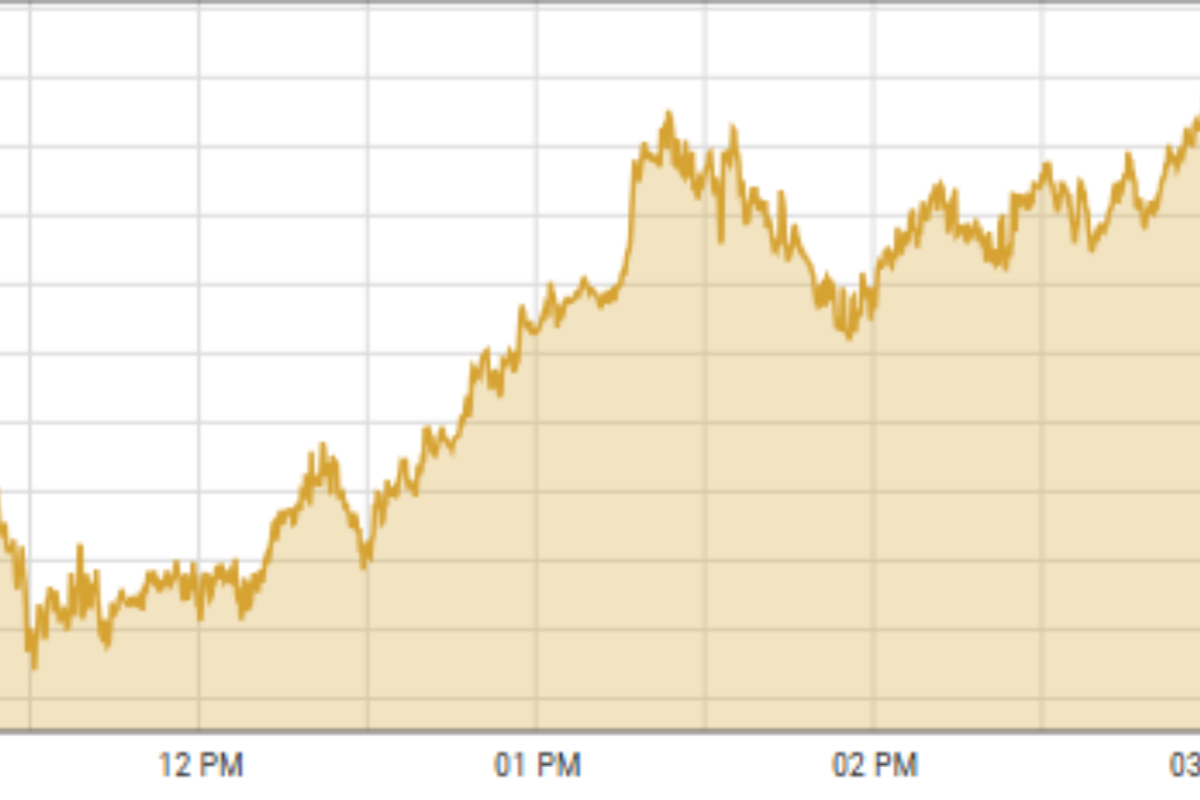

PSX reaches new high on circular debt 'progress', trade talks optimism

Cement, commercial banks, and technology & communication sectors were the major contributors in today's session, cumulatively adding 866 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

A snapshot of trading activity at the Pakistan Stock Exchange on Monday

PSX website

The Pakistan Stock Exchange (PSX) started off the week in the green, reaching a new record high on optimism that improving Pakistan-United States relations would lead to fresh foreign investment and boost textile exports.

Another major development that improved sentiment was the Oil and Gas Development Company's announcement that it had received the first interest payment under the government's circular debt resolution plan.

The benchmark KSE-100 index recorded an increase of 1,017 points or 0.7% to close at 142,052 points.

Cement, commercial banks, and technology & communication sectors were the major contributors in today's session, cumulatively adding 866 points to the index.

The Oil and Gas Development Company received the first interest payment of PKR 7.7 billion from Power Holding Private Limited (PHPL) against Term Finance Certificates (TFCs) issued as part of the 2013 circular debt settlement. The total outstanding interest of PKR 92 billion is scheduled to be paid in 12 monthly instalments starting from July.

The development raised hopes that other companies would also benefit soon. The government had reached a loan agreement with banks two months ago to clear PKR 1,275 billion of the outstanding circular debt.

The market has been optimistic since Pakistan concluded trade talks with the U.S. that resulted in the reciprocal tariffs on Pakistani exports being lowered to 19% from 29%. The reduction is perceived to be a good omen for textile companies in particular and exporters in general.

Another factor that improved sentiment was the continuous appreciation of the Pakistani rupee. A little over a week ago, the rupee had fallen to 285.05 per dollar, a 19-month low. However, after government security agencies launched a crackdown against hundi/hawala operators and smugglers, the domestic currency started to recover.

In the last 10 sessions, the currency has recovered by PKR 2.39. On Monday, the rupee closed at PKR 282.66 in the interbank market, improving by six paisa compared to Friday's close.

A leading trader said the market has entered in the overbought zone where there is possibility that the index might shed some weight. This would be healthy for the market and entice those who missed the rally to enter the market, he said.

An analyst from Ismail Iqbal Securities attributed the rally primarily to improved industry sales in the cement sector, further supported by strength in banking stocks as the central bank's recent decision signalled there would be a delay in the monetary easing cycle.

Meanwhile, an analyst at Al Habib Capital said that gains were driven by U.S.-Pakistan trade talks, Pakistan's first oil import agreement with the U.S. via Cnergyico, and exploration and joint development of oil reserves in Balochistan. A strong rebound in July cement dispatches also boosted sentiment, he added.

Comments

See what people are discussing