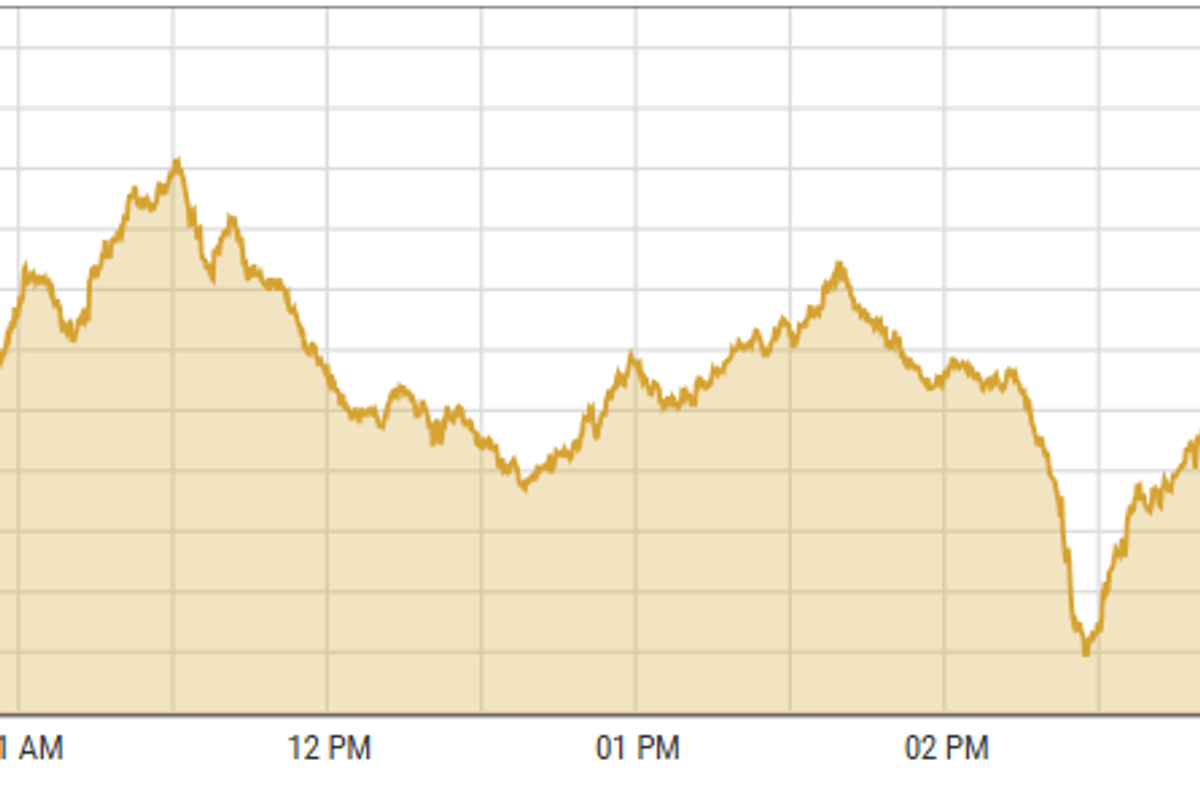

Pakistan stocks fall on institutional profit taking amid fears of more taxes

KSE-100 index lost 0.45% to close at 93,224.56 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index lost 0.45% to close at 93,224.56 points

PSX

Pakistan stocks fell on Tuesday as institutions booked profits across the board in the over-bought market.

Moreover, there were concerns that since Federal Board of Revenue (FBR) is facing a revenue collection shortfall, additional taxers could be imposed on imports, businesses and individuals.

The concerns over upcoming IMF's first review of the Extended Fund Facility and China's energy debt rollover also kept investors at backfoot.

Key sectors such as automobile assemblers, banking, fertilizer, oil and gas exploration companies, oil marketing companies (OMCs), and power generation faced selling pressure. Major stocks like HUBCO, SNGPL, OGDC, PPL, NBP, and HBL traded negatively.

KSE-100 index lost 423.76 points or 0.45% to close at 93,224.56 points.

The Indian stock market had another difficult day. Despite starting strong on Tuesday, November 12, the early optimism quickly vanished as investors resumed their 'sell on the rise' approach.

This fast selling left little chance for the indices to bounce back, leading to consistent weakness throughout the day.

This ongoing trend of selling during rallies has kept the markets struggling, making it hard for any substantial rebound to happen.

India’s BSE 100 Index lost 1.18% or 300.42 points to close at 25,195.09 points.

The Dubai Financial Market (DFM) General Index gained 0.83% or 38.51 points to close at 4,690.94 points.

Commodities

Oil prices remained mostly unchanged on Tuesday as investors awaited OPEC's monthly report for further guidance on prices. Disappointment over China's latest stimulus plan and worries about oversupply kept gains limited.

Concerns about deflation in China and the lack of clear fiscal measures to boost demand are affecting investor sentiment.

Brent crude prices increased 0.56% to $72.23 per barrel.

Gold prices stayed close to a one-month low on Tuesday as investors were cautious while waiting for important US economic data and remarks from Federal Reserve officials.

The US dollar, which has been getting stronger recently, was near a four-month high. Investors prefer the dollar due to the expected economic policies under President-elect Donald Trump.

International gold prices declined 0.77% reaching $2,591.07 per ounce. In Pakistan, gold prices decreased by PKR 1,300 to PKR 277,500/tola on Monday.

Currency

US dollar strengthened against PKR, up 0.04% in the inter-bank market. Pakistani currency settled at 277.92, a loss of 06 paisas against the US dollar. In the open market USD was trading at PKR 280.5.

Comments

See what people are discussing