Pakistan stocks continue rally on gains in oil and banking sector

KSE-100 index gained 0.75% to close at 109,054 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.75%

PSX

Pakistan's stock market ended on a positive note marking yet another record high, mainly boosted by gains in the oil and banking sectors.

A recent $3 billion deposit rollover from the Saudi Fund has helped strengthen Pakistan's foreign exchange reserves. This has also brought stability to the Pakistani rupee and improved economic indicators.

These factors played a significant role in the Pakistan Stock Exchange (PSX) reaching new record levels.

Investors are anticipating an interest rate cut in the upcoming Monetary Policy Committee meeting. With few attractive alternative investment opportunities, many are turning to equities, which are currently available at relatively low prices.

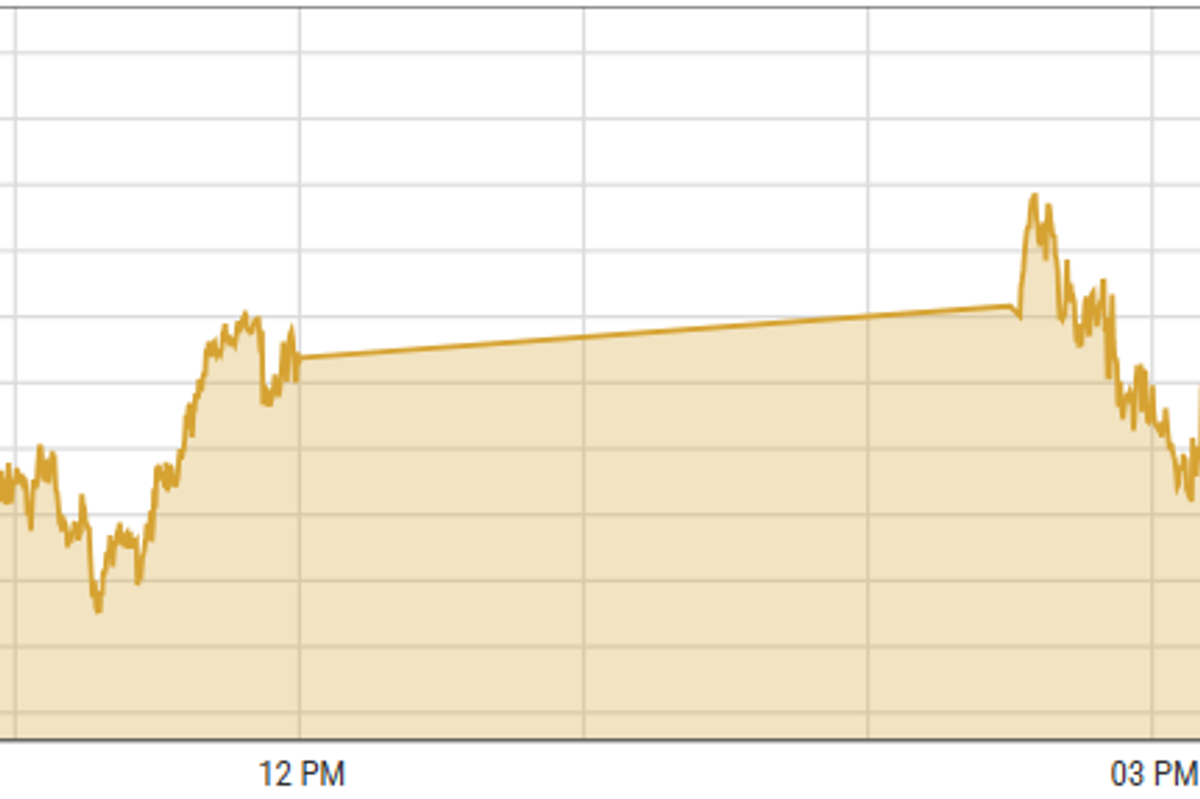

The KSE-100 index gained 814.99 points or 0.75% to close at 109,053.95 points.

Indian stocks barely moved on Friday. The Reserve Bank of India's Monetary Policy Committee kept the main interest rate at 6.5%, but reduced the economic growth forecast for FY25 to 6.6% from 7.2%.

They also lowered the cash reserve ratio (CRR) for banks, easing monetary conditions to help the slowing economy.

BSE-100 index gained 18.20 points or 0.07% to close at 26,196.86 points.

DFM General index gained 34.08 points or 0.71% to close at 4,854.45 points.

Commodities

Oil prices dipped on Friday as OPEC+ delayed planned supply increases and extended output cuts to the end of 2026 due to weak demand.

The group postponed oil output rises by three months until April and extended the unwinding of cuts by a year, originally set for October 2024.

The decision was influenced by slowing global demand, particularly in China, and increasing production elsewhere.

Brent crude prices decreased 0.96% to $71.4 per barrel.

Gold prices didn't change much on Friday. People expect the US Federal Reserve to lower interest rates in December, which keeps US Treasury bond yields low. This also keeps the US Dollar weak, helping gold prices.

Other reasons for steady gold prices include a slight increase in global worries, geopolitical tensions, and trade war fears, making gold a safe investment.

International gold prices surged 0.55% reaching $2,639.1 per ounce. In Pakistan, gold prices declined by PKR 1,000 to PKR 274,700/tola.

Currency

US dollar steadied against PKR in the inter-bank market, up 0.03%. Pakistani currency settled at 278 with a loss of 6 paisas. In the open market USD was trading at PKR 279.

Comments

See what people are discussing