Pakistan stock market reaches yet another all-time high

Equity expert says the market has been in an upbeat mood on expectations the interest rate will be cut

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

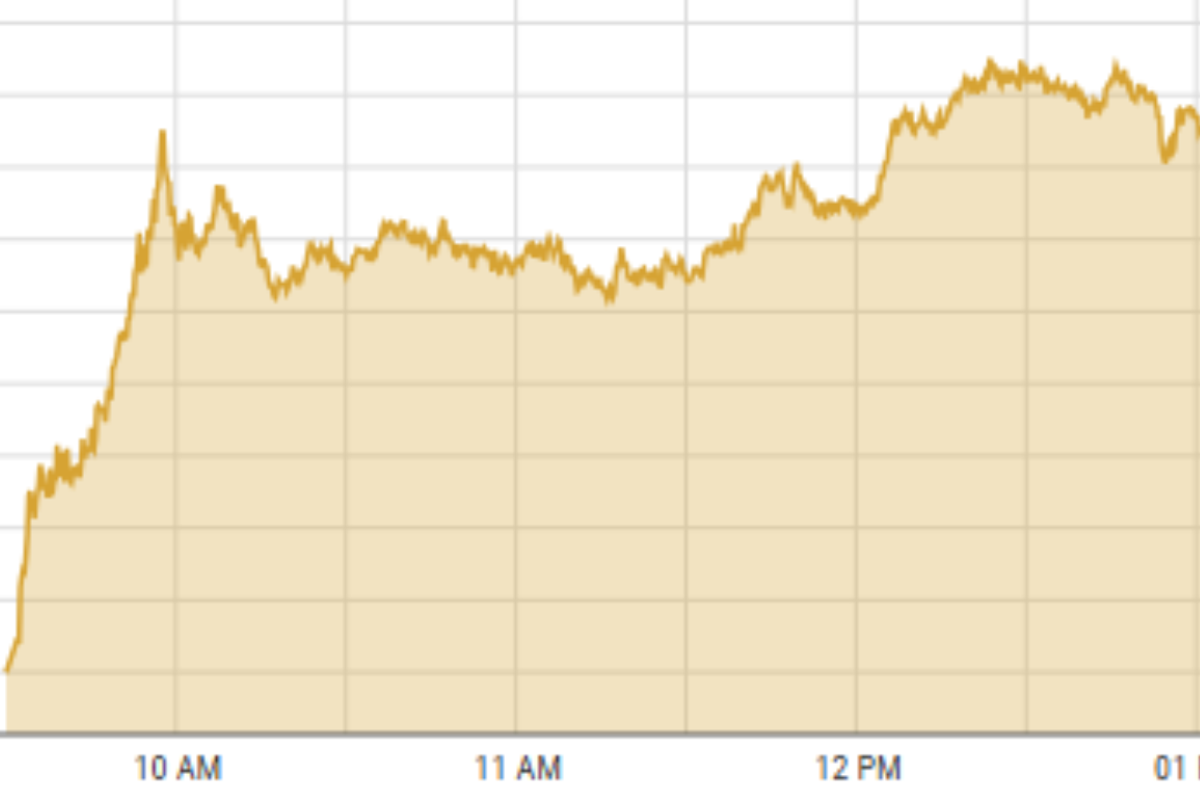

A snapshot of trading activity at the Pakistan Stock Exchange on Tuesday

PSX Website

The Pakistan Stock Exchange closed at a historic high on Tuesday following Field Marshal Asim Munir's meeting with businessmen.

A participant of the meeting told Nukta that traders' issues, especially those related to taxation, were discussed during the meeting.

CEO of Arif Habib Commodities Ahsan Mehanti said the benchmark KSE-100 index traded at a new all-time high following the meeting during which the field marshal assured the military's support for economic progress.

Moreover, the government winning majority of the Senate seats also fueled the rally since the win would help it in getting legislation approved easily.

In addition, speculations over the central bank likely easing the monetary policy next week and expectations over strong financial results and annual payouts in the earning season played a catalyst role in bullish activity at the PSX, he added.

The KSE-100 index closed with a gain of 1,202 points or 0.9% at 139,419 points. Trading volumes increased to 246 million shares as compared to 222 million shares in the previous session.

Fertilizer, oil & gas exploration companies, and commercial banks were the major contributors in today's session, cumulatively adding 810 points to the index.

Rate cut expectation

Equity expert Jibran Sarfraz said the market has been in an upbeat mood on expectations that a surging real interest rate combined with inflation of under 4% create room for cut in the interest rate.

Moreover, optimism of good results also built the rally in equities that hold promise of good returns. He added that the index was also propelled higher because of key economic indicators showing signs of recovery — low inflation rate, current account in surplus for the first time in 14 years, and remittances growing at a faster pace.

A leading trader said that some of the textile companies were in the buying chart following data released recently showing that exports of products amounted to $1.5 billion in June compared with $1.4 billion recorded in 2024. In the fiscal year ended June 30, overall textile shipments helped country earn around $17.8 billion, showing an increase of 7% compared with the previous year.

Another factor which triggered buying in textile sector was the expected favorable outcome from talks with the U.S. on tariffs.

Circular debt plan

Ali Nawaz, CEO of Chase Securities, said that the market showed strong recovery on back of fresh liquidity injected from financial institutions. Another factor which boosted sentiment was the government’s strategy regarding the circular debt issue pertaining to gas sector which has mounted to PKR 2,800 billion.

According to an analyst from Al Habib Capital Market, the recovery in the market was mainly due to the government's decisive plan to resolve the PKR 2,800 billion gas sector circular debt, which improves liquidity, earnings visibility, and investor confidence, along with the gradual recovery in fertilizer offtake, which, despite earlier challenges from the removal of support prices, is now supporting sentiment for listed fertilizer companies.

Comments

See what people are discussing