the day. Reports surfaced about a possible meeting between U.S. and Chinese officials this week, which, if confirmed, could lift market sentiment.

Last month, both nations implemented reciprocal tariffs, fueling a trade war that heightened fears of a global recession and drove investors toward gold as a protective asset.

International gold prices decreased 0.78% to close at $3,389.08 per ounce. In the local market, gold prices increased PKR 800 to 356,900 per tola.

Comments

See what people are discussing