Pakistan stocks record largest single-day decline due to profit selling

KSE-100 index shed 3.3% to close at 111,070 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 3.3%

PSX

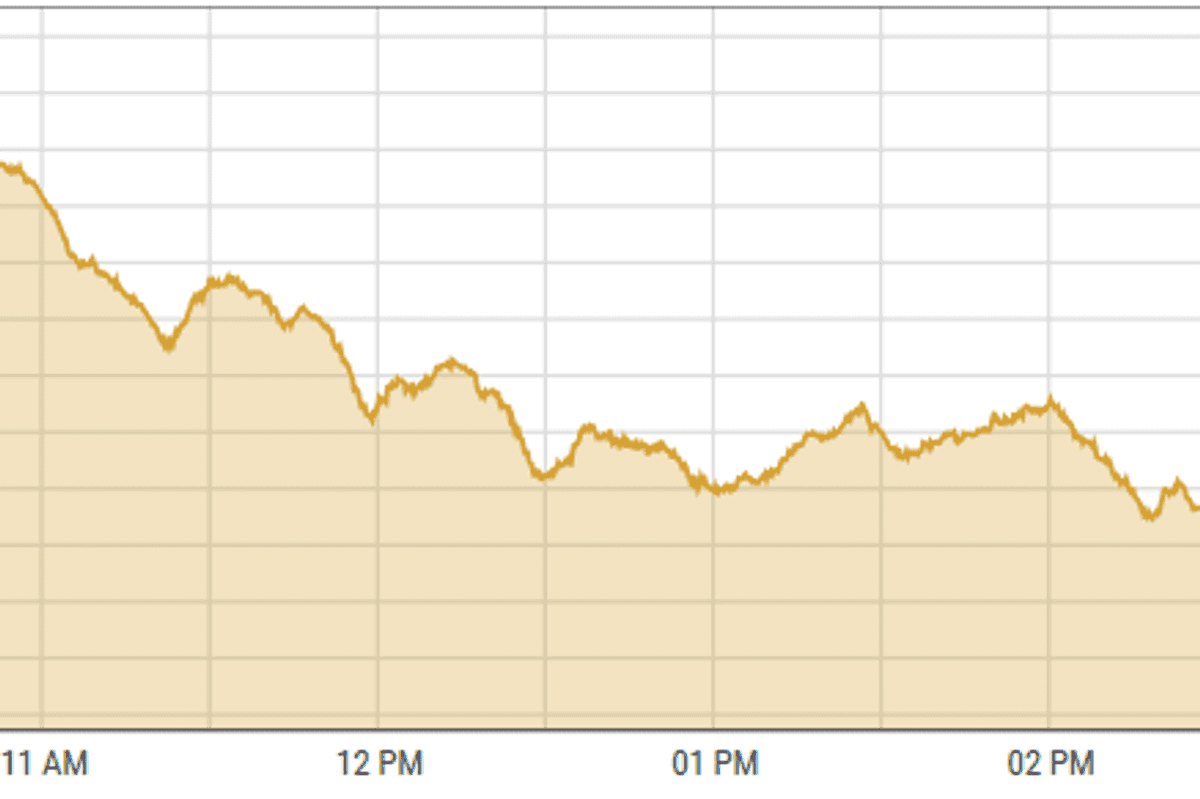

Pakistan Stocks faced a historic drop on Wednesday, recording its largest ever single-day decline of 3,790 points.

The market was overwhelmed by intense selling pressure, largely attributed to profit-taking and reports of local mutual fund redemptions.

For the past fourteen consecutive trading sessions, local mutual funds had been net buyers, providing steady support to the market. However, the trend abruptly reversed as these funds turned into net sellers, significantly impacting market sentiment.

Key stocks, including Mari Petroleum Company Limited (MARI), Fauji Fertilizer Company Limited (FFC), Hub Power Company Limited (HUBC), Pakistan Petroleum Limited (PPL), and Meezan Bank Limited (MEBL), were the primary contributors to the downturn.

The KSE-100 index lost 3,790.40 points or 3.3% to close at 111,070.29 points.

On Wednesday, Indian stocks continued to face pressure as investors remained cautious in anticipation of the US Federal Reserve's significant policy decision, which may hint at the direction of future interest rate cuts.

Financials, auto, and energy sectors saw the most significant declines, while pharmaceutical and IT stocks outperformed, achieving gains.

BSE-100 index shed 165.41 points or 0.64% to close at 25,697.69 points.

DFM General index shed 42.78 points or 0.84% to close at 5,037.07 points.

Commodities

Crude Oil prices edged higher on Wednesday, finding some support from a significant drawdown in crude stockpiles reported by the American Petroleum Institute (API) on Tuesday.

The drawdown amounted to 4.7 million barrels, surpassing the anticipated decline of 1.85 million barrels, which gave Crude Oil prices a slight boost.

Brent crude prices gained 0.55% to $73.59 per barrel.

Gold prices remained steady on Wednesday as investors exercised caution ahead of the US Federal Reserve's upcoming policy decision. This decision is anticipated to provide insights into the Fed's outlook for the next year.

Investors are particularly focused on the updated economic projections for 2025, which will be released alongside the policy decision, especially in terms of the expected rate easing for the coming year.

International gold prices declined 0.05% reaching $2,645.17 per ounce.

Currency

US dollar eased against PKR in the inter-bank market, down 0.01%. Pakistani currency settled at 278.22 with a gain of 5 paisas. In the open market USD was trading at PKR 279.

Comments

See what people are discussing