Pakistan faces economic heat as oil prices soar amid Middle East tensions

A global oil price surge risks inflating Pakistan’s import bill, fueling inflation, draining reserves, and raising transport costs

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

The government needs to secure external financing, optimize energy procurement strategies, and develop contingency plans to safeguard economic stability.

Reuters

Pakistan’s exposure to global oil price shocks is set to deepen, with ripple effects expected across key economic sectors.

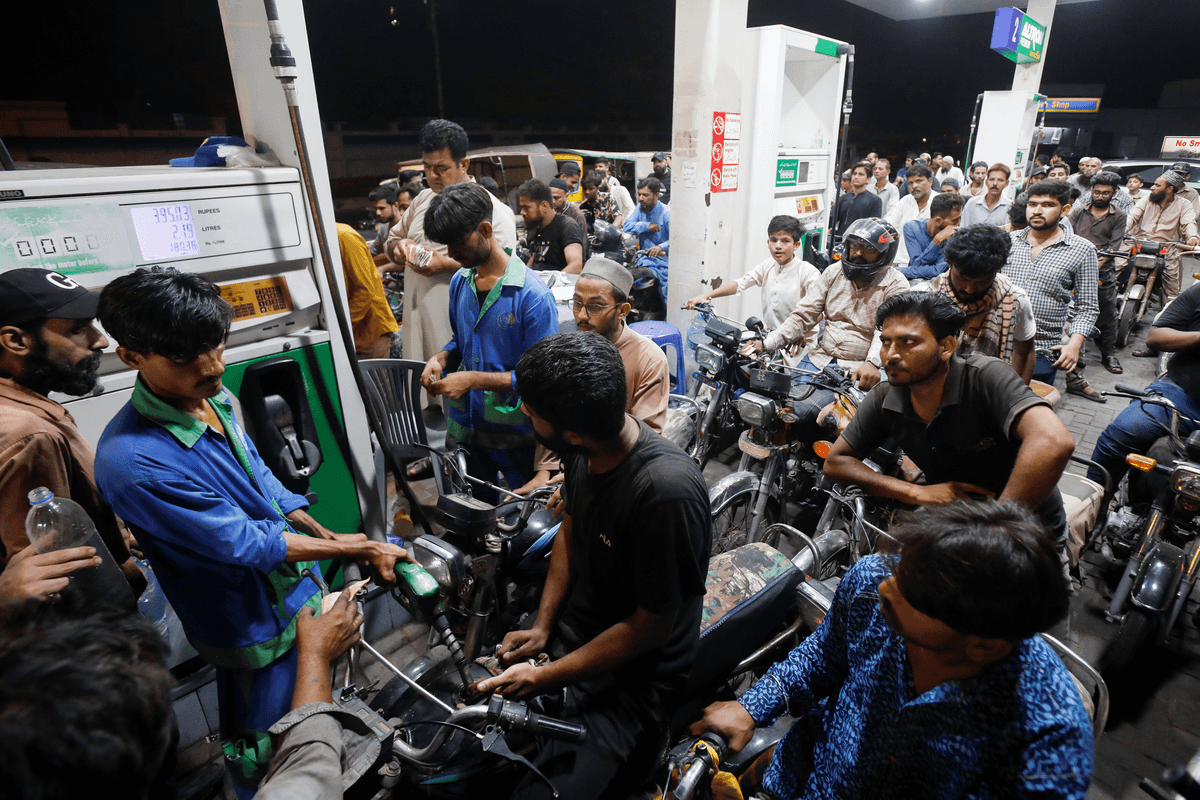

A surge in global crude prices threatens to inflate the country’s oil import bill, fuel inflation, strain foreign exchange reserves, and raise the cost of transporting goods—especially oil cargoes—adding to the overall cost of doing business.

Oil prices surge amid Israel-Iran conflict

Global crude oil prices spiked over 7% on Friday as escalating tensions between Israel and Iran renewed fears of a broader disruption in Middle Eastern energy supplies.

Brent crude futures rose by $4.87, or 7.02%, to settle at $74.23 per barrel after earlier soaring over 13% to an intraday high of $78.50—the highest since January 27. Over the week, Brent prices climbed 12.5%.

Meanwhile, U.S. West Texas Intermediate (WTI) crude surged $4.94, or 7.26%, to close at $72.98 per barrel. During the session, WTI hit an intraday high of $77.62—its strongest level since January 21—registering a weekly gain of 13%.

Both benchmarks recorded their largest intraday moves since 2022, when Russia’s invasion of Ukraine sent energy markets into turmoil.

Pakistan’s rising import bill

In the first 10 months of the current fiscal year, Pakistan imported $12.8 billion worth of petroleum products—a 3% increase from the same period last year. Historically, every $10 rise in global oil prices adds approximately $1.8 billion annually, or $150 million monthly, to Pakistan’s oil import bill.

An analyst at Al-Habib Capital Markets warned that if the conflict drags on, elevated oil prices could severely strain Pakistan’s trade balance and weaken its broader fiscal outlook.

Current Account likely to come under pressure

Pakistan’s external sector is at risk of renewed stress, as higher global oil and LNG prices could erode the country’s current account surplus. Although the current account recorded a $1.9 billion surplus over the past 10 months, this buffer may vanish quickly if energy prices stay elevated.

A slide back into deficit territory could compel Pakistan to seek additional external financing—whether through multilateral support, Saudi oil credit, or bilateral loans. This could complicate ongoing IMF negotiations and force the government to redirect development funds toward essential imports.

Rupee and inflation outlook dim

The shock to global energy prices is expected to stoke inflation and put downward pressure on the rupee. Headline inflation averaged 4.6% during Jul–May FY25, but analysts warn that sustained oil prices above $70 per barrel could push inflation higher in the coming months.

At the same time, increased demand for U.S. dollars to cover pricier imports may weaken the Pakistani rupee past 285/USD, reversing the relative stability seen in recent weeks.

In response, the State Bank of Pakistan (SBP) may have to postpone or abandon anticipated interest rate cuts. Holding the policy rate at 11% could further suppress credit availability and stifle private sector growth.

Shipping and trade logistics disruption

The impact of rising oil prices extends beyond energy markets. Roughly 20% of the world’s oil and LNG passes through the Strait of Hormuz—a strategic chokepoint now threatened by the Israel–Iran standoff.

Any extended disruption could drive up freight charges and double war-risk insurance premiums. With Pakistan importing over 200 petroleum cargoes annually, added insurance and freight costs of $600,000–800,000 per shipment could inflate the trade bill by $120–160 million annually.

Fiscal dilemma deepens

The oil price surge poses a tough policy choice: pass costs onto consumers and risk unrest and inflation, or absorb them through subsidies and widen the fiscal deficit. Pakistan has already spent more than PKR 1.04 trillion on energy subsidies in recent years.

Any further subsidy burden risks worsening the circular debt crisis—which currently exceeds PKR 5.2 trillion (Power and Gas combined)—and undermining fiscal consolidation efforts under the IMF program.

To prevent a slide into macroeconomic instability, Pakistan must act swiftly. The government needs to secure external financing, optimize energy procurement strategies, and develop contingency plans to safeguard economic stability.

Without prompt and strategic intervention, the country faces a dangerous mix of stagflation, balance-of-payments stress, and declining investor confidence -- outcomes it can scarcely afford.

Comments

See what people are discussing