Pakistan’s industrial power tariff at 13.5 cents – more than twice the rate in India, US

Higher rate limiting country’s ability to strengthen its export competitiveness and compete in global markets

Nida Gulzar

Research Analyst

A distinguished economist with an M. Phil. in Applied Economics, Nida Gulzar has a strong research record. Nida has worked with the Pakistan Business Council (PBC), Pakistan Banks' Association (PBA), and KTrade, providing useful insights across economic sectors. Nida continues to impact economic debate and policy at the Economist Intelligence Unit (EIU) and Nukta. As a Women in Economics (WiE) Initiative mentor, she promotes inclusivity. Nida's eight 'Market Access Series papers help discover favourable market scenarios and export destinations.

Imagine paying nearly double for electricity compared to your biggest competitors. That’s the reality for industries in Pakistan, where power costs have surged past those in the U.S., China, and India. This cost disparity raises serious concerns about the country’s ability to compete in global markets and maintain export competitiveness.

How Pakistan’s electricity costs compare globally

A new report by the International Energy Agency (IEA), Electricity 2025 – Analysis & Forecast to 2027, highlights the stark contrast in electricity prices across different countries. The electricity rates averaged 6.3 cents per kilowatt-hour (kWh) in both the United States and India, while China saw rates at 7.7 cents.

Pakistan’s industrial electricity rate is currently 13.5 cents per kWh, while the total electricity price,vincluding taxes and surcharges, reaches PKR 47 per kWh – one of the highest in South Asia.

Why is electricity cheaper in other countries?

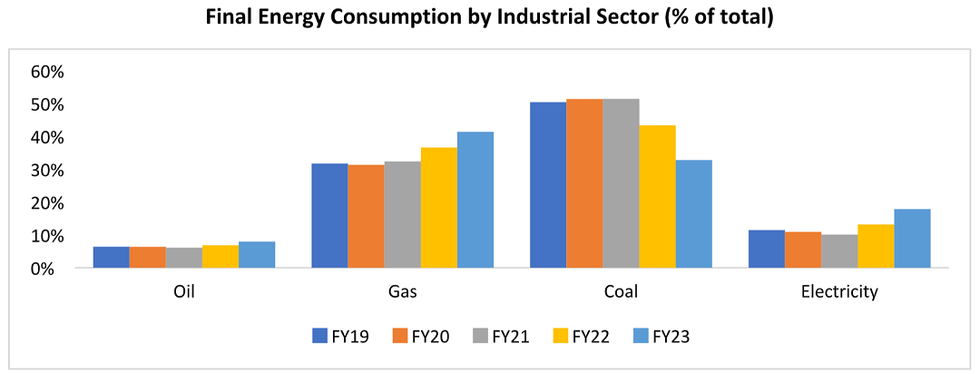

Several factors contribute to lower electricity costs in other nations:

Energy mix efficiency: Bangladesh benefits from a diverse energy mix, including natural gas, hydro, and coal.

Government subsidies: Bangladesh’s government provides direct subsidies to industries, lowering costs for manufacturers.

Efficient power distribution: Countries with lower electricity losses due to well-managed transmission and distribution networks experience reduced costs.

These factors allow regional competitors to produce goods more cheaply, giving them a significant edge over Pakistani exporters.

Pakistan’s industries pay more than even the EU

While Pakistan is not explicitly mentioned in the IEA’s report due to its non-member status, a comparison with European electricity prices reveals a concerning reality:

Industries in Pakistan pay 17% more than those in the European Union, despite the EU having a far more developed infrastructure and higher living costs.

Pakistani manufacturers are struggling to stay profitable as they face rising operational costs alongside existing economic uncertainty.

IMF and policy pressures: why are prices rising?

Pakistan’s electricity prices are 45% higher than those of neighboring countries due to:

IMF structural reforms: The International Monetary Fund (IMF) has pressured Pakistan to remove energy subsidies, leading to a direct increase in costs.

Circular debt crisis: Power distribution companies face massive inefficiencies and debt, which are ultimately passed on to consumers through higher tariffs.

Currency depreciation: Unlike India and Bangladesh, Pakistan’s unstable exchange rate makes energy imports more expensive, leading to sudden tariff hikes whenever global prices fluctuate.

Moreover, recently the global fund has refused to provide temporary relief measures such as the winter relief package for the industrial and agricultural sectors nationwide keeping circular debt problem in focus. To recall, Pakistan has met measures outlined by the IMF on the energy sector.

Pakistan’s IMF energy sector commitments

Industrial competitiveness at risk

The impact of high electricity prices on Pakistan’s manufacturing sector is severe:

• Local manufacturers struggle to compete against cheaper imports.

• Many exporters are losing market share due to rising operational costs.

• Businesses face profitability challenges, forcing them to cut production or pass costs onto consumers.

• The recent removal of subsidies has intensified the problem, further widening the gap between Pakistan and its regional peers.

How can Pakistan ease the industrial burden?

Tax reforms and policy adjustments

The Pakistan Business Council (PBC), in its “Recommendations for the Fiscal Policy and Tax Regime for FY26,” highlights the urgent need to:

Broaden the tax base to generate revenue.

Impose a 39% advance tax on non-filers to ensure a fairer distribution of tax burdens.

Use additional revenue to lower electricity tariffs for tax-compliant businesses.

The way forward: a sustainable energy strategy

Pakistan’s future in global trade depends on urgent policy reforms to create a fair and competitive energy pricing structure. Without decisive action, manufacturers will continue to face mounting challenges, risking economic decline.

For Pakistan’s industrial sector to remain viable, the government must:

Reform the energy sector by addressing inefficiencies in distribution and tackling circular debt.

Introduce targeted subsidies for key industries to maintain competitiveness.

Improve economic stability to control currency fluctuations and reduce dependency on foreign aid.

Comments

See what people are discussing