Oil prices stabilize amid China concerns, Middle East tensions

Oil markets remain volatile as fears over China's economic outlook collide with escalating geopolitical risks in the Middle East, with analysts forecasting price hikes driven by uncertainty.

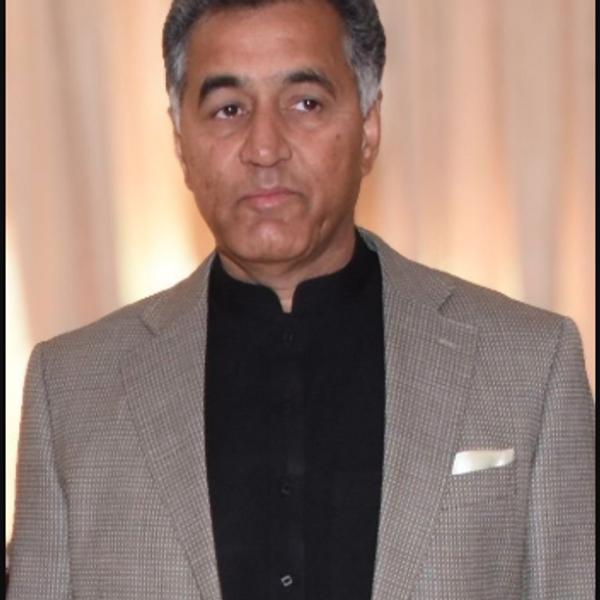

Rana Tabbara

Senior Business Producer

Rana Tabbara is a UAE-based reporter and content creator known for dynamic storytelling, impactful reporting, and high-profile interviews. She interviewed leaders including the UAE Minister of Energy, the Australian Prime Minister, the Saudi Minister of Tourism, the Armenian Minister of Economy, and CEOs of major companies. Rana covered big events like the World Government Summit, LEAP, Cityscape KSA, IDEX, among others. Her previous experiences include The New York Times, CNN Business Arabic, and L'Orient-Le Jour.

Oil prices stabilized following their steepest drop in over a year during the previous session, driven by mounting concerns about China's economic outlook.

Simultaneously, the market is closely monitoring Israel's potential response to a barrage of Iranian missiles last week.

Brent crude hovered near $77 per barrel after plunging 4.6% on Tuesday, while West Texas Intermediate (WTI) dipped below $74. Beijing's decision to refrain from introducing significant new stimulus measures after returning from a week-long holiday has exacerbated worries about the future growth of demand from the world’s largest crude oil importer.

The decline in prices coincides with rising geopolitical tensions, particularly the possibility of an Israeli strike on Iran's oil infrastructure.

Israel's defense minister postponed a critical visit to the United States, which was expected to be an opportunity for the allies to devise a joint strategy against Tehran.

Meanwhile, U.S. President Joe Biden urged Israel not to target Iran’s oil fields, as Iran continues to export crude from its main terminal on Kharg Island.

Despite these warnings, markets remain on edge, with options increasingly favoring buyers who stand to profit if prices surge amid heightened volatility.

Morgan Stanley raised its forecast for Brent crude by $5, now expecting it to reach $80 per barrel in the fourth quarter, citing rising geopolitical risks. However, the bank cautioned about a potential supply glut in 2025.

Comments

See what people are discussing