Rao Aamir

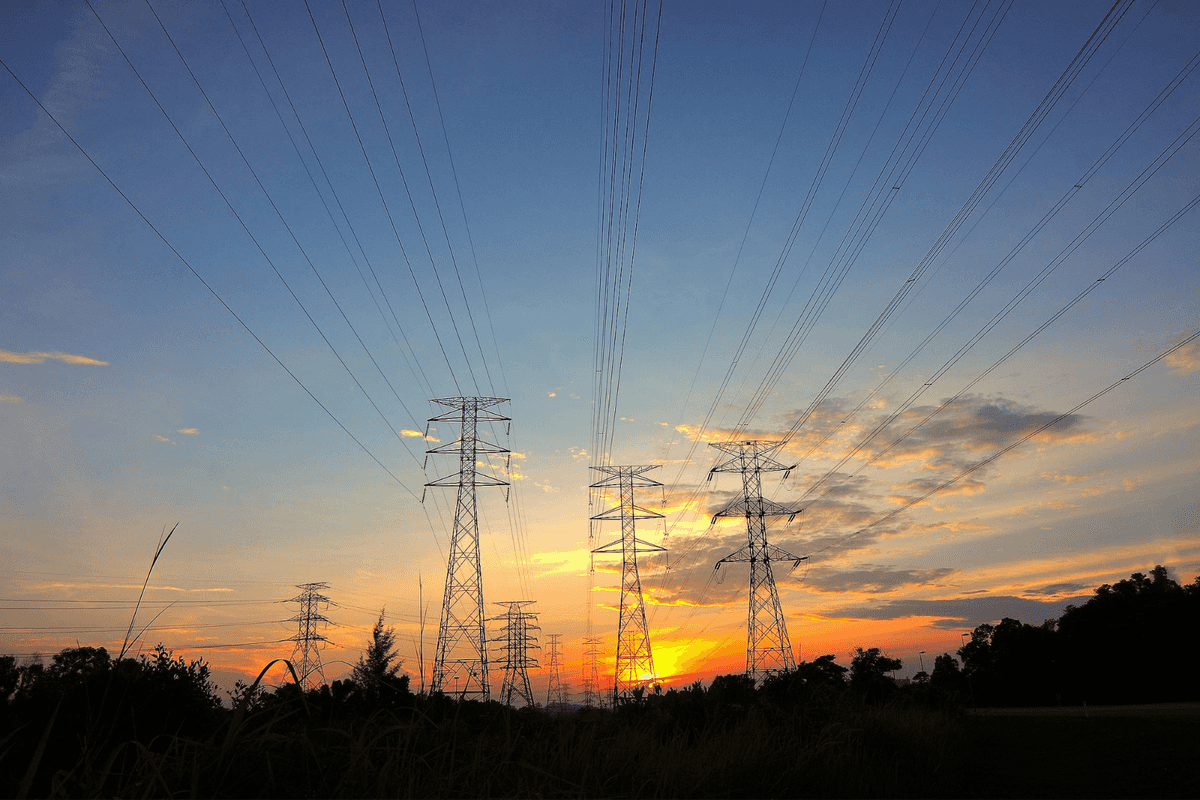

Pakistan's power generation fell by 17% year-on-year to 13,179 gigawatts in August

It's a vicious cycle — when Pakistan generates less electricity than its target, it also earns less, and to make up the shortfall, it charges consumers higher rates in the future for some time.

Pakistan's power generation fell by 17% year-on-year to 13,179 gigawatts in August, marking a 20% decline compared to the reference generation level. This was the lowest recorded generation in August since 2017.

The drop in power generation was primarily due to unusually heavy rainfall, which was 147% above average for this period. This contributed to the fifth-lowest mean maximum temperature in the past 64 years, leading to reduced electricity demand.

How does this lower generation affect consumers? The answer lies in the electricity tariff breakdown, which reveals a significant mismatch between how Pakistan generates electricity and how it pays for it. Around 67% of electricity costs are fixed, while 33% are variable. However, only 4% of revenue comes from fixed sources, with 96% reliant on consumption.

As a result, when electricity consumption falls below the reference level, it creates a revenue shortfall, which is recovered from consumers through Quarterly Tariff Adjustments (QTA).

Quarterly Tariff Adjustments

Currently, a QTA of PKR 1.74 per unit is being charged to power consumers, effective from September to November this year.

During the first two months of fiscal year 2024-2025 (FY25), power generation was 12% below the reference level, with August alone seeing a 20% shortfall. Assuming electricity generation in September remains 5% lower than in September 2023, overall generation for FY25's first quarter is expected to be 11% below the reference level.

This will result in a revenue shortfall of approximately PKR 123 billion, which will be passed on to consumers from December 2024 to February 2025. Based on the reference generation for this period, Nukta forecasts a QTA of PKR 5.16 per unit, to be charged from December 2024 to February 2025.

Pakistan's Consumer Price Index (CPI) also reflects changes in the QTA for electricity. According to Nukta's calculations, if a QTA of PKR 5.16 per unit is implemented from December 2024 to February 2025, inflation will rise by 60 basis points.

It’s important to note that the net increase in QTA will be PKR 3.42 per unit, as the current QTA of PKR 1.74 per unit, which ends in November, is already in effect.

Comments

See what people are discussing