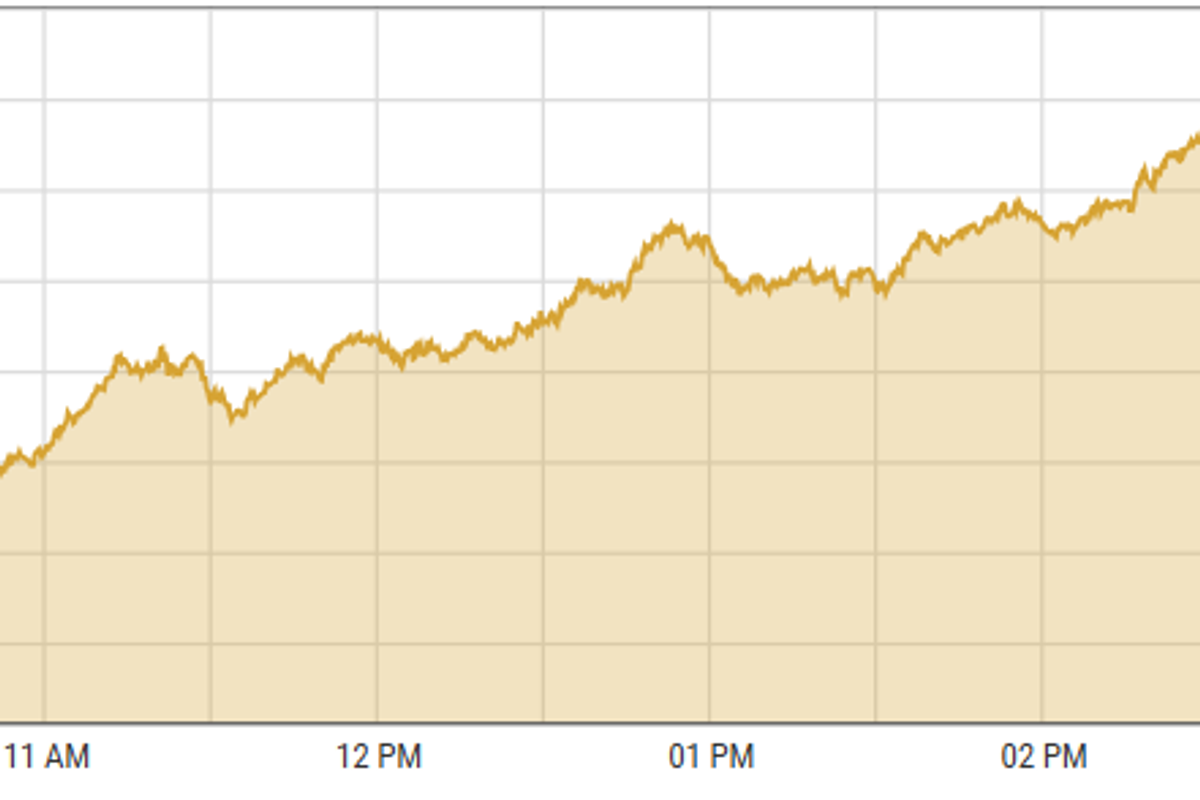

Pakistan stock market records 2nd largest single-day increase

Investors' sentiment strengthened on talks between government and PTI

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 4.03%

PSX

The Pakistan Stock Exchange recorded its second-highest single-day gain on Monday, bolstered by a lower inflation environment and a steady decline in secondary market yields.

Investors responded positively to easing political tensions as the government and largest opposition party — Pakistan Tehreek-e-Insaaf — engaged in constructive patch-up talks.

The improved economic landscape prompted a surge in liquidity, encouraging a shift in asset allocation towards equities, making them a more attractive investment option.

Additionally, the Ministry of Power announced on Sunday that the targets agreed upon with the International Monetary Fund (IMF) were progressing well.

The ministry confirmed that the end-December target for restricting the circular debt was comfortably within the set limits, further contributing to the positive market sentiment.

The benchmark KSE-100 index gained 4.03% or 4,411.27 points to close at 109,513 points.

On Monday morning, the Indian stock market went up by over 600 points because of a mix of positive global signals.

The overall market trend was positive. Experts believe that in the short term, the market will see rebounds, which might be followed by renewed selling by foreign institutional investors (FIIs).

There was buying activity in sectors like metal, real estate, commodities, IT, auto, public sector banks, financial services, fast-moving consumer goods (FMCG), and pharmaceuticals.

BSE-100 index gained 150.99 points or 0.6% to close at 25,157.80 points.

Meanwhile, the DFM General index gained 2.01 points or 0.04% to close at 5,059.31 points.

Commodities

Oil prices changed little because lower-than-expected U.S. inflation brought hopes for easier policies.

However, the possibility of too much oil supply next year kept the market down. Both major oil benchmarks dropped over 2% last week due to worries about global economic growth and oil demand.

The U.S. central bank's cautious stance on easing monetary policy and research from China's top refiner, Sinopec, which predicts China's oil consumption will peak in 2027, also negatively impacted prices.

Brent crude prices shed 0.16% to $72.82 per barrel.

On Monday, the price of spot gold stayed mostly the same in low trading activity.

This followed gains on Friday due to a weaker US dollar and lower Treasury yields, as US economic data suggested a slowdown in inflation.

International gold prices decreased 0.05% reaching $2,621.84 per ounce.

Currency

The PKR weakened against the US dollar in the interbank market, down 0.05%. Pakistani currency settled at 278.56 with a loss of 15 paisas. In the open market USD was trading at PKR 279.

Comments

See what people are discussing