Pakistan stocks sink amid heightened tensions with India

Dollar hits 15-month high in the inter-bank market

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

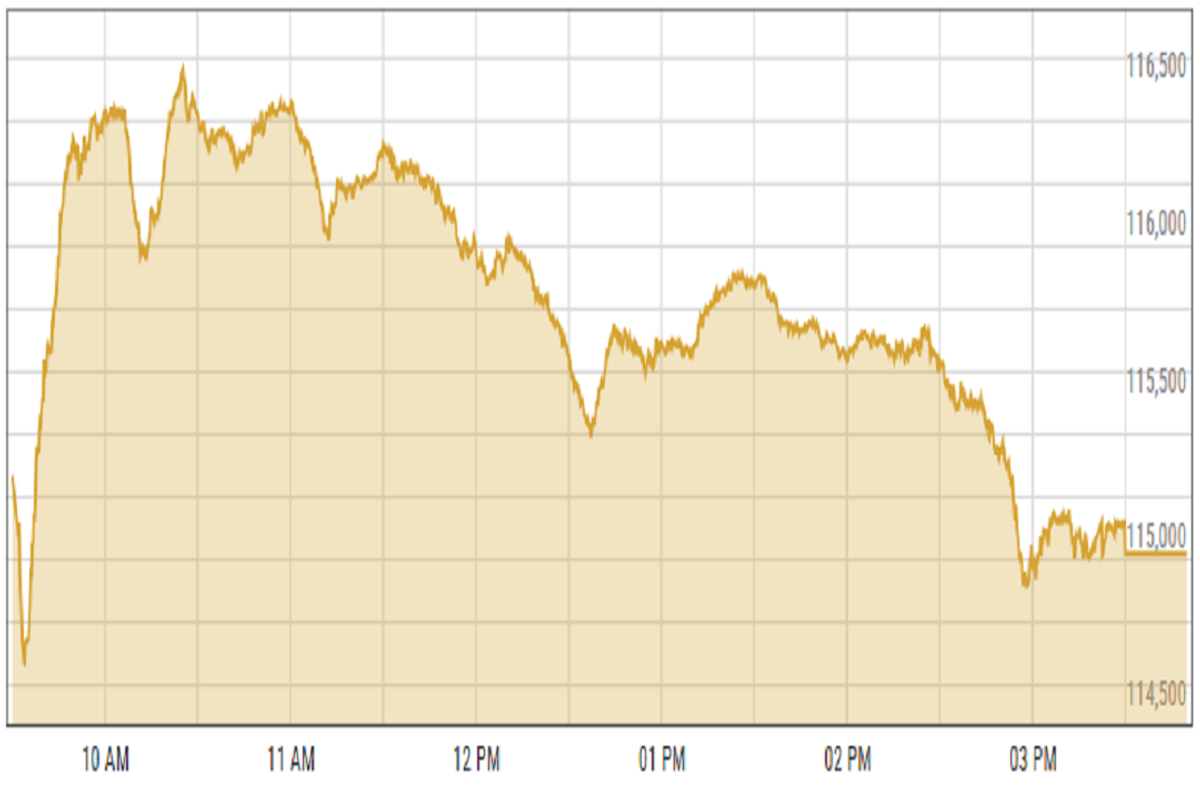

KSE-100 index lost 1.88%

PSX

Pakistan’s stock market ended in the red Thursday as investor concerns mounted over potential retaliation from Islamabad following India's recent moves related to attacks in occupied Kashmir.

The KSE-100 Index extended its previous day's losses, as commercial banks, oil and gas exploration firms, and fertilizer companies led the downturn. Analysts attributed the bearish trend to heightened regional tensions and the conclusion of the futures rollover week.

"Investor sentiment remained cautious," an analyst at Ismail Iqbal Securities said, noting that the market faced pressure from both geopolitical uncertainty and technical factors.

An analyst at Topline Securities echoed similar concerns, stating that the market maintained a "distinctly risk-off tone" throughout the session, weighed down by fears of escalating friction between India and Pakistan.

The uncertainty surrounding geopolitical developments continues to cast a shadow over investor confidence, leaving the market vulnerable to further volatility in the days ahead.

KSE-100 index lost 1.88% or 2,206.33 points to close at 115,019.82 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency shed 10 paisas to close at 281.07. In the open market USD was trading at PKR 282.3.

Indian Stocks

Indian stocks fell due to profit booking amid weak global trends. The market, lacking fresh positive triggers, was pressured by Reliance Industries and banking stocks.

Concerns over U.S. tariffs weighed on sentiment, though foreign inflows and hopes of easing U.S.-China trade tensions could provide support.

BSE-100 index declined 0.27% or 68.93 points to close at 25,414.15 points.

DFM General Index shed 0.18% or 9.52 points to close at 5,195.82 points.

Crude Oil

Oil prices rebounded on Thursday as investors weighed a possible OPEC+ output increase against mixed signals on tariffs from the White House and ongoing U.S.-Iran nuclear talks.

The previous session saw a nearly 2% drop after reports suggested some OPEC+ members might push for faster production hikes in June.

Brent crude prices increased by 1.03% to $66.80 per barrel.

Gold Prices

Gold surged to a record $3,398 on Monday as the weakening U.S. dollar and growing trade policy concerns boosted demand. A cheaper dollar makes gold more attractive globally, while uncertainty over Federal Reserve independence fuels its appeal as a safe haven.

International gold prices increased 1.71% to close at $3,341.39 per ounce. In the local market, gold prices remained unchanged at 352,000 per tola.

Comments

See what people are discussing