Pakistan stocks end positive amid optimism over IMF review

Positivity was also influenced by government efforts to address circular debt

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

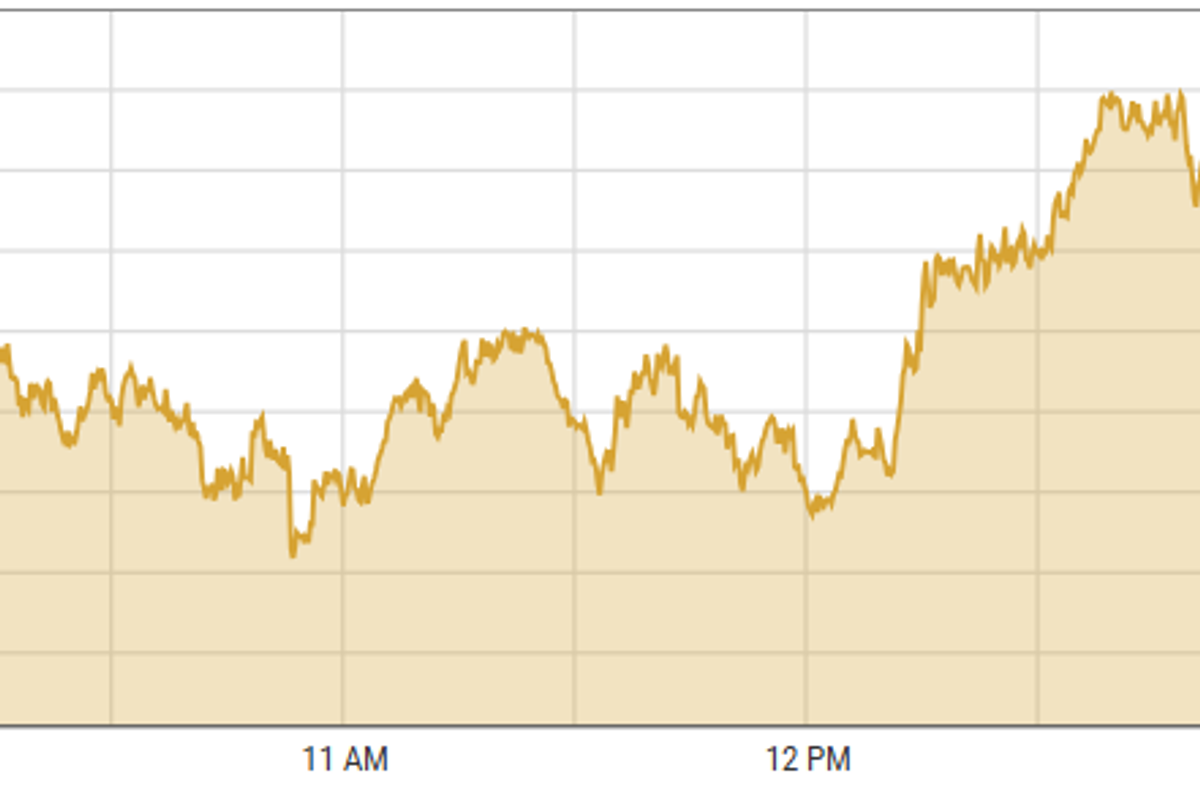

KSE-100 index gained 0.57%

PSX

Pakistan's stock market closed on a positive note Monday, driven by broad-based buying as investor sentiment improved following the International Monetary Fund's (IMF) expressed satisfaction with the first review of the Extended Fund Facility.

“Optimism grew as investors anticipate reaching a staff-level agreement soon,” said an analyst at Ismail Iqbal Securities.

Key sectors, including oil and gas exploration, oil and gas marketing, and cement, were the primary contributors to the rally, collectively adding 634 points to the benchmark index.

An analyst at Topline Securities noted the session's positivity was also influenced by government efforts to address the nation’s power sector circular debt.

However, the analyst added that a PKR 1.25 trillion agreement to tackle the issue is still pending final approval.

Meanwhile, the IMF acknowledged strong progress on Pakistan’s $7 billion loan program, despite the absence of a finalized staff-level agreement, further boosting investor confidence.

KSE-100 index gained 0.57% or 663.42 points to close at 116,199.59 points.

US dollar declined by 6 paisas to close at PKR 280.16. In the open market USD was trading at PKR 281.6.

Indian Stocks

Indian stocks rose on Monday, supported by positive global trends and lower-than-expected inflation in the U.S. and India.

However, weak global sentiment and moderating valuations in Indian markets may affect short-term trading decisions.

BSE-100 index gained 0.57% or 131.98 points to close at 23,459.10 points.

DFM General Index gained 0.41% or 20.88 points to close at 5,161.49 points.

Commodities

Crude oil prices surged as U.S. attacks on Yemeni Houthis escalated. The Defense Department warned attacks would persist until the Houthis cease targeting ships in the Red Sea.

These disruptions have forced ships to take longer routes around Africa, raising costs and increasing fuel demand.

Brent crude prices increased by 0.89% to $71.21 per barrel.

Gold prices went up on Monday after crossing $3,000 last week for the first time. Meanwhile, people are now focusing on the U.S. Federal Reserve's meeting this week.

On Sunday, U.S. Treasury Secretary Scott Bessent warned that there is no certainty the country can avoid a recession, which has made investors more worried about a possible economic slowdown caused by the U.S. President's trade policies.

International gold prices remained flat at $2,997 per ounce.

Comments

See what people are discussing