War unlikely despite Indian threats as markets reject Modi’s 'bluff'

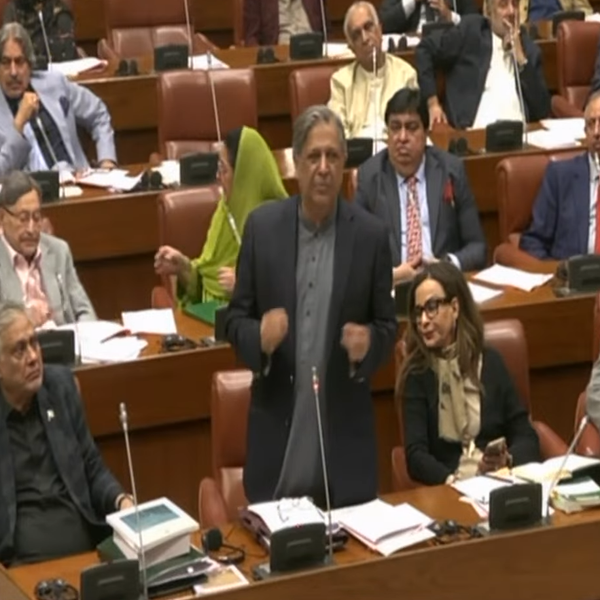

Kamran Khan points to reaction of Bombay Stock Exchange and Nifty 50 index, which surged rather than panicked after Indian leaders escalated their rhetoric

News Desk

The News Desk provides timely and factual coverage of national and international events, with an emphasis on accuracy and clarity.

Kamran Khan says fears of a large-scale war or nuclear conflict between India and Pakistan are exaggerated, citing what he calls “clear signals” from regional diplomacy and Indian financial markets.

In his vlog, Khan said that despite threats from Indian politicians and sensationalist media coverage following the April 22 Pahalgam attack, he sees no realistic prospect of a full-blown war between the two nuclear-armed neighbors.

“There will be no major war or nuclear conflict—just conventional skirmishes and maybe airstrikes,” Khan said. “India’s war threats are already fizzling out, even inside India.”

He pointed to the reaction of the Bombay Stock Exchange (BSE) and the Nifty 50 index as key indicators of investor sentiment. According to Khan, both indices surged rather than panicked after Indian leaders escalated their rhetoric, demonstrating that markets are not pricing in the risk of war.

On April 23, just one day after the Pahalgam incident, the Sensex closed up 520 points while Nifty gained 161 points, Khan noted. Even after India unilaterally suspended the Indus Waters Treaty on April 24, markets remained largely stable, showing only minor corrections attributed to profit-taking rather than geopolitical tension.

“Indian investors and global players are sending a message loud and clear—they’re not buying Modi’s war bluff,” Khan said. “This is not a country bracing for war. It’s a country staging political theater.”

Khan argued that the Modi government is using traditional tactics to rally domestic support ahead of elections, including the possibility of false flag operations and “dramatic” airstrikes. But any serious escalation would come at an unsustainable cost.

“India cannot afford to breach the Indus Waters Treaty or the suspension of the Simla Agreement,” Khan said. “These are red lines that would hurt India more than Pakistan.”

Khan also referenced comments from U.S. State Department spokesperson Tammy Bruce, who said Secretary of State Marco Rubio is in contact with both Islamabad and New Delhi, urging restraint. According to Khan, this shows Washington and other global powers are not supporting India's escalation.

In fact, foreign investment in Indian equities surged in the last nine trading sessions of April. Khan cited a net inflow of $4.1 billion from foreign portfolio investors (FPI), the highest in nearly two years. This led to a 6.6% increase in the Nifty index over the same period.

“When there’s a real threat of war, markets melt down,” Khan said. “Look at Pakistan’s markets—they’ve been in turmoil this past week. But in India, where trillions of dollars are invested, there’s no panic. That tells the real story.”

Khan also noted that on April 28, when Indian forces fully deployed along the Line of Control and President Trump suggested both countries resolve disputes bilaterally, the Indian markets responded with a sharp rebound. The Sensex jumped over 1,000 points and Nifty rose 289 points.

Even after the Modi government said its armed forces had been given “full operational freedom,” markets remained calm.

Khan concluded that while border clashes and media-fueled hysteria will continue, there is no appetite—either politically or financially—for an actual war.

“Modi might launch rhetorical missiles in rallies or conduct surgical strikes in Bollywood style,” Khan said. “But there will be no nuclear confrontation. Investors in New Delhi already know that.”

Comments

See what people are discussing