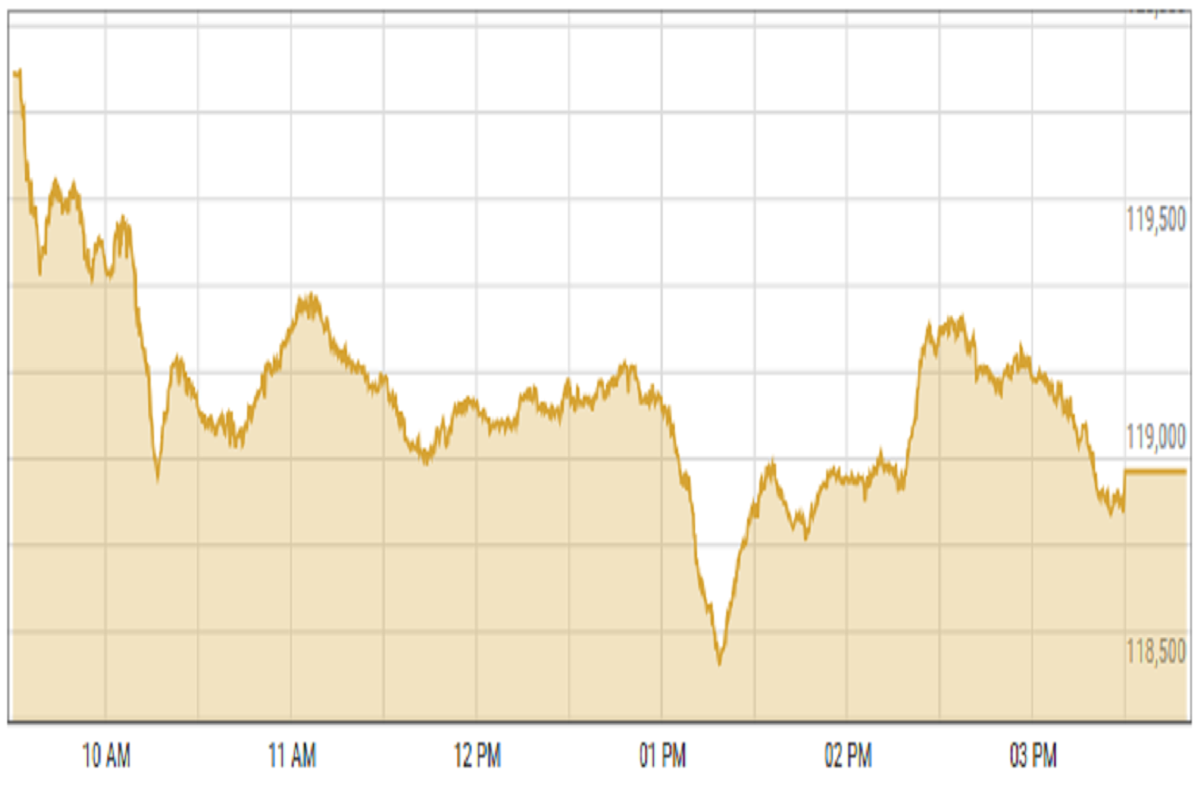

Pakistan stocks fall as investors await budget, IMF concerns loom

Banking, energy sectors lead declines amid pre-budget uncertainty, profit-taking

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.6%

PSX

Pakistan’s benchmark stock index ended in the red Tuesday as investors remained cautious ahead of the upcoming federal budget announcement, analysts said.

"With most developments already factored in, market sentiment remained subdued, awaiting fresh cues that could shift the momentum," said an analyst at Ismail Iqbal Securities.

Commercial banks, oil and gas exploration companies, and fertilizer sectors were the major laggards, collectively shedding 469 points from the index.

Ahsan Mehanti of Arif Habib Corp said stocks closed lower due to pre-budget uncertainty and concerns over parliamentary approval of proposed tax measures linked to International Monetary Fund conditions. These measures include phasing out industrial incentives and implementing tax reforms in the agricultural sector.

"IMF warnings over external risks from U.S. tariff policies and escalating tensions with India also impacted sentiment," Mehanti said.

An analyst at Topline Securities said the market remained volatile, reflecting a day of consolidation.

"The decline was attributed to persistent profit-taking, compounded by the absence of any positive triggers," the analyst said.

KSE-100 index shed 0.6% or 718.51 points to close at 118,971.13 points.

Currency

US dollar steadied against PKR in the inter-bank market. Pakistani currency shed 15 paisas to close at 281.92. In the open market USD was trading at PKR 283.8.

Indian Stocks

Indian stock markets fell for the third day in a row, likely because investors were selling stocks to secure profits. Many traders were being cautious as they waited for updates on the India-US trade deal.

With no big positive news and concerns about the U.S. economy, selling pressure was high. Since stock prices are already quite high and the trade deal is taking time, experts believe the market may remain unstable for a while, which could lead foreign investors to reduce their investments in India.

BSE-100 index shed 1.21% or 315.15 points to close at 25,815.80 points.

DFM General Index shed 0.42% or 23.24 points to close at 5,468.01 points.

Crude Oil

Oil prices dipped slightly on Tuesday, staying within a narrow range as traders waited for a clear reason to push the market in a new direction.

Investors were watching key diplomatic developments, such as Russia-Ukraine peace talks and US-Iran nuclear negotiations, which could affect supply and demand. Meanwhile, concerns about China's economic outlook added to the cautious mood in the market.

Brent crude prices decreased by 0.2% to $65.41 per barrel.

Gold Prices

Gold prices stayed nearly the same on Tuesday. Investors were more willing to take risks because China and Australia lowered interest rates, helping stock markets rise.

China warned that U.S. chip export restrictions were harming a recent trade deal, but this didn’t have a big impact on markets. At the same time, investors were still processing Moody’s recent downgrade of the U.S. credit rating.

Gold gained some strength after Moody’s downgrade, but this didn’t last long due to the dollar and U.S. stock market staying strong overnight.

International gold prices increased 0.24% to close at $3,237.46 per ounce. In the local market, gold prices increased PKR 300 to 342,800 per tola.

Comments

See what people are discussing