Pakistan stocks rally amid UN call for restraint in regional tensions

Strong earnings, global market momentum drive PSX gains despite volatility

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

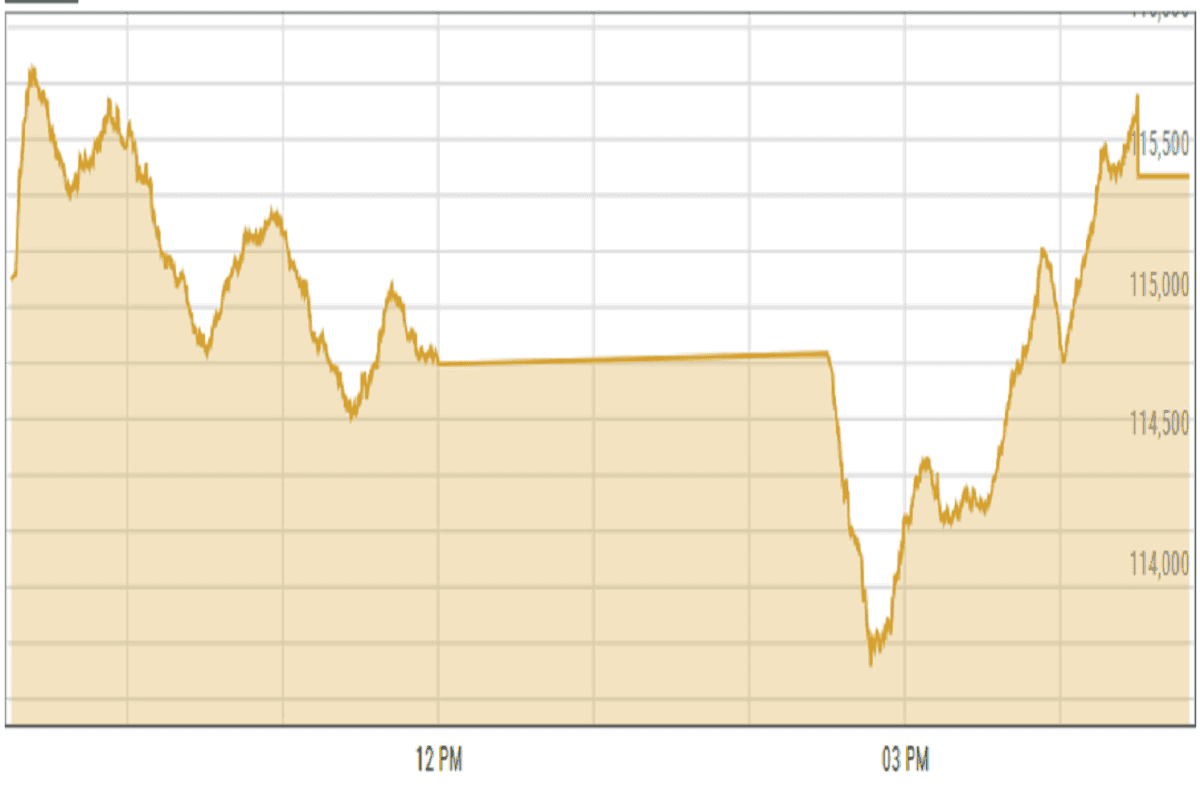

KSE-100 index gained 0.39%

PSX

Stocks turned bullish Friday following the United Nations' call for Pakistan and India to exercise restraint and resolve tensions through mutual engagement, analysts said.

Ahsan Mehanti of Arif Habib Corp attributed the market’s upward movement to strong financial results, rising global equities, and expectations of monetary easing from the State Bank of Pakistan.

Despite geopolitical concerns causing range-bound activity for much of the day, some recovery was observed in the latter half of the session, according to an analyst at Topline Securities.

An analyst at Ismail Iqbal Securities noted that the benchmark index closed in positive territory, though volatility persisted due to earnings season fluctuations. "Investors navigated through mixed earnings reports, which contributed to the choppy market movement," the analyst said.

Commercial banks, fertilizer, and cement stocks led the gains, collectively adding 632 points to the index, analysts reported.

KSE-100 index gained 0.39% or 449.53 points to close at 115,469.35 points.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 10 paisas to close at 280.97. In the open market USD was trading at PKR 282.3.

Indian Stocks

The Indian stock market declined for the second straight session on Friday, April 25, as investors booked profits amid escalating tensions between India and Pakistan.

The downturn followed a deadly militant attack in Kashmir, which intensified geopolitical concerns.

BSE-100 index declined 1.18% or 299.88 points to close at 25,114.27 points.

DFM General Index shed -0.64% or 33.21 points to close at 5,162.61 points.

Crude Oil

Oil prices fell on Friday, reversing earlier gains, and were set for a weekly loss due to expectations of increased global supply amid US-Iran talks and potential Opec+ output hikes.

Concerns over the US-China trade war also weighed on prices. Oil rose in the morning on hopes of tariff negotiations but later declined after China denied such talks.

The outlook remains negative, with higher supply and weaker demand, as the IMF sharply lowered global growth forecasts.

Brent crude prices decreased by 0.86% to $65.98 per barrel.

Gold Prices

Gold prices are facing challenges in maintaining support at $3,200, as heavy profit-taking has led to the most significant selloff of the precious metal in five years.

Despite the downturn, analysts suggest this correction was expected, considering the remarkable surge in prices both this year and over the past 12 months.

International gold prices declined 1.88% to close at $ 3,271.85 per ounce. In the local market, gold prices shed PKR 3,300 to 348,700 per tola.

Comments

See what people are discussing