Pakistan stocks surges as investors seize buying opportunities

Diplomatic assurances, record-low inflation drive market recovery

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

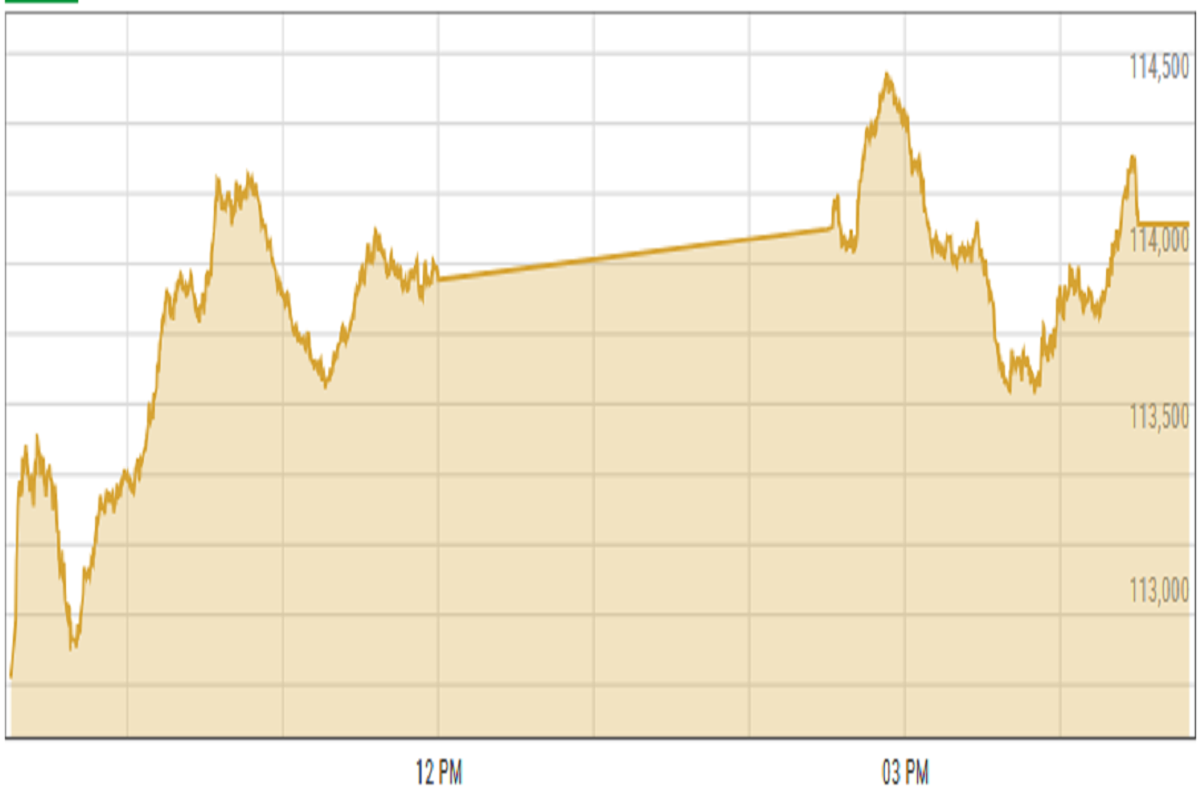

KSE-100 index gained 2.5%

PSX

Pakistan’s stock market rebounded Thursday after two consecutive sessions of pressure, driven by investor confidence following diplomatic assurances from the U.S. administration that tensions between India and Pakistan would not escalate into a broader regional conflict.

The benchmark index surged as investors capitalized on attractive valuations, reversing the previous session’s selling pressure. “Attractive valuations prompted fresh positions, helping the market recover and close in the green,” said an analyst at Ismail Iqbal Securities.

Ahsan Mehanti of Arif Habib Corp said stocks showed a sharp recovery after calls from the United States and the United Nations urging Pakistan and India to de-escalate tensions.

Additionally, reports of record-low inflation, expectations of further easing in State Bank of Pakistan policy, and the anticipated approval of an International Monetary Fund (IMF) tranche this month played a catalytic role in the market’s record bullish close.

Major contributors to the rally included commercial banks, cement, and oil and gas exploration companies, collectively adding 1,810 points to the index.

KSE-100 index gained 2.5% or 2,787.36 points to close at 114,113.93 points.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 9 paisas to close at 281.06. In the open market USD was trading at PKR 282.9.

Indian Stocks

The Indian stock market stayed mostly unchanged on Friday, even though global markets showed positive signs. Foreign investors continued to put money into Indian stocks, and gains in other Asian markets helped.

Despite a sharp drop earlier caused by Trump’s trade tariffs and the Pahalgam terror attacks, April ended with over 4% gains in the Nifty index. This strong recovery happened mainly because foreign investors kept buying stocks for eleven straight trading days.

BSE-100 index gained 0.06% or 15.28 points to close at 25,390.52 points.

DFM General Index gained 0.35% or 18.57 points to close at 5,291.37 points.

Crude Oil

Oil prices fell on Friday as traders adjusted ahead of an OPEC+ meeting and monitored U.S.-China trade tensions. China’s Commerce Ministry is considering Washington’s proposal for talks on tariffs, raising hopes for easing tensions. However, concerns remain over global economic growth and oil demand.

The situation is further complicated by U.S. threats of sanctions on buyers of Iranian oil, particularly China, following postponed nuclear talks with Iran.

Brent crude prices decreased by 0.24% to $61.98 per barrel.

Gold Prices

Gold prices are rising slightly on Friday as buyers look for good deals. The recent price drop has attracted more interest, showing that investors still expect gold to gain value in the long run, especially around key price levels.

Hopes for new trade talks between the U.S. and China have boosted overall market confidence but have also limited gold’s gains.

International gold prices increased 1.19% to close at $3,255.7 per ounce. In the local market, gold prices decreased PKR 1,300 to 344,500 per tola.

Comments

See what people are discussing