Pakistan stocks reach all-time high on strong investor confidence

KSE-100 index gained 1.19% to close at 91,938 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 1.19% to close at 91,938 points

PSX

Pakistan's stock market soared to an all-time high on Monday, reflecting strong investor confidence and robust economic momentum.

The rally was fueled by expectations of an additional rate cut in ahead of Monetary Policy Committee (MPC) meeting, supported by a favorable inflation outlook and declining international oil prices.

On the economic front, Federal Minister for Information, Broadcasting, National Heritage and Culture Attaullah Tarar announced on Friday that Qatar would invest $3 billion in various sectors. He stated that this financing would have a significant impact on the national economy and ultimately benefit the masses.

Additionally, discussions to finalize a $2 billion investment in Pakistan by Denmark's giant Maersk Lise are scheduled for a high-level meeting during the Danish Foreign Minister's visit on November 12.

These positive developments contributed to the bullish activity in the stock market, driving it to new heights.

KSE-100 index gained 1,078.15 points or 1.19% to close at 91,938 points.

Indian stock markets continued to be volatile, with benchmark indices dropping nearly 2% by noon. Major sectors, including IT, pharma, and financial stocks, saw significant declines. High-profile stocks like Reliance Industries, Hero Motorcorp, Coal India, ONGC, and Tata Motors also faced steep drops.

The Indian rupee hit record lows, and government bond yields rose, reflecting investor caution and a prolonged period of uncertainty. This volatility, coupled with the U.S. election dynamics, is creating both caution and opportunities for traders.

India’s BSE 100 Index lost 0.44% or 113.33 points to close at 25,674.59 points.

The Dubai Financial Market (DFM) General Index gained 0.66% or 30.32 points to close at 4,621.37 points.

Commodities

Oil prices rose on Monday due to OPEC+ deciding to delay increasing output and extend production cuts of 2.2 million barrels per day through December 2024, citing weak demand and rising supply from non-member countries.

Traders are also watching the upcoming US presidential election, with a close race between Kamala Harris and Donald Trump.

Additionally, the Federal Reserve is expected to cut rates by 25 basis points this week. In China, the National People's Congress meeting from November 4 to 8 is expected to approve stimulus measures to support the economy, potentially boosting oil prices as China is the largest oil importer.

Brent crude prices surged 2.2% to $74.71 per barrel.

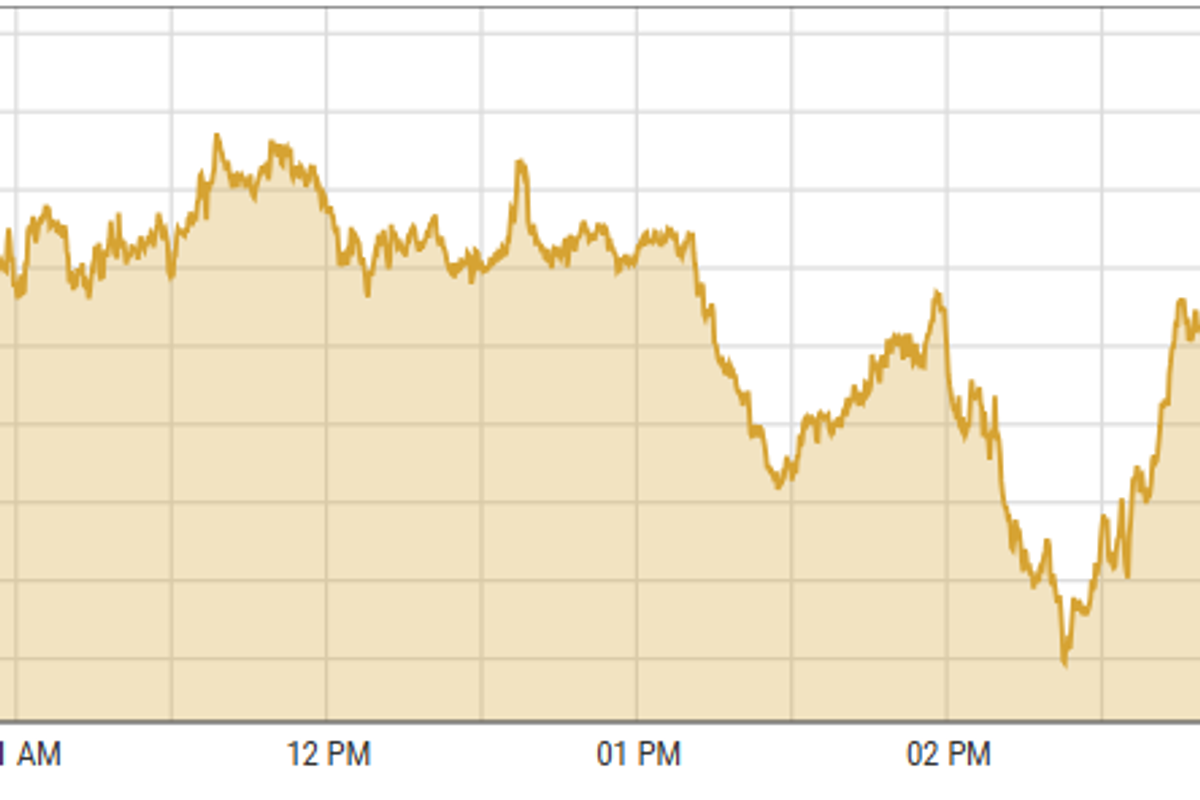

Gold prices held steady on Monday, driven by risks from the upcoming US presidential election and Middle East tensions, which boost safe-haven demand. However, rising US dollar demand and bond yields may limit growth. Investors are closely watching the election on Tuesday and the Federal Reserve's rate decision on Thursday, expecting a 25 basis point rate cut.

International gold prices eased 0.02% reaching $2,739.84 per ounce. In Pakistan, gold prices dropped by PKR 2,500 to PKR 284,700/tola on Friday.

Currency

US dollar strengthened against PKR, up 0.02% in the inter-bank market. Pakistani currency settled at 277.78, a loss of 8 paisas against the US dollar. In the open market USD was trading at PKR 280.0

Comments

See what people are discussing