Pakistan stocks suffer sharp decline amid escalating tensions with India

Investor sentiment plummets as Islamabad warns of possible military strike within 24 hours

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

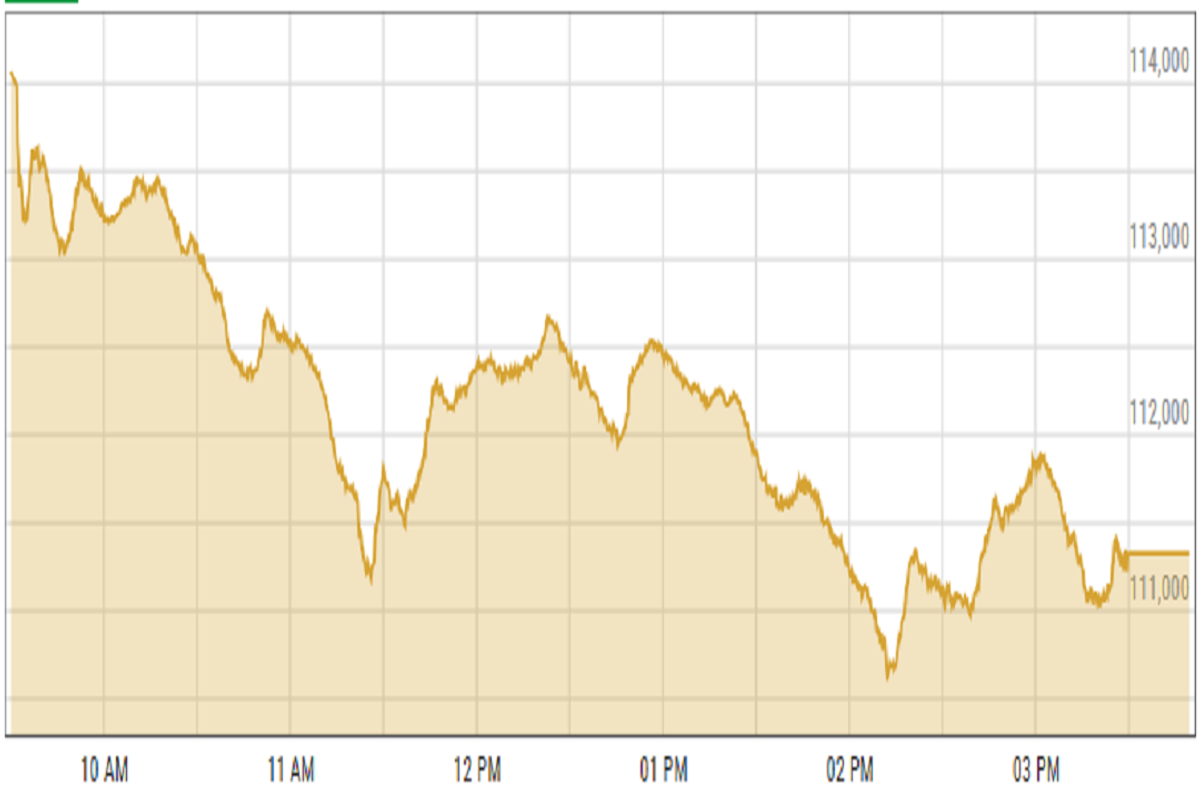

Pakistan’s benchmark stock index closed in the red Wednesday as escalating geopolitical tensions between Pakistan and India rattled investor sentiment, triggering cautious trading and a sharp market downturn.

Stocks fell broadly across sectors following reports that India is considering military action against Pakistan, analysts said. Ahsan Mehanti of Arif Habib Corp noted that concerns over a potential escalation weighed heavily on the market. “A slump in global crude oil prices and fears over heightened border tensions played a catalyst role in record bearish activity,” he said.

Commercial banks, cement companies, and oil and gas exploration firms led the losses, collectively dragging the index down by 1,789 points.

An analyst at Ismail Iqbal Securities said persistent regional instability continued to erode investor confidence, contributing to a subdued market tone.

The downturn was fueled by growing fears of military escalation after Pakistan’s Minister for Information and Broadcasting said Islamabad has “credible intelligence” indicating India may launch a strike within the next 24 to 36 hours. The announcement sent shockwaves through the equity market, sparking widespread risk aversion as investors rushed to reduce exposure amid deepening uncertainty.

KSE-100 index shed 3.09% or 3,545.60 points to close at 111,326.58 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency shed 13 paisas to close at 281.15. In the open market USD was trading at PKR 282.9.

Indian Stocks

Indian stocks ended Wednesday on a steady note, capping off a robust month fueled by optimism over a potential U.S.-India trade deal and increased foreign investment.

Analysts attributed April's market gains to capital shifting from the U.S. to emerging markets amid economic uncertainty, alongside expectations of strengthened trade ties between India and the U.S.

However, concerns over possible tensions between India and Pakistan could lead to heightened market volatility in the coming weeks.

BSE-100 index shed 0.23% or 59.11 points to close at 25,375.24 points.

DFM General Index gained 1.26% or 65.85 points to close at 5,307.15 points.

Crude Oil

Crude oil prices continued their downward trend today, poised for what Reuters reports could be the steepest monthly decline in three years. The primary driver behind this slump appears to be former U.S. President Trump's tariff measures, which have sparked widespread concern among analysts and economists about potential global economic instability.

These forecasts have weighed heavily on oil prices, a pressure further intensified by OPEC+’s decision to unwind production cuts more aggressively than originally planned, amplifying fears of an oversupply in the market.

Brent crude prices decreased by 0.98% to $63.62 per barrel.

Gold Prices

Gold prices declined on Wednesday as the US dollar gained strength amid indications of easing trade tensions. Investors are now focused on upcoming key US economic data, which could shape the Federal Reserve's next interest rate decision.

The dollar rose by 0.1% against major currencies, making gold more costly for holders of other currencies and adding downward pressure on the precious metal.

International gold prices declined 1.51% to close at $3,273.56 per ounce. In the local market, gold prices decreased PKR 3,400 to 345,800 per tola.

Comments

See what people are discussing