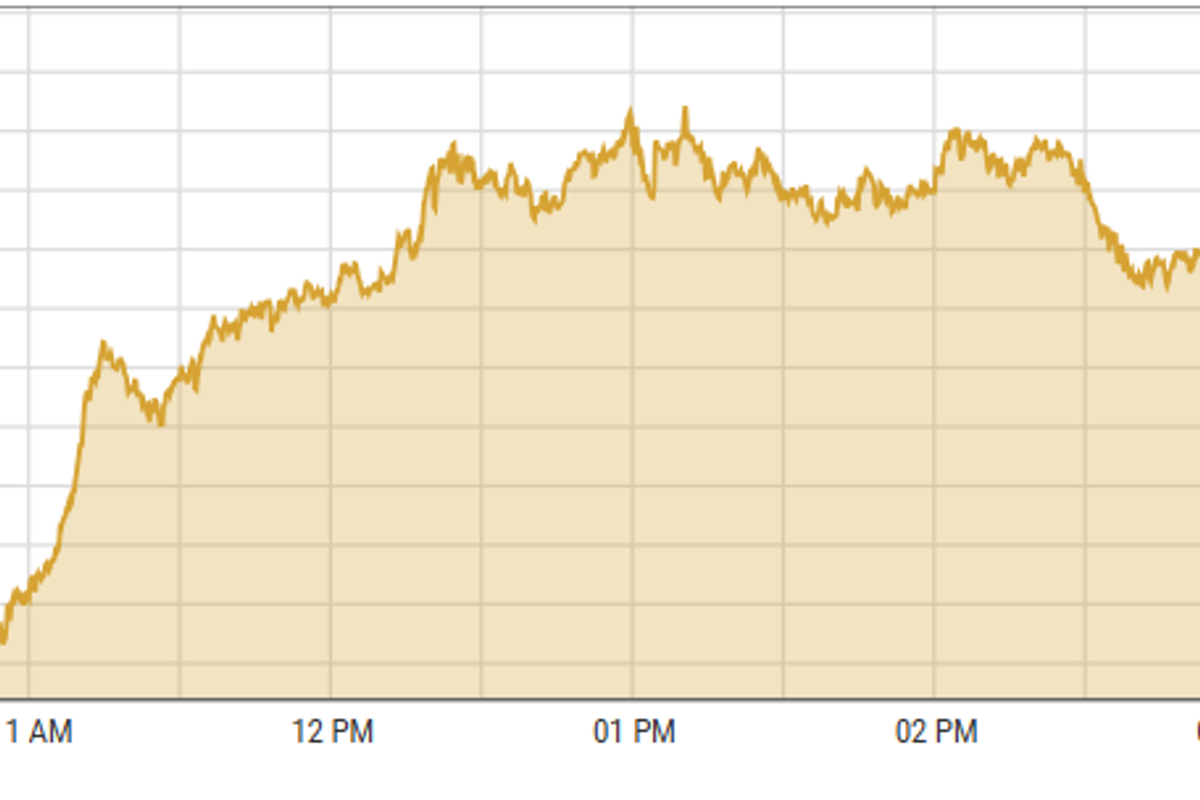

Pakistan stocks close new all-time high as investors take fresh bets after interest rate cut

KSE-100 index gained 0.4% to close at 92,304 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.4% to close at 92,304 points

PSX

Pakistan stocks closed at a new all-time high as investors celebrated a 250 basis point interest rate cut and seized value buying opportunities.

Several factors contributed to the bullish market including over $3 billion expected in remittances in October 2024, cement exports surging by over 50% in October 2024, expected $500 million funding from the ADB this month, and higher global crude oil prices. These elements played a key role in driving the record high close at the Pakistan Stock Exchange (PSX).

Pakistan's stock market soared to an all-time high on Monday, reflecting strong investor confidence and robust economic momentum.

The rally was fueled by expectations of an additional rate cut in ahead of Monetary Policy Committee (MPC) meeting, supported by a favorable inflation outlook and declining international oil prices.

On the economic front, Federal Minister for Information, Broadcasting, National Heritage and Culture Attaullah Tarar announced on Friday that Qatar would invest $3 billion in various sectors. He stated that this financing would have a significant impact on the national economy and ultimately benefit the masses.

Additionally, discussions to finalize a $2 billion investment in Pakistan by Denmark's giant Maersk Lise are scheduled for a high-level meeting during the Danish Foreign Minister's visit on November 12.

These positive developments contributed to the bullish activity in the stock market, driving it to new heights.

KSE-100 index gained 366.32 points or 0.4% to close at 92,304.32 points.

Indian stocks recovered strongly thanks to late buying in banking, metal, and other key sectors.

Market sentiment improved with hopes of a revival in consumption in the second half of the financial year. Metal stocks gained significantly due to expectations of major stimulus from China expected later this week.

The US Presidential elections are causing heightened volatility in global equity markets due to the uncertainty around the outcome.

India’s BSE 100 Index gained 0.77% or 196.16 points to close at 25,524.59 points.

The Dubai Financial Market (DFM) General Index gained 0.2% or 9.32 points to close at 4,594.53 points.

Commodities

Oil prices traded in a narrow range on Tuesday ahead of the US presidential election, after rising more than 2% in the previous session because Opec+ delayed plans to increase production in December.

Opec oil output rebounded in October as Libya resumed production, but Iraq's efforts to meet its cuts limited the overall gain.

Additionally, Iran plans to increase its output by 250,000 barrels per day, as reported by the oil ministry on Monday.

Brent crude prices surged 2.2% to $74.71 per barrel.

Gold prices held steady on Tuesday. Last week, gold hit a record high of $2,790.15 but has since seen ups and downs as investors remain cautious before the US presidential election and a Federal Reserve policy meeting.

While US elections haven't historically affected gold prices immediately, ongoing geopolitical tensions are expected to raise the value of this safe-haven asset, according to a recent note by the World Gold Council.

International gold prices surged 0.1% reaching $2,740.01 per ounce. In Pakistan, gold prices dropped by PKR 500 to PKR 283,200/tola on Tuesday.

Currency

US dollar strengthened against PKR, up 0.02% in the inter-bank market. Pakistani currency settled at 277.83, a loss of 5 paisas against the US dollar. In the open market USD was trading at PKR 280.0.

Comments

See what people are discussing