State Bank of Pakistan announces monetary policy schedule for rest of 2025

SBP to hold next policy meeting on July 30 amid stable rates and easing inflationary pressures

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

The State Bank of Pakistan (SBP) has released the schedule for its Monetary Policy Committee (MPC) meetings for the second half of 2025, reaffirming its commitment to transparency and a forward-looking approach.

The first policy meeting is set for July 30, 2025, maintaining the central bank's bimonthly schedule. Previous decisions this year were announced on January 27, March 10, May 5, and June 16.

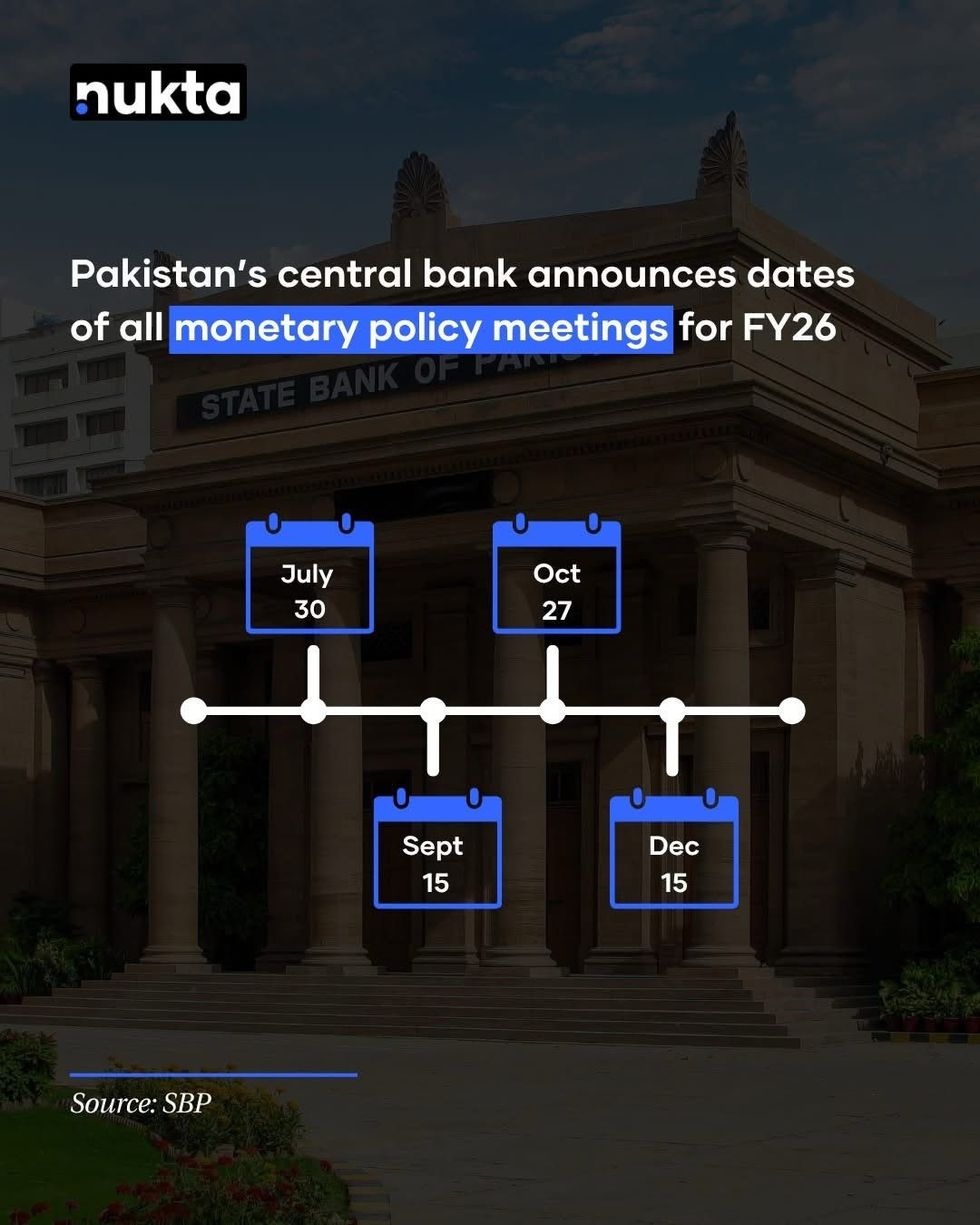

The remaining MPC meetings for the current and upcoming fiscal years will be held on:

- Monday, September 15, 2025

- Monday, October 27, 2025

- Monday, December 15, 2025

- Monday, January 26, 2026

- Monday, March 9, 2026

- Monday, April 27, 2026

- Monday, June 15, 2026

The announcement comes as inflation in Pakistan has sharply decelerated. Average inflation for fiscal year 2025 stood at 4.5%. In June, headline inflation rose to 3.2% year-on-year, up from a historic low of 0.3% in April, indicating a possible base-effect reversal.

Market expectations for July inflation now range between 4.5% and 5.0%. Upside risks include recent increases in fuel prices and electricity tariffs.

With the policy rate currently at 11%, real interest rates in Pakistan have turned positive. This is a major shift from the deeply negative real rates during fiscal years 2023 and 2024.

The SBP cut its key policy rate by a cumulative 1,100 basis points between June 2024 and May 2025. This brought the rate down from a record 22% to 11% over six consecutive decisions. The central bank paused further easing in June, citing medium-term risks and the need to keep inflation expectations anchored.

In its June policy statement, the MPC said, “the current stance is appropriate,” and noted that real rates are now positive and monetary conditions remain sufficiently tight.

Analysts expect the SBP to proceed cautiously in the coming months. Although lower rates have eased borrowing costs and improved credit flow, global commodity price volatility, fiscal imbalances, or imported inflation could restrict further rate cuts.

The July 30 meeting will be closely watched for any signals on whether the central bank will maintain its pause or resume its easing cycle later this year.

Comments

See what people are discussing